Navigating the complexities of income tax e-filing can be a challenge for many individuals. However, with the advent of user-friendly online tax filing solutions, the process is streamlined to offer simplicity and efficiency. This article serves as a comprehensive guide to harnessing these digital tools effectively. We’ll explore how easy tax filing becomes when using online tax forms, suitable for every type of filer, including those who are self-employed. Additionally, we will delve into the benefits of tracking your tax refund through secure online tax filing systems, ensuring both peace of mind and swift processing. By leveraging these e-filing solutions, taxpayers can enjoy a more tailored and efficient tax season experience, with tax filing assistance readily available to guide you at every step.

- Simplifying Income Tax E-Filing: A Step-by-Step Guide to Easy Tax Filing

- Maximizing Convenience with Online Tax Forms for Every Filer

- Tracking Your Tax Refund with Secure Online Tax Filing Systems

- Tailored Assistance for Self-Employed Tax Filers through Digital Platforms

- Enhancing the Tax Filing Experience: Security and Efficiency in E-Filing Solutions

Simplifying Income Tax E-Filing: A Step-by-Step Guide to Easy Tax Filing

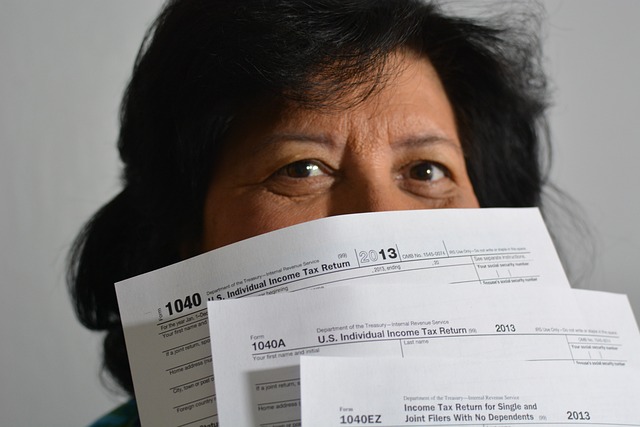

Embarking on the process of income tax e-filing can be efficiently managed by leveraging online tax forms. These digital tools are designed to streamline the experience, making easy tax filing a reality for individuals and self-employed tax filers alike. The process begins with gathering all necessary financial documents, which can then be inputted into the user-friendly interface of your chosen online tax software. This platform will guide you through each step of the tax return preparation, from categorizing income sources to claiming deductions and credits. By utilizing these services, you can ensure that your tax filing is accurate and compliant with current tax laws.

For those who require additional support, many online tax filing platforms offer tax filing assistance. This assistance can come in various forms, including step-by-step guidance, customer service help, and the use of tax refund tracking tools. These resources are particularly beneficial for self-employed individuals or those with more complex tax situations. With secure online tax filing, you can submit your returns with confidence, knowing that your sensitive financial information is protected throughout the process. Moreover, by using online tax forms, you can receive your tax refunds faster and without the need to physically mail paper returns. This not only simplifies the tax filing process but also brings convenience and peace of mind to taxpayers everywhere.

Maximizing Convenience with Online Tax Forms for Every Filer

The advent of digital technology has revolutionized the way individuals and businesses handle income tax e-filing. Online tax forms have been designed with every filer in mind, offering an intuitive platform that simplifies the often complex process of preparing taxes. These electronic forms are tailored to cater to a diverse array of taxpayers, from the self-employed managing business income to those with straightforward personal returns. The ease of accessing and filling out these forms online cannot be overstated; with just an internet connection and basic information at hand, users can navigate through their tax details with minimal effort. This streamlined approach not only maximizes convenience but also ensures that each section of the tax return is accurately completed.

Moreover, the integration of secure online tax filing systems provides a layer of protection for sensitive financial data. These platforms employ robust encryption and privacy measures to safeguard your personal information throughout the tax filing process. Additionally, taxpayers have access to real-time tax refund tracking, allowing them to monitor the status of their returns without the need for cumbersome paperwork or in-person visits to tax authorities. For those who may require additional assistance, many online tax filing services offer guidance and support to help users through each step, ensuring that even filers with less tax experience can confidently prepare their returns. This blend of accessibility, security, and user support makes online tax forms an indispensable tool for anyone looking to make their tax season as straightforward and stress-free as possible.

Tracking Your Tax Refund with Secure Online Tax Filing Systems

Engaging in income tax e-filing through secure online tax filing systems offers a multitude of benefits for taxpayers, particularly those who are self-employed or have complex financial situations. These platforms streamline the process of submitting easy tax filings by providing intuitive online tax forms tailored to individual circumstances. The convenience of electronic filing is further amplified by the integration of tax refund tracking features. Once your return is processed, you can monitor the status of your tax refund with precise accuracy and in real-time. This feature provides peace of mind as you wait for your refund, knowing that every step of this sensitive process is securely managed online. The added assurance of privacy and protection of sensitive financial information is a cornerstone of these systems, ensuring that tax filing assistance is both efficient and safeguarded against unauthorized access or fraudulent activities. With the ability to track your tax refund from submission to disbursement, the stress and uncertainty of the tax season process are significantly reduced. This level of transparency and control in the tax return process underscores the advancements made in online tax filing systems, making them a preferable choice for taxpayers nationwide.

Tailored Assistance for Self-Employed Tax Filers through Digital Platforms

For self-employed individuals, navigating the complexities of income tax e-filing can be particularly challenging due to the unique nature of their business transactions. However, digital platforms have revolutionized the process by offering tailored assistance for self-employed tax filers. These online solutions are equipped with specialized features that cater to the diverse financial activities associated with freelance work or running a small business. The user-friendly interface guides these taxpayers through the nuances of reporting income from various sources, deducting business expenses, and calculating the correct amount of self-employment taxes. The software ensures that all online tax forms are accurately completed, reflecting the intricacies of one’s professional activities. Furthermore, these platforms facilitate secure online tax filing by employing advanced encryption and providing real-time guidance to help avoid common errors or omissions that could lead to complications or delays.

Additionally, self-employed individuals can take advantage of easy tax filing services that often come with additional support for tracking tax refunds. This feature is particularly beneficial as it allows for continuous monitoring of the status of one’s refund, providing peace of mind and a clear understanding of the timeline involved in the processing of their return. The integration of tax refund tracking within the online tax filing system streamlines the entire process, making it more manageable for those who may have found previous tax seasons overwhelming. With these secure, efficient, and supportive digital tools at their disposal, self-employed tax filers can approach the annual income tax e-filing process with confidence, knowing that they have a reliable ally in their pursuit of compliance and potential tax savings.

Enhancing the Tax Filing Experience: Security and Efficiency in E-Filing Solutions

The advent of income tax e-filing has revolutionized the way individuals and self-employed taxpayers approach their annual tax obligations. E-filing solutions have streamlined the process, making it not only easier but also more efficient than ever before. Taxpayers can now access a variety of online tax forms with just a few clicks, facilitating an easy tax filing experience that caters to users of all income levels. These platforms are designed with intuitive interfaces that guide users through each necessary step, from the initial input of personal and financial information to the final submission of their returns. The integration of secure online tax filing protocols ensures that sensitive tax data is protected throughout the process, giving filers peace of mind as they navigate their tax liabilities. Additionally, these digital tools offer real-time tax refund tracking capabilities, allowing individuals to monitor the status of their refunds with precision and accuracy. For those who may need additional assistance, online tax filing services often provide resources and support to help users understand complex tax codes and optimize their tax positions. By leveraging these advanced e-filing solutions, taxpayers can save time, reduce errors, and enjoy a more secure and hassle-free tax season.

Navigating income tax e-filing no longer needs to be a source of stress. The transition to online tax filing systems has democratized the process, making it accessible and straightforward for all filers through user-friendly interfaces and easy tax filing options. With the advent of these digital platforms, individuals and self-employed taxpayers alike can maximize convenience using online tax forms designed specifically for their needs. The ability to track your tax refund with secure online tax filing systems adds an additional layer of assurance, ensuring that your return is processed efficiently. Furthermore, the integration of tax filing assistance within these platforms caters to individual circumstances, offering tailored solutions that enhance both the security and efficiency of e-filing income tax. Embracing this modern approach to tax season not only simplifies the process but also positions you to file accurately and on time, ultimately making your financial obligations more manageable in the digital age.