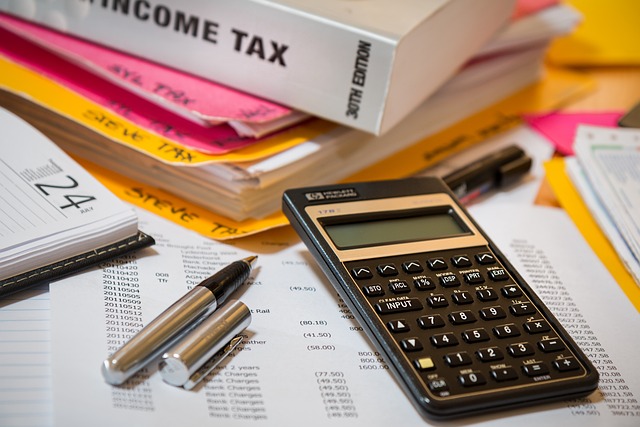

2023 tax season is upon us, and managing your finances efficiently has never been more critical. Our comprehensive income tax services are tailored to simplify the complexities of tax preparation for both individuals and businesses. With expert certified tax preparers at the helm, we guide you through Year-End Tax Planning, ensuring you benefit from every possible tax saving strategy. Our tailored income tax calculation and taxpayer relief services are designed to navigate the intricacies of the IRS’s latest initiatives, thereby minimizing errors and maximizing your savings. As you prepare your federal and state tax returns, our corporate tax solutions offer the accuracy and timeliness you require. Let us help you traverse the tax landscape with confidence and peace of mind this year.

- Maximizing Your Year-End Tax Planning with Expert Certified Tax Preparers

- Tailored Tax Saving Strategies for Individuals and Businesses through Income Tax Calculation

- Streamlined Tax Filing Assistance in Line with IRS Initiatives for 2023

- Comprehensive Corporate Tax Solutions: Ensuring Accuracy and Timeliness in Your Tax Returns

- Navigating Taxpayer Relief Services: A Guide to Minimizing Errors and Maximizing Savings

Maximizing Your Year-End Tax Planning with Expert Certified Tax Preparers

As the year draws to a close, proactive Year-End Tax Planning becomes crucial for both individuals and businesses seeking to optimize their financial outcomes. Our certified tax preparers at Taxpayer Relief Services are adept at devising strategies that align with your unique circumstances, ensuring you take full advantage of legal tax savings opportunities. These experts specialize in income tax calculation, leveraging their deep understanding of the ever-evolving tax laws to identify deductions and credits that may have been overlooked. By engaging with our services, you can rest assured that your corporate tax solutions are tailored to minimize your tax liabilities and maximize your financial well-being.

Furthermore, our team’s expertise extends beyond mere compliance; they offer strategic advice on how to structure transactions and investments in a tax-efficient manner. The goal is to provide you with peace of mind, knowing that your tax affairs are handled by professionals who are not only certified but also committed to staying abreast of the latest IRS initiatives aimed at streamlining the tax process. Our personalized approach ensures that you receive the most current and relevant tax saving advice, positioning you for a more favorable tax season and setting the stage for successful financial management in the new year.

Tailored Tax Saving Strategies for Individuals and Businesses through Income Tax Calculation

Our income tax calculation services are meticulously tailored to optimize tax savings for individuals and businesses alike, ensuring a personalized approach to year-end tax planning. Utilizing our certified tax preparers, we delve into each client’s financial situation to identify opportunities where taxpayer relief services can be most beneficial. By leveraging the latest tax laws and regulations, our team provides strategic advice that aligns with your unique economic position, aiming to maximize deductions while minimizing liabilities. Our expertise extends beyond individual returns; we offer comprehensive corporate tax solutions that address the complexities of business taxation, ensuring that every deduction is claimed, and no overpayments occur. This proactive strategy not only simplifies tax season but also positions our clients to maintain financial health throughout the year.

In addition to expert tax preparation and filing assistance, we are committed to staying abreast of IRS initiatives aimed at streamlining the tax process. Our consultative approach is designed to keep you informed and in compliance with current tax laws. We pride ourselves on our ability to navigate the intricacies of income tax calculation, offering peace of mind that your taxes will be filed accurately and on time. With a focus on long-term strategies, we help individuals and businesses alike to develop a robust tax-saving plan, ensuring you benefit from every possible advantage while maintaining transparency and accountability throughout our engagement.

Streamlined Tax Filing Assistance in Line with IRS Initiatives for 2023

As we approach the 2023 tax season, our income tax services have been meticulously updated to align with the latest IRS initiatives, ensuring a streamlined and efficient tax filing experience for both individuals and businesses. Our year-end tax planning strategies are crafted by certified tax preparers who stay abreast of the evolving tax landscape. We understand that effective tax saving is not just about filling out forms but also about leveraging legal opportunities to optimize financial outcomes. Our team’s expertise in income tax calculation and corporate tax solutions is complemented by a commitment to providing tailored taxpayer relief services, ensuring that each client benefits from personalized advice to maximize deductions and minimize errors.

Our approach encompasses comprehensive tax preparation and filing assistance, with a focus on accuracy and timeliness. We are dedicated to keeping pace with the IRS’s efforts to simplify the process and offer relief to taxpayers. Our services extend beyond the standard tax returns; we also provide ongoing compliance support to navigate the complexities of federal and state regulations. By partnering with our firm, clients can rest assured that their taxes are not only filed correctly but are also strategically managed to align with their financial goals and reduce the tax burden effectively.

Comprehensive Corporate Tax Solutions: Ensuring Accuracy and Timeliness in Your Tax Returns

Our corporate tax solutions are meticulously crafted to navigate the complexities of income tax calculation for businesses. Utilizing our year-end tax planning services, certified tax preparers at the forefront of tax law updates ensure that your organization’s finances are optimized for tax savings. We delve into your company’s unique financial landscape to implement effective strategies that align with your long-term goals, all while adhering to the ever-evolving regulatory framework. Our commitment extends beyond mere compliance; we strive to minimize your tax liability and maximize your financial potential through strategic planning and informed decision-making.

Furthermore, our taxpayer relief services are designed with precision to offer timely and accurate tax preparation and filing assistance. We understand the pressure of meeting deadlines while ensuring that every deduction is utilized to its fullest extent. Our team of seasoned tax professionals leverages their expertise in corporate tax solutions to provide personalized support, ensuring that your federal and state tax returns are filed with the utmost accuracy and within the prescribed timelines. With a keen eye on compliance and a steadfast commitment to client satisfaction, our services are tailored to alleviate the burden of tax season, allowing you to focus on what you do best—running your business.

Navigating Taxpayer Relief Services: A Guide to Minimizing Errors and Maximizing Savings

Engaging with taxpayer relief services is a prudent step for individuals and businesses seeking to navigate the complexities of year-end tax planning. Our tailored taxpayer relief services are designed to minimize errors and maximize savings, ensuring that each client’s unique financial situation is addressed effectively. Certified tax preparers at our firm leverage their expertise to provide strategic guidance, aligning with corporate tax solutions to optimize income tax calculations. By staying abreast of the latest IRS initiatives, we offer comprehensive support for federal and state tax returns, guaranteeing compliance while also identifying opportunities for significant tax savings. Our approach is proactive, employing advanced strategies to manage your tax liabilities in a manner that aligns with your financial goals and objectives.

Maximizing deductions and exploring all possible avenues for tax-saving benefits are at the core of our service ethos. We understand that each client’s needs are distinct, which is why our taxpayer relief services are customized to suit individual circumstances. Our team’s deep understanding of the intricacies of tax law and their commitment to staying current with the latest developments ensure that clients receive the most accurate and timely tax filing assistance. Whether it’s through meticulous income tax calculation or by offering informed consulting, our goal is to provide peace of mind, knowing that your financial interests are safeguarded throughout the tax season.

In conclusion, our commitment to delivering top-tier income tax services this year is unwavering. Our expertise in Year-End Tax Planning and utilization of Certified Tax Preparers ensures that individuals and businesses can navigate the complexities of tax law with confidence. By implementing tailored Tax Saving Strategies through precise Income Tax Calculation, we empower our clients to optimize their financial outcomes. As the IRS continues to introduce initiatives aimed at streamlining the process, our proactive approach to tax filing assistance keeps pace, offering solutions that are both innovative and in line with these advancements. Furthermore, our Taxpayer Relief Services provide a safeguard against errors, ensuring accuracy and timeliness. For businesses, our Corporate Tax Solutions offer comprehensive support, addressing all facets of federal and state returns. In the spirit of assisting you to meet your tax obligations with ease and efficiency, we stand ready to help you reap the benefits of informed, strategic planning. Let us together transform the often daunting task of tax preparation into a seamless experience, allowing you to focus on what matters most—your business and personal growth.