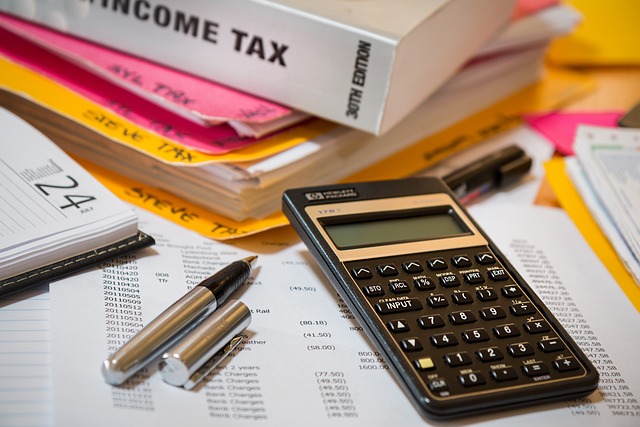

2023 heralds a new chapter for the self-employed, offering both tax challenges and strategic opportunities to optimize financial outcomes. Self-employed individuals must navigate the complexities of tax law to leverage benefits such as Tax Exemption Eligibility and avoid the pitfalls of IRS Penalties and Interest associated with late filings. This year, staying abreast of Nonprofit Tax Filing requirements and adapting to Tax Code Changes becomes more important than ever. By maximizing deductions like home office expenses and health insurance premiums, and strategically planning for Tax-efficient Investments through a SEP IRA or similar retirement accounts, self-employed individuals can not only comply with tax regulations but also enhance their financial well-being. This article delves into these topics, providing insights and guidance to ensure your 2023 Filing Status is optimized and your tax strategy is as effective as possible.

- Leveraging Tax Exemption Eligibility for Self-Employed Individuals

- Navigating IRS Penalties and Interest: Key Dates and Deadlines

- Maximizing Deductions: Home Office Expenses, Health Insurance, and Beyond

- Strategic Planning for Nonprofit Tax Filing and Tax-efficient Investments

- Adapting to Tax Code Changes and Optimizing Filing Status in 2023

Leveraging Tax Exemption Eligibility for Self-Employed Individuals

Self-employed individuals have a unique opportunity to leverage tax exemption eligibility through strategic planning and a thorough understanding of the IRS guidelines. The Internal Revenue Service provides specific provisions for those who are self-employed, allowing them to potentially exempt certain types of income from taxation. For instance, income derived from nonprofit organizations can be tax-exempt under specific conditions, which includes working for a charitable, religious, or governmental entity. It is imperative to stay abreast of the latest tax code changes, as these can alter eligibility criteria and available deductions. By keeping up with these modifications, self-employed individuals can ensure they are taking advantage of all applicable exemptions, thereby reducing their overall tax burden.

Moreover, staying compliant and avoiding IRS penalties and interest is essential for maintaining a healthy financial status. The IRS imposes strict filing deadlines and requires precise adherence to tax laws. Late filings can result in penalties and interest that negate any potential savings from deductions or exemptions. Self-employed individuals must, therefore, prioritize timely tax filings. Additionally, by focusing on tax-efficient investments and optimizing filing statuses, self-employed individuals can further enhance their financial positions. Strategic investment choices can provide both financial growth and tax benefits, aligning with the evolving tax landscape to secure the most favorable outcomes.

Navigating IRS Penalties and Interest: Key Dates and Deadlines

Self-employed individuals must be vigilant about IRS deadlines to avoid incurring penalties and interest. The IRS imposes strict timelines for tax filing and payment, which can vary depending on one’s tax exemption eligibility and filing status. Missed deadlines can lead to costly charges, emphasizing the importance of marking key dates on your calendar. For instance, understanding that quarterly estimated tax payments are due on specific dates throughout the year is essential for maintaining good standing with the IRS. Similarly, knowing when to file an annual return, particularly if one is operating as a nonprofit tax filing entity, requires attention to detail and adherence to the set deadlines.

To mitigate the risk of incurring IRS penalties and interest, it’s imperative to stay informed about tax code changes. These adjustments can affect not only one’s tax exemption eligibility but also influence how one should optimize their filing status. Additionally, savvy financial planning involves leveraging tax-efficient investments, such as a Simplified Employee Pension (SEP) IRA, which can provide significant benefits for the self-employed. By strategically utilizing these and other investment vehicles in accordance with current tax laws, individuals can not only minimize their tax liability but also enhance their long-term financial security. Regularly consulting with a tax professional or utilizing reputable resources to stay abreast of the latest tax code changes is crucial for self-employed individuals to navigate the complexities of tax exemption eligibility and maintain compliance with IRS regulations.

Maximizing Deductions: Home Office Expenses, Health Insurance, and Beyond

Self-employment offers a unique set of tax considerations, where savvy planning can lead to significant tax exemption eligibility. Among the deductions that self-employed individuals can leverage are home office expenses and health insurance premiums. The IRS allows for a deduction on a portion of the home used regularly and exclusively for business purposes, which can encompass a portion of mortgage interest, utilities, repairs, and depreciation of the home office space. This deduction can be substantial, especially for those who have a significant portion of their home dedicated to business activities. Similarly, health insurance premiums are often overlooked as a deductible expense, yet they can be claimed as a self-employed health insurance deduction, reducing taxable income.

Beyond these common deductions, self-employed individuals should also stay abreast of changes in the tax code to maximize their tax savings. Strategic planning for tax-efficient investments, such as contributing to a Simplified Employee Pension (SEP) IRA, can offer substantial benefits. These contributions not only bolster retirement savings but also serve as a tax shield against current income. For those who qualify, nonprofit tax filing status can further reduce tax liabilities. It’s imperative to ensure that all filings are completed accurately and on time to avoid IRS penalties and interest. Moreover, optimizing one’s filing status can have a material impact on the ultimate tax burden. A thorough understanding of the current tax laws and how they apply to one’s specific situation is crucial for self-employed individuals to make informed decisions and stay ahead in their financial planning. By leveraging all available deductions and credits, and by staying informed about IRS filing deadlines and potential changes in the tax code, self-employed individuals can position themselves to minimize their tax liability and enhance their overall financial health.

Strategic Planning for Nonprofit Tax Filing and Tax-efficient Investments

Self-employed individuals operating within the nonprofit sector face a distinct set of tax challenges and opportunities. Strategic planning for nonprofit tax filing is paramount, as it involves understanding the nuances of Tax Exemption Eligibility under section 501(c)(3) of the IRS code. Nonprofits must meticulously adhere to stringent reporting requirements, including the annual Form 990, which provides detailed financial information to the public and the IRS. Staying abreast of Tax Code Changes is crucial for nonprofit organizations to maintain their exempt status and ensure compliance, thus avoiding IRS Penalties and Interest that can arise from missteps or oversights.

In addition to navigating the complexities of nonprofit tax filing, self-employed individuals must also consider Tax-efficient Investments as part of their financial strategy. These investments are designed to minimize tax liabilities while aligning with personal values and mission-driven goals. Seeking out investment vehicles that offer both a social impact and potential tax benefits, such as donor-advised funds or socially responsible ETFs, can be particularly advantageous. Furthermore, optimizing Filing Status Optimization can lead to additional tax savings for the self-employed. It is through a comprehensive approach that combines understanding of the tax code with strategic financial planning that nonprofits and self-employed individuals alike can leverage tax benefits effectively and sustain their operations.

Adapting to Tax Code Changes and Optimizing Filing Status in 2023

As tax laws evolve, self-employed individuals must stay vigilant and adapt to new Tax Exemption Eligibility guidelines. The IRS regularly updates its stipulations, which can affect how tax exemptions are claimed and the overall financial planning for taxes. For instance, the tax code changes in 2023 may introduce new deductions or alter existing ones, necessitating a review of eligibility criteria and strategies to minimize tax liabilities. To navigate these shifts effectively, it’s imperative to monitor IRS announcements and updates throughout the year, ensuring compliance and optimizing one’s tax position. This proactive approach can help prevent costly IRS Penalties and Interest that often accompany late or incorrect filings.

Optimizing filing status is another critical aspect for self-employed individuals in 2023. The right filing status can significantly influence the amount of taxes owed, as well as the tax credits and deductions one is eligible to claim. For those who may qualify as a nonprofit organization or are considering nonprofit tax filing, understanding the nuances of these filings is essential. Additionally, selecting the most advantageous filing status in conjunction with strategic investment choices can lead to substantial savings. Tax-efficient investments, such as contributing to a Simplified Employee Pension (SEP) IRA, should be carefully considered within the context of one’s overall financial plan. These investments not only serve as a retirement fund but also offer potential tax advantages, aligning with the ever-shifting landscape of tax code changes and ensuring that self-employed individuals are poised to maximize their tax benefits in the coming year.

Self-employment offers a multitude of tax planning opportunities for those willing to navigate the intricate details of tax law. By leveraging tax exemption eligibility, such as identifying and properly documenting home office expenses and health insurance premiums under Tax Exemption Eligibility, self-employed individuals can significantly reduce their taxable income. Staying vigilant about IRS Penalties and Interest, particularly adhering to key deadlines outlined in ‘Navigating IRS Penalties and Interest: Key Dates and Deadlines,’ is essential for evading unnecessary charges. Furthermore, exploring strategic planning avenues like Nonprofit Tax Filing and making Tax-efficient Investments through a Simplified Employee Pension (SEP) IRA can yield substantial tax benefits, as detailed in ‘Strategic Planning for Nonprofit Tax Filing and Tax-efficient Investments.’ In light of the ever-evolving Tax Code Changes, it is imperative to stay informed and adapt one’s filing strategy accordingly. By optimizing one’s Filing Status Optimization in 2023, self-employed individuals can ensure they are making the most of their tax situation, as outlined in ‘Adapting to Tax Code Changes and Optimizing Filing Status in 2023.’ Regular financial planning for taxes is a prudent approach that helps maintain compliance and maximize the advantages available to those who work for themselves.