When choosing affordable auto insurance, it's vital to understand the difference between liability and full coverage. Liability coverage, which most states require, protects others against harm you may cause. Full coverage, on the other hand, includes liability as well as comprehensive and collision protection, safeguarding your vehicle from damage or theft. New drivers should explore car insurance quotes from top-rated companies to find the best deals on cheap car insurance for young drivers, while also considering various discounts available, such as those for good students, defensive driving, multi-car policies, and vehicles with safety features. By comparing rates from the best auto insurance companies and taking advantage of these discounts, you can secure a cost-effective policy that balances financial considerations with adequate coverage. This ensures that new drivers and seasoned motorists alike have the protection they need on the road at a price point that's manageable.

Embarking on the quest for full coverage auto insurance can seem daunting amidst a multitude of options. Our comprehensive guide simplifies the process, distinguishing between liability and full coverage, and tailoring advice for both novice and seasoned drivers. With a focus on affordability, we highlight how to compare car insurance quotes from top-rated providers, ensuring you receive the best auto insurance companies’ value without compromising quality. Learn the strategies to maximize your savings through unique discounts and understand how to find cheap car insurance for young drivers, making your journey to secure robust coverage not just possible, but also cost-effective.

- Navigating Full Coverage Auto Insurance: Understanding Your Options

- Liability vs. Full Coverage: What's the Difference and Why Does It Matter?

- Tailoring Auto Insurance to Your Needs: Strategies for New and Experienced Drivers

- Finding Affordable Auto Insurance: Comparing Quotes from Top Providers

- Maximizing Your Savings: Exploring Auto Insurance Discounts for Every Driver

Navigating Full Coverage Auto Insurance: Understanding Your Options

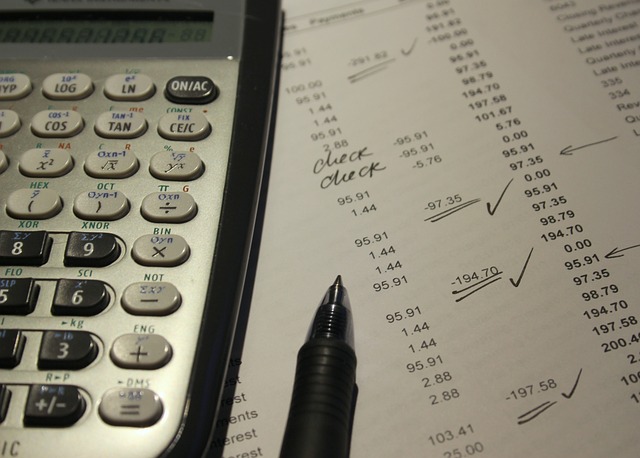

When shopping for full coverage auto insurance, it’s crucial to understand your options and how they can impact both your safety and your finances. Full coverage auto insurance, which typically includes both collision and comprehensive coverage in addition to liability insurance, offers broader protection than its liability-only counterpart. This comprehensive approach can be particularly beneficial in the event of an accident or if your vehicle is damaged by non-collision events such as theft, vandalism, or natural disasters. To make an informed decision, start by comparing car insurance quotes from top providers to assess the range of rates and coverage levels available. Utilizing online tools and platforms that allow you to compare car insurance rates can streamline this process, making it easier to find affordable auto insurance without sacrificing necessary protection.

For new drivers, the journey towards securing the best auto insurance companies can be daunting, but there are strategies to make it more accessible. Young and inexperienced drivers often face higher premiums due to perceived increased risk. However, by taking advantage of auto insurance discounts tailored for new drivers, such as good student, driver’s education, or defensive driving course discounts, costs can be reduced significantly. Additionally, exploring options like paying annual premiums rather than monthly, maintaining a clean driving record, and bundling policies with other insurance products can further lower expenses. It’s also advisable to review your policy regularly as you gain more experience on the road, ensuring that your coverage evolves alongside your driving expertise, thereby keeping you protected without overburdening your budget.

Liability vs. Full Coverage: What's the Difference and Why Does It Matter?

When navigating the world of auto insurance, understanding the distinction between liability and full coverage is crucial for making an informed decision that aligns with your needs and budget. Liability coverage is the minimum requirement in many states, addressing the damage you may cause to others or their property but not covering your own vehicle if it’s damaged in an accident you cause. On the other hand, full coverage extends beyond this, offering protection for your car as well. It includes comprehensive and collision coverage, which can help pay for repairs or replacement if your vehicle is damaged due to events like theft, vandalism, natural disasters, or a collision with an object or another vehicle, regardless of who is at fault.

Choosing between liability and full coverage involves a careful consideration of various factors, including the value of your car, your financial situation, and the level of risk you’re willing to assume. For new drivers, who statistically are more likely to be involved in accidents, finding affordable auto insurance that offers robust protection is particularly important. The best auto insurance companies understand this and provide cheap car insurance options tailored for young drivers, often by offering unique auto insurance discounts. By comparing car insurance quotes from top providers, you can identify the most cost-effective policies that still offer the coverage you need. These comparisons enable you to find a balance between affordability and the assurance that comes with full coverage auto insurance, ensuring that your investment in a vehicle is protected without unnecessary financial strain.

Tailoring Auto Insurance to Your Needs: Strategies for New and Experienced Drivers

When tailoring auto insurance to fit your unique needs as either a new or an experienced driver, it’s crucial to understand the differences between liability and full coverage policies. For new drivers, the journey towards affordable auto insurance can seem daunting due to higher risks perceived by insurers, which often results in pricier premiums. However, by exploring options from some of the best auto insurance companies and comparing car insurance quotes across various providers, young drivers can find cost-effective solutions that provide the necessary protection without compromising their financial well-being. It’s not just about finding cheap car insurance for young drivers; it’s about balancing coverage levels with rates to ensure they are adequately protected on the road.

As you gain more experience, your driving profile becomes more favorable to insurers, potentially leading to lower premiums. During this transition, understanding how auto insurance discounts can significantly reduce costs is invaluable. Full coverage auto insurance offers comprehensive protection against various risks, from collision and comprehensive coverage to medical payments and uninsured/underinsured motorist coverage. When comparing car insurance rates, it’s important to evaluate both liability and full coverage options, taking into account the specific risks you face and your tolerance for out-of-pocket expenses in the event of an incident. By continually reassessing your needs and making use of available discounts, both new and experienced drivers can secure a policy that aligns with their coverage requirements and budget constraints.

Finding Affordable Auto Insurance: Comparing Quotes from Top Providers

When navigating the search for affordable auto insurance, understanding the nuances between liability and full coverage is paramount. Liability coverage, which typically covers damages or injuries you inflict on others, is mandatory in most states but may not be sufficient to protect your own vehicle from accidents or theft. Full coverage, on the other hand, includes comprehensive and collision coverage, offering a more robust shield against a wider range of financial losses. To find the best policy for your needs, it’s essential to compare car insurance quotes from top providers. These quotes provide a clear view of the cost differences among companies, allowing you to identify the most affordable options that still deliver the necessary level of protection. Utilizing online platforms where you can input your information once and receive multiple quotes simultaneously is an efficient way to start this process. It’s not just about finding cheap car insurance for young drivers; it’s about securing a policy that offers the right balance between cost and coverage, especially as premiums can vary significantly based on age, driving history, and vehicle type. Additionally, exploring auto insurance discounts can further reduce your expenses. From multi-car policies to good student or defensive driving course discounts, these savings opportunities can make a substantial difference for new drivers and those with more experience alike. By carefully comparing car insurance rates and taking advantage of available discounts, you can confidently choose the right auto insurance policy that keeps you protected on the road without straining your budget.

Maximizing Your Savings: Exploring Auto Insurance Discounts for Every Driver

When navigating the world of auto insurance, understanding your options is key to maximizing savings and securing affordable coverage that suits your needs. Auto insurance discounts can significantly reduce your premiums and are available for every driver. From the best auto insurance companies to those tailored for young drivers, these discounts are a valuable tool in your quest for cheap car insurance. Exploring a wide range of car insurance quotes from top providers allows you to compare rates effectively, ensuring that you don’t overpay for your policy. For instance, multi-car policies, good student discounts, and safe driver incentives can provide substantial savings for new drivers who are often perceived as higher risk. Additionally, discounts for vehicles equipped with anti-theft devices or those with advanced safety features can also lower your costs. By understanding the difference between liability vs. full coverage, you can determine which type of policy aligns with your financial situation and driving habits. Full coverage auto insurance typically offers more protection, including collision and comprehensive coverage, which can be crucial if your vehicle is at risk of damage beyond what a liability-only policy would cover. Tailoring your coverage to fit your unique circumstances, coupled with applying for all available discounts, will help you find the most cost-effective auto insurance without compromising on necessary protection.

When embarking on the quest for reliable and affordable auto insurance, it’s crucial to navigate through the plethora of options available. Our comprehensive guide demystifies the differences between liability and full coverage policies, offering clarity to drivers at every stage of their driving careers. With practical strategies tailored for both new and seasoned drivers, along with insights on how to compare car insurance quotes from top-rated providers, you’re equipped to make an informed decision without overspending. By leveraging a variety of auto insurance discounts, young drivers can find cost-effective coverage that suits their needs. In summary, our article serves as your roadmap to secure the best affordable auto insurance, ensuring peace of mind for every journey ahead.