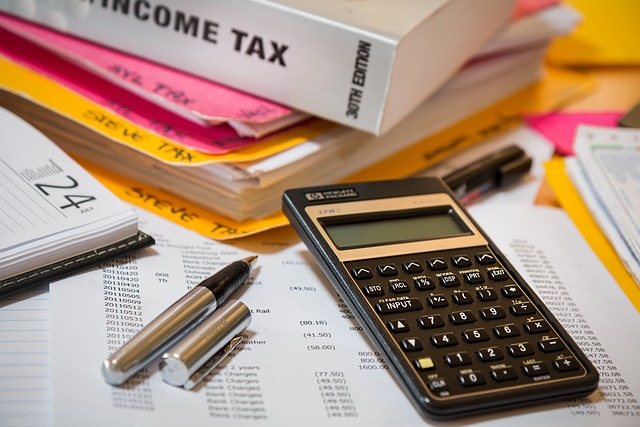

Effective small business tax planning is a cornerstone for enhancing financial health and maximizing annual savings. By employing strategic tax-saving tips, entrepreneurs can significantly reduce their income tax burden. This article delves into the nuances of tax optimization strategies, guiding small business owners through the intricacies of leveraging deductions, utilizing tax-efficient investments, and mastering the timing of income and expenses. Additionally, it addresses retirement tax planning and wealth management tax strategies tailored for high-income earners and business owners. Regular consultations with a tax advisor are pivotal in ensuring compliance while uncovering opportunities for greater tax savings. Read on to transform your tax approach and secure your financial future.

- Maximizing Tax Savings through Strategic Small Business Tax Planning

- Leveraging Deductions: A Guide to Claiming All Eligible Expenses

- The Role of Tax-Deferred Accounts in Reducing Annual Tax Liabilities

- Income and Expense Timing: Key to Effective Tax Management for Entrepreneurs

- Long-Term Wealth Preservation: Tax Efficiency in Retirement Planning

- Tailored Tax Strategies for High-Income Earners and Business Owners

Maximizing Tax Savings through Strategic Small Business Tax Planning

For small business owners, the art of tax planning is not just a compliance task but a strategic financial endeavor that can yield significant savings. Implementing tax-saving tips is paramount, as it involves identifying all eligible deductions and credits to reduce income tax effectively. These deductions might encompass a range of business expenses such as office supplies, equipment purchases, and employee wages. By meticulously categorizing and documenting these expenditures, businesses can maximize their deductions and significantly decrease their taxable income, thereby improving cash flow.

Moreover, small business tax planning extends beyond mere income tax reduction; it encompasses long-term financial health through tax-efficient investments. Wealth management tax strategies for small businesses often include setting up tax-deferred accounts like retirement plans, which allow funds to grow tax-free until withdrawal. For high-income earners, these strategies become even more critical as they navigate complex tax codes and aim to retain more of their hard-earned income. Tax optimization strategies should be an ongoing process, with regular consultations with a tax advisor to ensure compliance, stay ahead of changes in tax laws, and identify new opportunities for savings. By adopting a proactive approach and staying informed about the latest tax planning for high-income earners, small business owners can effectively manage their tax liabilities and position themselves for financial success.

Leveraging Deductions: A Guide to Claiming All Eligible Expenses

Small business owners have a plethora of opportunities to optimize their tax situation through strategic planning and leveraging deductions. A comprehensive approach to tax-saving tips involves identifying all eligible business expenses that can be deducted from gross income, thereby reducing income tax. It’s imperative for small businesses to keep meticulous records and stay informed about the latest tax laws, as deductible items often extend beyond the obvious. For instance, home office expenses, vehicle usage, and certain types of training or professional development can all be claimable. By thoroughly reviewing business expenditures with a fine-toothed comb, entrepreneurs can ensure they’re not missing out on potential tax savings.

In addition to leveraging deductions, small businesses should consider tax-efficient investments and retirement tax planning as part of their overall wealth management tax strategies. Investing in tax-deferred accounts, such as traditional IRAs or 401(k)s, allows for the deferral of taxes until a later date, often when one’s income may be lower. This not only improves cash flow in the short term but also sets the stage for a more tax-optimized financial future. High-income earners can particularly benefit from these strategies by minimizing their current tax liabilities while planning for long-term wealth preservation and growth. Regular consultations with a tax advisor are indispensable in this process, as they can offer tailored advice to align with one’s unique financial situation and objectives.

The Role of Tax-Deferred Accounts in Reducing Annual Tax Liabilities

For small business owners, leveraging tax-deferred accounts is a cornerstone in reducing annual tax liabilities and enhancing overall financial health. These accounts, such as Individual Retirement Accounts (IRAs) or Simplified Employee Pension (SEP) plans, allow entrepreneurs to set aside funds for retirement while deferring the associated income taxes until a later date. By contributing to these accounts, small business owners can significantly lower their taxable income during high-earning years, which is particularly advantageous for high-income earners looking to optimize their income tax reduction. This strategic deferral of taxes not only improves cash flow in the present but also sets the stage for more tax-efficient investments and robust retirement tax planning.

Tax optimization strategies must be a priority within small business tax planning, as they can yield substantial savings. By planning ahead and making contributions to tax-deferred accounts before year-end, businesses can effectively manage their wealth by deferring taxes on investment gains. Additionally, these accounts often offer a variety of investment options that can grow tax-free until withdrawal, providing a dual benefit of compounded growth and reduced current tax liabilities. Consulting with a tax advisor is essential to navigate the complexities of these accounts, ensuring compliance while identifying opportunities for further income tax reduction. With careful planning and professional guidance, small businesses can utilize these tax-saving tips to their advantage, laying the groundwork for both immediate financial relief and long-term retirement security.

Income and Expense Timing: Key to Effective Tax Management for Entrepreneurs

For small business owners, the art of income and expense timing is a cornerstone of effective tax management. By strategically scheduling transactions, entrepreneurs can significantly reduce their income tax burden. Tax-saving tips such as deferring income recognition to the next tax year or accelerating deductible expenses into the current year can be pivotal in lowering taxable income. This approach not only impacts the immediate tax liability but also enhances cash flow, which is crucial for the sustenance and growth of the business.

Incorporating tax-efficient investments as part of one’s wealth management tax strategies can further augment these benefits. These investments often offer tax deductions or deferred tax liabilities, aligning well with the retirement tax planning needs of small business owners. By contributing to tax-advantaged accounts such as IRAs or 401(k)s, entrepreneurs can secure their financial future while concurrently optimizing their current tax situation. Additionally, for high-income earners, understanding which deductions and credits are available, and how to apply them effectively, is essential. Regular consultations with a tax advisor are indispensable in this process, as they can provide personalized tax optimization strategies tailored to the unique financial landscape of the business. This proactive approach ensures that small business owners not only comply with tax regulations but also capitalize on every legal opportunity to save on taxes, thereby safeguarding their financial health both now and in the future.

Long-Term Wealth Preservation: Tax Efficiency in Retirement Planning

For small business owners and high-income earners alike, long-term wealth preservation is a pivotal aspect of financial planning, particularly when it comes to retirement. Effective tax efficiency in retirement planning is not a one-size-fits-all solution but rather a carefully crafted approach that leverages tax-saving tips to reduce income tax throughout one’s working years and beyond. A robust tax optimization strategy should be at the forefront of small business tax planning, ensuring that every possible deduction and credit is claimed to minimize taxable income. This proactive stance not only improves immediate cash flow but also sets the stage for a more tax-efficient retirement.

Investing in tax-efficient investments, such as Roth IRAs or tax-deferred accounts like 401(k)s, can significantly impact an individual’s future tax liabilities. These vehicles are designed to allow investments to grow tax-free or defer taxes until withdrawal, providing a shield against the erosive effects of income taxes on retirement savings. Furthermore, small business owners can optimize their retirement tax planning by adopting plans like SEP IRAs or SIMPLE plans, which offer higher contribution limits than traditional IRAs. Regular consultations with a knowledgeable tax advisor are essential to navigate these complexities and to stay abreast of any changes in tax laws that could further benefit one’s wealth management tax strategies. By integrating these tax-saving tips into their planning, individuals can effectively reduce their overall tax burden and preserve more of their hard-earned wealth for retirement.

Tailored Tax Strategies for High-Income Earners and Business Owners

For high-income earners and business owners, crafting tailored tax-saving tips is paramount for income tax reduction. Engaging in tax-efficient investments and strategic tax optimization can significantly alleviate the tax burden. These individuals often have a broader array of options at their disposal, such as contributing to retirement accounts, which can be leveraged for immediate tax benefits and long-term wealth management tax strategies. By maximizing contributions to tax-advantaged retirement plans like 401(k)s or IRAs, they can reduce taxable income, thereby lowering their current year’s taxes. Additionally, business owners can utilize small business tax planning to defer income recognition and accelerate deductible expenses. This careful timing of income and expenses is a potent tool for managing cash flow while optimizing tax liabilities. Regular consultation with a knowledgeable tax advisor is essential, as they can provide guidance on the latest tax laws and uncover innovative ways to minimize taxes throughout the year. These personalized strategies are not one-size-fits-all; they require a deep understanding of individual circumstances and access to professional expertise in tax planning for high-income earners.

Effective tax planning is a cornerstone of small business success and personal wealth management. By implementing tax-saving tips such as claiming all eligible deductions and strategically investing in tax-deferred accounts, small business owners can significantly reduce their income tax liabilities, thereby enhancing their cash flow. The nuances of timing income and expenses are particularly critical for entrepreneurs seeking to exert greater control over their tax situation. Regular consultations with a tax advisor not only ensure adherence to the ever-changing tax laws but also reveal additional opportunities for income tax reduction. As this article has outlined, from leveraging tax-efficient investments to employing retirement tax planning strategies, there are numerous avenues for tax optimization. High-income earners and business owners, in particular, can benefit from tailored tax strategies designed to preserve and grow their wealth over the long term. In conclusion, with a proactive approach to small business tax planning and a commitment to staying informed about wealth management tax strategies, businesses and individuals alike can achieve substantial financial benefits.