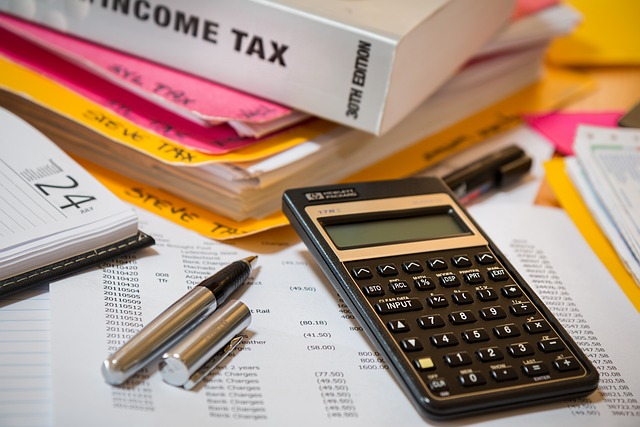

Navigating the complexities of tax planning and filing is a critical component of maintaining one’s financial health. As tax laws evolve and the tax code shifts, staying ahead with informed strategies can lead to significant savings and reduce the burden on both individuals and businesses. This article delves into the nuances of effective income tax preparation, highlighting key areas such as Tax Exemption Eligibility, understanding which exceptions and credits may apply to your situation. It also addresses the importance of adhering to IRS filing deadlines to avoid IRS Penalties and Interest, which can escalate if not managed promptly. Additionally, we explore how nonprofit organizations can stay compliant with their Tax Filing obligations through Mastering Nonprofit Tax Filing. For those looking to enhance their financial standing, Leveraging Tax-efficient Investments provides insights on maximizing savings within the current tax framework. Lastly, Optimizing Your Filing Status offers actionable strategies to minimize tax liability and potentially increase your refund. By proactively managing these aspects of tax return preparation, you can achieve compliance and better navigate the ever-changing landscape of tax laws for optimal financial outcomes.

- Understanding Tax Exemption Eligibility: A Guide to Qualifying Exceptions and Credits

- Navigating IRS Penalties and Interest: Deadlines and Strategies for Timely Tax Filing

- Mastering Nonprofit Tax Filing: Compliance and Best Practices for Tax-Exempt Organizations

- Leveraging Tax-efficient Investments: Maximizing Savings Within the Framework of Current Tax Laws

- Optimizing Your Filing Status: Strategies to Minimize Tax Liability and Increase Refunds

Understanding Tax Exemption Eligibility: A Guide to Qualifying Exceptions and Credits

navigating the intricacies of tax exemption eligibility is a pivotal aspect of securing your financial standing. To qualify for tax exemptions, individuals and entities must possess a clear understanding of the IRS guidelines and criteria. Eligibility for these exceptions can be influenced by factors such as filing status, income levels, and specific life events. For instance, certain investments may offer tax-efficient benefits, which can be particularly advantageous when planning for retirement or managing estate assets. It’s imperative to stay abreast of the latest tax code changes, as these can alter eligibility requirements and potential savings opportunities. Nonprofit organizations must also adhere to distinct tax filing regulations, ensuring their status is accurately reflected in their returns to avoid IRS penalties and interest. By meticulously reviewing your financial situation against current tax laws, you can identify and leverage the most suitable tax exemptions and credits, thereby optimizing your overall tax strategy and potentially increasing your refund. Regularly consulting the IRS guidelines and consulting with a tax professional can provide clarity on these matters, ensuring that you take full advantage of the tax benefits available to you.

Navigating IRS Penalties and Interest: Deadlines and Strategies for Timely Tax Filing

Navigating IRS penalties and interest requires a diligent approach to timely tax filing. The Internal Revenue Service (IRS) imposes penalties for late filings and underpayment of taxes, which can accumulate quickly and diminish one’s financial standing. To avoid such consequences, it is imperative to stay abreast of IRS deadlines, which vary depending on one’s tax filing status. For instance, individuals must file their returns by April 15th of each year, while certain groups, such as those with nonprofit tax filing statuses, may have different due dates. Understanding the specific requirements for one’s tax filing category is crucial for adherence and compliance.

Strategies to mitigate IRS penalties and interest include leveraging tax exemption eligibility, utilizing tax-efficient investments, and optimizing one’s filing status. Taxpayers should explore their eligibility for various deductions and credits that can reduce their taxable income, thereby lowering the amount of taxes owed. Contributions to retirement accounts or health savings accounts can also serve as pre-tax dollars invested in one’s future, further contributing to a more tax-efficient financial plan. Additionally, staying informed about tax code changes is essential, as updates to the tax code can alter eligibility for certain exemptions and credits. Regularly reviewing and adjusting investment strategies in light of these changes can ensure that one’s portfolio remains compliant with current laws, thereby maximizing potential tax savings and optimizing one’s overall financial well-being.

Mastering Nonprofit Tax Filing: Compliance and Best Practices for Tax-Exempt Organizations

Nonprofit organizations play a pivotal role in society by addressing various community needs and providing essential services. To maintain their tax-exempt status under section 501(c)(3) of the Internal Revenue Service (IRS) code, these entities must adhere to stringent compliance measures and understand the intricacies of nonprofit tax filing. Mastering this process is crucial for maintaining public trust and ensuring that donations are allocated efficiently. Organizations seeking Tax Exemption Eligibility must navigate the complex Tax Code Changes, which can alter eligibility requirements and reporting obligations. It is imperative for these organizations to stay abreast of these changes to avoid IRS Penalties and Interest that could accrue from non-compliance.

The nonprofit tax filing process is multifaceted, involving meticulous documentation of all financial activities throughout the year. This includes a detailed account of donations received, expenditures made, and adherence to the organization’s stated mission. To optimize their filing status, nonprofits should strategically plan their fundraising events and investment choices, ensuring that Tax-efficient Investments are prioritized. By doing so, they not only enhance their operational efficiency but also demonstrate fiscal responsibility to donors and stakeholders. Effective tax planning for these organizations often involves identifying opportunities for cost savings and maximizing the impact of every contribution. Implementing best practices for nonprofit tax filing not only ensures compliance with federal regulations but also allows these entities to allocate more resources toward their core missions, ultimately benefiting the communities they serve.

Leveraging Tax-efficient Investments: Maximizing Savings Within the Framework of Current Tax Laws

Engaging with tax-efficient investments is a prudent strategy for maximizing savings within the confines of current tax laws. Tax exemption eligibility should be a focal point for investors, as certain investments offer avenues to shield income from taxation. For instance, traditional Individual Retirement Accounts (IRAs) allow pre-tax dollars to grow compounded until withdrawal, often decades later, which can result in substantial tax savings over time. Similarly, Health Savings Accounts (HSAs) provide a triple tax advantage: contributions are typically tax-deductible, the funds grow tax-free, and withdrawals for qualified medical expenses are tax-free. It’s imperative to stay abreast of IRS guidelines to ensure these accounts are utilized optimally, avoiding any inadvertent penalties and interest that could erode potential savings.

Moreover, individuals must be adept at navigating the labyrinthine tax code changes, which can alter eligibility criteria for tax exemptions and impact the tax efficiency of investments. Nonprofit tax filing statuses, for example, require stringent adherence to IRS regulations to maintain their exempt status. For the average taxpayer, understanding these complexities is crucial. Filing status optimization can significantly affect the amount of taxes owed or the potential refund received. By meticulously reviewing one’s financial situation in light of the latest tax laws and IRS updates, taxpayers can make informed decisions that align with their long-term savings goals. Regularly consulting with a tax professional can offer guidance on the most advantageous investment choices and ensure that all available tax benefits are being leveraged effectively.

Optimizing Your Filing Status: Strategies to Minimize Tax Liability and Increase Refunds

Optimizing your filing status is a strategic move to minimize tax liability and maximize potential refunds. Understanding your eligibility for tax exemption statuses is crucial, as it can lead to significant savings. For instance, individuals who are blind or over the age of 65 may qualify for additional deductions, while heads of households have distinct benefits that single filers do not. Married couples can benefit from filing jointly, which often provides a more favorable tax position than filing separately. It’s imperative to review your status annually, as changes in the tax code can affect eligibility and potential savings. Staying abreast of these changes is essential, as outdated knowledge of the tax exemption eligibility criteria could lead to missed opportunities for tax reduction.

Furthermore, the filing status you select has implications beyond deductions; it also impacts how your income is viewed by the IRS. For those who are part of a nonprofit organization, understanding the nuances of nonprofit tax filing can be advantageous. These organizations often engage in tax-efficient investments that can further reduce taxable income. To ensure compliance and avoid IRS penalties and interest, it’s prudent to file accurately and on time. Utilizing tax software or consulting with a tax professional can help navigate these complexities. By carefully considering your filing status and leveraging the benefits available to you, such as retirement account contributions and health savings accounts, you can position yourself to pay less in taxes and potentially receive a larger refund. Proactive management of your tax return preparation is key to optimizing your filing status and achieving financial well-being throughout the year.

navigating the intricacies of tax planning is a pivotal aspect of maintaining financial health. As outlined in this article, understanding one’s eligibility for Tax Exemption Eligibility and leveraging available deductions and credits is crucial for reducing taxable income effectively. Prompt adherence to IRS Penalties and Interest guidelines ensures compliance and safeguards against costly penalties. For nonprofit entities, mastering Nonprofit Tax Filing demands diligent attention to detail and adherence to specific best practices to maintain tax-exempt status. Similarly, making Tax-efficient Investments in accordance with the ever-evolving Tax Code Changes can significantly enhance savings. Finally, Optimizing Your Filing Status is a strategic move that can yield substantial benefits by minimizing tax liability and potentially increasing one’s refund. Regular financial planning for taxes equips individuals and businesses with the tools to adapt to new tax laws and maximize their advantages. In conclusion, proactive management of tax return preparation is not just a compliance necessity but a vital component in achieving optimal financial outcomes.