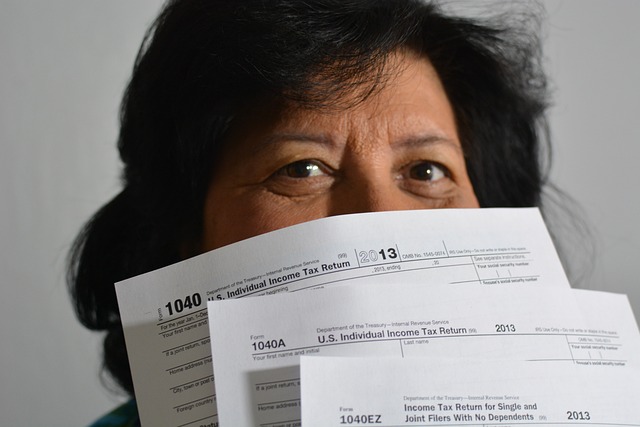

2023 tax season is upon us, and optimizing your tax refund has never been more accessible or expertly managed. Our article delves into the multifaceted approach of our income tax services, designed to streamline your tax experience through advanced online tax filing and dedicated professional tax preparation. We pride ourselves on delivering comprehensive income tax services personalized for individuals and small businesses alike. By leveraging our expertise, you can navigate the complexities of tax laws with ease, ensuring you don’t miss out on valuable deductions and credits. From strategic tax planning and filing to provide maximum refunds, to offering accessible virtual tax filing for all states, our commitment to your financial wellbeing is unparalleled. Stay informed with critical tax deadline reminders and utilize our tax return help to make this fiscal year’s filing as stress-free as possible. Additionally, our corporate tax filing services ensure compliance and optimization, while our tax advisory services are instrumental in enhancing your overall financial health. Join us as we guide you through the process of making your tax refund reflective of your hard work.

- Leveraging Online Tax Filing for Efficient Returns

- Expertise in Professional Tax Preparation Services

- Comprehensive Income Tax Services Tailored to Your Needs

- Navigating Tax Filing for Small Businesses with Ease

- Strategic Tax Planning and Filing to Maximize Refunds

- Important Tax Deadline Reminders for the Fiscal Year

- Accessible Virtual Tax Filing and State Tax Assistance

Leveraging Online Tax Filing for Efficient Returns

In the current digital era, online tax filing has become a cornerstone for efficient returns, offering a streamlined process that aligns with the fast-paced nature of modern life. Utilizing professional tax preparation services through online platforms allows individuals and businesses alike to navigate complex tax codes with ease, ensuring accuracy and optimizing the potential for higher refunds. These services provide a user-friendly interface that guides users step-by-step through their income tax services, identifying all eligible deductions and credits. For small business owners, tax filing for businesses becomes less daunting as these online systems are designed to handle intricate financial statements and categorize expenses accurately. Moreover, state tax filing and corporate tax filing can be managed from a single portal, making the process more cohesive and less fragmented. With virtual tax filing assistance, individuals can access real-time tax return help, ask questions, and receive prompt responses from knowledgeable tax advisor services, all within the confines of their own home or office. The integration of tax planning and filing into a digital format not only saves time but also reduces the likelihood of human error, ensuring that your returns are filed on time and in compliance with state and federal regulations. Additionally, these platforms often offer tax deadline reminders, which help in avoiding penalties due to late filings. By leveraging the convenience and expertise of online tax filing, you can trust that your financial situation is being handled by professionals who prioritize maximizing your tax refund while adhering to the highest standards of accuracy and compliance.

Expertise in Professional Tax Preparation Services

Our professional tax preparation services stand at the forefront of ensuring that our clients optimize their tax refunds through meticulous online tax filing and state tax filing processes. Our seasoned tax advisors leverage their expertise to navigate the complexities of federal and state income tax services, identifying all possible deductions and credits for both small business tax services and individual filings. With a commitment to accuracy and efficiency, we provide virtual tax filing assistance that is both comprehensive and tailored to each client’s unique financial situation. Our team’s proficiency in corporate tax filing is matched by our proactive approach to tax planning and filing, ensuring compliance with the latest tax laws and deadlines. We understand the importance of staying current with tax regulations, which is why we offer timely tax deadline reminders and ongoing support throughout the tax season, helping you to maximize your returns and minimize potential liabilities. Our online platform simplifies the process, allowing for seamless tax return help that adapts to your needs, making complex tax situations more manageable. With our professional tax preparation services, clients can trust that their income tax services are in capable hands, ready to guide them through every step of the tax process with precision and care.

Comprehensive Income Tax Services Tailored to Your Needs

Our income tax services are meticulously tailored to cater to the diverse financial landscapes of our clients. We leverage cutting-edge online tax filing solutions, ensuring a seamless and efficient process for individuals and businesses alike. Our professional tax preparation expertise is at your disposal, guiding you through the intricate details of tax laws and maximizing your refund potential. Whether you’re an entrepreneur or an individual filer, our team is dedicated to uncovering every eligible deduction and credit, crafting a personalized strategy for tax return help that aligns with your unique situation. We stay abreast of the latest in state tax filing and corporate tax filing requirements, providing accurate and timely tax advisor services. Our proactive approach to tax planning and filing means we don’t just prepare your taxes; we anticipate upcoming tax deadline reminders, ensuring you never miss an important date. With our virtual tax filing support, you can trust that your financial well-being is in expert hands, allowing you to focus on what matters most to you.

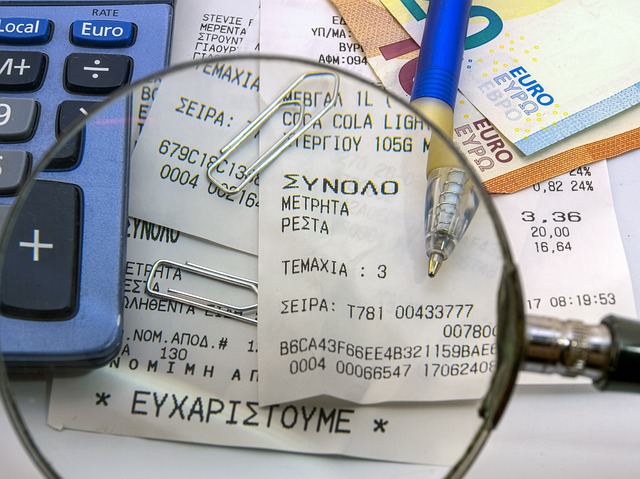

Navigating Tax Filing for Small Businesses with Ease

Navigating the complexities of tax filing for small businesses can be a daunting task, but with the right support, it doesn’t have to be. Our online tax filing services simplify the process, allowing business owners to focus on what they do best—running their operations. We provide professional tax preparation tailored to each client’s unique financial landscape, ensuring that all eligible deductions and credits are maximized. Our income tax services are designed to cater to the diverse needs of small businesses, from sole proprietorships to partnerships. We understand that staying on top of the ever-changing tax laws is crucial for compliance and optimizing your financial position.

To streamline the process further, we offer virtual tax filing assistance, which can be conducted from the comfort of your home or office. Our state-of-the-art platform ensures secure and efficient online tax filing, making it easy to manage both federal and state tax filings. Our corporate tax filing expertise is complemented by our proactive tax planning and filing approach, which helps businesses anticipate and prepare for upcoming tax deadlines with reminders. Our dedicated team of tax advisor services professionals stands ready to provide return help and advice, ensuring that your business’s tax obligations are met with precision and care. Whether you’re preparing for the tax season or looking to plan ahead, our comprehensive services are here to support your financial health throughout the year.

Strategic Tax Planning and Filing to Maximize Refunds

Our approach to maximizing your tax refund is rooted in strategic tax planning and meticulous filing, leveraging our comprehensive income tax services. We understand that each individual and business has unique financial circumstances, which is why our professional tax preparation goes beyond simple online tax filing; it’s a tailored process designed to uncover every possible deduction and credit you’re entitled to. Our team excels in both individual filings and tax filing for businesses, ensuring no stone is left unturned. With the complexities of state tax filing and corporate tax filing, our expertise becomes even more valuable, guiding you through the maze of regulations and deadlines with virtual tax filing assistance that’s accessible from anywhere at any time. We pride ourselves on providing not just tax return help, but also timely tax deadline reminders to avoid penalties. Our tax advisor services are a testament to our commitment to maximizing your returns while minimizing your tax obligations, ensuring you receive the refund assistance you deserve, all year round. By partnering with us, you’re not just filing taxes; you’re making a strategic move towards financial empowerment and peace of mind.

Important Tax Deadline Reminders for the Fiscal Year

As the fiscal year draws to a close, adhering to important tax deadline reminders is crucial for both businesses and individuals alike. For starters, online tax filing has streamlined the process, making it more accessible than ever before. However, it’s imperative to remain vigilant about the various deadlines that apply to your situation. Businesses should be aware of their specific tax filing for businesses deadline, as it often differs from individual tax return deadlines. These dates can vary depending on whether you’re filing state or corporate tax filings, and professional tax preparation services can help navigate these complexities. It’s not just about meeting the deadlines; it’s also about maximizing your refund through thorough income tax services that identify all eligible deductions and credits. Our team’s expert guidance in tax planning and filing ensures that clients leverage every opportunity to minimize their tax liability and receive the refund assistance they are entitled to.

Moreover, this year’s tax season may bring new considerations with changes in tax laws or updates in virtual tax filing platforms. It’s essential to engage with a tax advisor who offers return help tailored to your unique financial circumstances. By staying informed and making use of comprehensive income tax services, you can rest assured that all aspects of your tax situation are handled with care and precision. Whether you’re an individual or a small business owner, timely and accurate tax return preparation is key to avoiding penalties and ensuring you receive the full benefits you deserve. Don’t underestimate the importance of these tax deadline reminders; they can significantly impact your financial health come tax season.

Accessible Virtual Tax Filing and State Tax Assistance

Our online tax filing platform provides a seamless and accessible experience for individuals and businesses alike, ensuring that professional tax preparation is within everyone’s reach. This innovative service facilitates income tax services with a user-friendly interface that guides users through the process of identifying all eligible deductions and credits, maximizing their refunds efficiently. Our virtual tax filing option caters to those who prefer the convenience of remote tax return help, offering the same level of expertise as an in-person meeting with a tax advisor. This service is particularly beneficial for tax filing for businesses that operate remotely or for those who prioritize social distancing without compromising on the quality of tax planning and filing assistance. Additionally, our state tax filing support ensures that clients navigate the complexities of local tax codes with confidence, providing comprehensive services tailored to both individual and corporate tax filing needs. Our commitment to staying current with tax laws means that we offer timely tax deadline reminders, ensuring that all filings are submitted promptly and accurately, thereby avoiding potential penalties and interest charges. With our expertise in income tax services and tax return help, clients can trust that they are receiving the most up-to-date and personalized support for their state and federal tax obligations.

Navigating the complexities of tax season can be overwhelming; however, with our dedicated online tax filing solutions and professional tax preparation expertise, your financial well-being is in capable hands. Our income tax services are meticulously designed to cater to individual and small business needs, ensuring no stone is left unturned when it comes to identifying potential deductions and credits. We pride ourselves on providing strategic tax planning and filing assistance, with the goal of maximizing your refund. As the fiscal year closes, our timely tax deadline reminders will keep you informed and prepared. For those requiring virtual or state tax filing support, our team is equipped to offer seamless, accessible services from anywhere. Trust our tax advisor services to guide you through corporate tax filing with ease and confidence. Let us help you secure the refund you are entitled to this tax season.