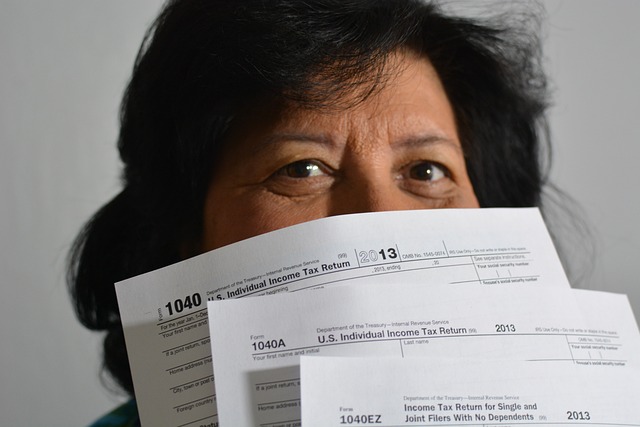

2023 marks a pivotal year for taxpayers seeking to optimize their financial standing. With careful planning and an understanding of the intricacies of the tax code, individuals can effectively leverage various strategies to mitigate their tax liabilities. This comprehensive guide delves into actionable tax-saving tips that cater to diverse financial situations. From maximizing IRA contributions for tax benefits to utilizing strategic investment approaches like Tax-loss harvesting, this article outlines a spectrum of opportunities designed to keep more of your income in your pocket. Additionally, it addresses the nuances of the Student Loan Interest Deduction, Estate Planning Tax Strategies, and Educational Tax Credits, which are particularly beneficial for those investing in their education or planning for their heirs. For seasoned investors, we explore methods for reducing Capital Gains Taxes. Beyond the conventional advice, this article also uncovers less obvious tax-saving opportunities that can significantly enhance your financial well-being over time. Embark on this journey to master tax-saving tactics and secure your financial future.

- Maximizing IRA Contributions for Tax Benefits

- Utilizing Tax-Loss Harvesting for Investment Portfolios

- Leveraging the Student Loan Interest Deduction

- Implementing Estate Planning Tax Strategies

- Understanding Educational Tax Credits for Lifelong Learning

- Strategies for Reducing Capital Gains Taxes

- Exploring Additional Tax-Saving Opportunities Beyond the Basics

Maximizing IRA Contributions for Tax Benefits

Maximizing IRA contributions can yield substantial tax benefits. Individuals looking to enhance their retirement savings while simultaneously reducing their current taxable income should consider fully funding an IRA account. Traditional IRAs offer a deduction for contributions made if certain income limits are met, effectively lowering taxable income for the year. For those who have already maximized their employer-sponsored retirement plan contributions, additional funds can be directed into a Roth IRA, where qualified distributions in retirement are entirely free from federal income taxes. This strategic allocation can provide a dual benefit: contributing to long-term financial security and immediate tax relief.

Beyond IRA contributions, there are other tax-saving strategies that complement your financial planning. Tax-loss harvesting involves selling investments at a loss to offset capital gains taxes. This tactic should be executed with care, adhering to “wash-sale” rules to avoid triggering taxable events. Additionally, those with student loan debt can take advantage of the student loan interest deduction, which allows for the deduction of up to $2,500 of qualified educational loan interest paid during the year. For families with children in higher education, exploring educational tax credits such as the American Opportunity Tax Credit or Lifetime Learning Credit can significantly reduce tax liabilities. Moreover, estate planning with tax strategies in mind is crucial for high-net-worth individuals to minimize the estate tax burden and ensure the transfer of assets is as efficient as possible. By integrating these tax-saving methods into your overall financial plan, you can effectively manage your capital gains tax exposure and enhance your overall tax position.

Utilizing Tax-Loss Harvesting for Investment Portfolios

Tax-loss harvesting is a strategy that can significantly reduce your capital gains tax bill while maximizing investment growth. This approach involves selling securities or investments at a loss and offsetting that loss against capital gains incurred from other assets sold within the same year. By doing so, investors can defer or even eliminate taxes on their capital gains. It’s important to note that this practice should be executed with care, as the IRS has specific rules regarding “wash-sale” rules to prevent tax avoidance. When implementing tax-loss harvesting, consider the long-term goals of your investment portfolio. For instance, after realizing a loss, you might replace the sold security with a similar one that maintains your overall investment strategy and diversification.

In addition to capital gains tax reduction, exploring tax-saving opportunities like IRA contributions can offer substantial tax benefits over time. Contributing to an IRA allows your investments to compound tax-deferred until you begin taking distributions typically in retirement. This not only reduces your current taxable income but also can result in a larger accumulation due to the compounded growth that is shielded from taxes. Moreover, for those with student loan debt, remembering to claim the student loan interest deduction can provide additional tax savings. When it comes to estate planning, employing tax strategies that leverage trusts and other vehicles can ensure your heirs receive more of their inheritance by minimizing estate taxes. Similarly, educational tax credits can provide a financial buffer for those pursuing higher education, reducing the overall tax burden associated with tuition expenses. All these measures, from capital gains tax reduction to leveraging tax-advantaged accounts and deductions, contribute to a comprehensive tax-saving strategy that benefits your current financial situation as well as your future wealth accumulation.

Leveraging the Student Loan Interest Deduction

When considering tax-saving strategies, one often overlooked opportunity is the Student Loan Interest Deduction. This deduction allows taxpayers to subtract the interest paid on student loans from their taxable income. For those burdened with educational debt, this can result in significant tax savings. The deduction can cover up to $2,500 of interest paid annually, making it a valuable tool for managing finances post-education. To maximize this benefit, it’s important to keep detailed records of the interest paid throughout the year, as the IRS requires documentation to substantiate the claim.

In addition to the Student Loan Interest Deduction, other tax benefits can be found in retirement savings and educational investments. For instance, contributing to an IRA can offer substantial tax advantages. Both traditional and Roth IRAs provide avenues for accumulating wealth on a tax-deferred basis, allowing your contributions and earnings to grow without current taxes. Moreover, if you have repayment responsibilities for student loans, making timely payments not only reduces the overall loan amount but also positions you to take full advantage of this deduction when tax season arrives. Furthermore, tax-loss harvesting can play a role in reducing capital gains tax exposure by strategically selling investments at a loss and offsetting capital gains. This tactic should be approached with caution and ideally, with the guidance of a financial advisor to ensure compliance with IRS rules. Lastly, estate planning tax strategies and educational tax credits are other areas where careful planning can yield substantial tax benefits, both for the individual and their heirs. These strategies not only facilitate wealth transfer but also potentially reduce estate taxes, ensuring that more assets pass to beneficiaries rather than to the government.

Implementing Estate Planning Tax Strategies

Implementing estate planning tax strategies is a prudent approach for individuals aiming to minimize their tax liabilities and ensure the efficient transfer of assets upon death. A key component of this strategy involves leveraging the tax benefits associated with IRA contributions. By contributing to an IRA, or even maximizing contributions throughout one’s life, heirs can inherit these accounts with potentially significant tax-deferred growth, thereby reducing the overall tax burden on the estate. Additionally, strategic IRA withdrawals can be planned to align with lower tax brackets, further optimizing the estate’s tax situation.

Beyond individual retirement accounts, estate planning tax strategies also encompass utilizing educational tax credits and engaging in tax-loss harvesting to offset capital gains. Tax-loss harvesting involves selling securities at a loss and replacing them with similar investments, thus reducing capital gains tax exposure. This technique can be particularly effective when managing an investment portfolio within the context of estate planning. Furthermore, taking advantage of educational tax credits for higher education expenses not only supports an individual’s or their heirs’ education but also provides a valuable tax deduction that can lessen the overall taxable income of the estate. By integrating these proactive tax-saving measures into a comprehensive estate plan, individuals can significantly reduce their tax burden and ensure their legacy is preserved for future generations.

Understanding Educational Tax Credits for Lifelong Learning

Educational tax credits play a pivotal role in making higher education more accessible and affordable for students and their families. Among the various educational tax credits available, the Lifetime Learning Credit stands out as it allows taxpayers to claim a credit for qualified education expenses for an unlimited number of years for either themselves or their dependents. This credit can cover undergraduate, graduate, and professional degree courses, as well as certain courses to acquire or improve job skills. For those pursuing further education, understanding how this credit can offset tuition and fees provides a tangible tax benefit, potentially reducing the overall tax liability by up to $2,000 per year for a moderate income level ($53,000 or less for singles; $108,000 or less for married filing jointly in 2021).

In addition to educational tax credits, taxpayers looking to maximize their tax benefits should consider the tax advantages of contributing to an IRA. These contributions not only offer a potential deduction that can lower your adjusted gross income but also allow investments to grow tax-deferred until withdrawal, often in retirement when one may be in a lower tax bracket. Furthermore, for those who have incurred student loan debt, the student loan interest deduction can provide a partial tax break on the interest paid on qualified education loans, further enhancing the tax benefits related to education. On the investment front, tax-loss harvesting is a strategy that involves offsetting gains from the sale of investments with losses to reduce capital gains tax exposure. This approach can be particularly effective when coupled with charitable contributions or other tax-deductible expenses, ultimately leading to a lower capital gains tax burden. Lastly, estate planning tax strategies are essential for ensuring one’s legacy is preserved in a tax-efficient manner, allowing heirs to benefit from the accumulated wealth without undue taxation. These strategies often involve timing the distribution of assets and utilizing trusts designed to minimize estate and gift taxes. By leveraging educational tax credits, optimizing IRA contributions, employing tax-loss harvesting, and implementing effective estate planning tax strategies, individuals can significantly enhance their overall tax position.

Strategies for Reducing Capital Gains Taxes

When it comes to capital gains taxes, savvy investors know that careful planning and strategic moves can significantly reduce their tax liabilities. One approach is to make contributions to an IRA, which can offer substantial tax benefits. Traditional IRAs, for instance, may allow you to defer taxes on investment gains until you withdraw the funds, often during retirement when you might be in a lower tax bracket. Additionally, Roth IRAs provide after-tax dollars with tax-free growth and withdrawals, offering a different kind of tax advantage.

Beyond IRA contributions, taxpayers can employ tax-loss harvesting as a strategy to minimize capital gains taxes. This involves selling securities at a loss and then reinvesting in similar assets to offset capital gains. It’s important to be mindful of the “wash-sale rule,” which prevents or adjusts losses for a period after selling securities. Another key strategy is the utilization of educational tax credits, such as the American Opportunity Tax Credit and the Lifetime Learning Credit, which can provide significant tax relief for those funding higher education.

For those with student loan debt, the interest deduction can serve as a valuable tax benefit, reducing the amount of income subject to tax by the interest paid on qualified student loans. Furthermore, estate planning is crucial not only for managing your assets posthumously but also for optimizing the tax implications for your heirs. By leveraging trusts and other estate planning tools, you can ensure that the transfer of wealth is as tax-efficient as possible.

Incorporating these strategies into your financial planning can result in substantial capital gains tax reduction. It’s advisable to consult with a tax professional who can guide you through the complexities of tax laws and help tailor a strategy that aligns with your individual financial situation and goals.

Exploring Additional Tax-Saving Opportunities Beyond the Basics

Beyond the foundational aspects of saving on taxes through traditional retirement accounts like IRAs and 401(k)s, taxpayers can further optimize their tax situation by exploring a variety of additional strategies. For instance, making contributions to an IRA can offer substantial tax benefits. Depending on your income level, you may be eligible for a deduction on traditional IRA contributions, or if you opt for a Roth IRA, you can enjoy tax-free growth and withdrawals in retirement. Another strategy is tax-loss harvesting, which involves selling investments that have lost value to offset taxes on capital gains. This tactic not only helps in reducing your tax bill but also allows for the reinvestment of funds into potentially more profitable assets.

Furthermore, those with student loan debt can take advantage of the student loan interest deduction, which allows taxpayers to deduct up to $2,500 of the interest paid on student loans each year. Estate planning is another critical area where tax considerations come into play. By carefully structuring your estate plan, you can leverage various tax strategies to minimize estate taxes and ensure that your assets pass to your heirs in the most tax-efficient manner possible. Additionally, educational tax credits such as the American Opportunity Tax Credit and the Lifetime Learning Credit can provide valuable relief for those funding higher education, reducing your taxable income dollar for dollar for qualified educational expenses. Lastly, when it comes to capital gains tax, strategic planning on when to sell assets can lead to significant reductions in tax liabilities. By timing the sale of investments to align with periods of lower capital gains rates or by offsetting gains with losses, investors can effectively manage their capital gains tax exposure.

In conclusion, savvy tax planning is within reach for individuals who are willing to explore the myriad of opportunities available to them. By maximizing IRA contributions and tapping into the tax benefits they offer, utilizing tax-loss harvesting strategies in investment portfolios, claiming the student loan interest deduction, implementing thoughtful estate planning tax strategies, and understanding educational tax credits for lifelong learning, taxpayers can significantly reduce their tax liabilities. Additionally, employing strategies to lower capital gains taxes further enhances one’s financial well-being. These steps, when combined, not only provide immediate tax savings but also contribute to long-term financial security. Taking proactive measures now can lead to substantial tax benefits and peace of mind in the future.