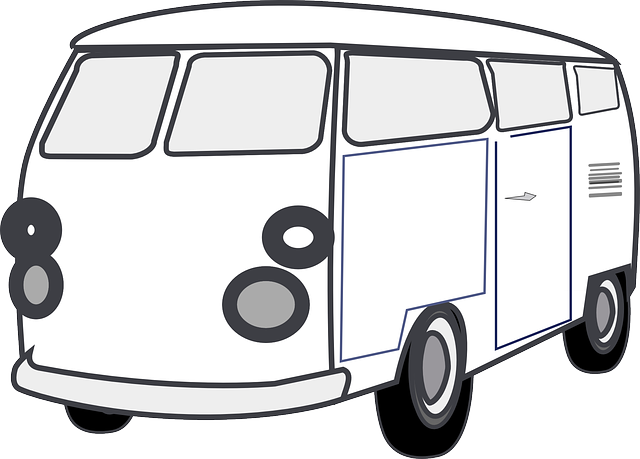

Small business owners with vans or fleets face unique challenges in securing insurance that aligns with their operational needs and budget constraints. This article delves into the nuances of obtaining Business Van Insurance tailored to the dynamic nature of small enterprises. We explore Fleet Van Insurance options, Commercial Vehicle Insurance, and the critical aspect of Van Liability Insurance, all aimed at safeguarding your assets without strain. Furthermore, we examine cost-effective solutions through Cheap Commercial Van Insurance, ensuring that your business remains agile and protected on the road to success. Whether you’re a courier or deliver goods, understanding the range of Commercial Auto Insurance for Vans is paramount. Let’s navigate the essentials of Delivery Van Insurance Coverage to keep your operations running smoothly.

- Optimizing Protection and Costs with Business Van Insurance

- Tailoring Fleet Van Insurance for Your Small Business Needs

- Understanding Commercial Vehicle Insurance Options

- The Importance of Van Liability Insurance for SMBs

- Exploring Affordable Solutions: Cheap Commercial Van Insurance

- Comprehensive Coverage with Commercial Auto Insurance for Vans

Optimizing Protection and Costs with Business Van Insurance

When it comes to safeguarding the assets of a small business that relies on vans for operations, Business Van Insurance stands out as a critical investment. This type of coverage is specifically designed to meet the unique needs of businesses operating fleets or single vans, offering tailored protection that aligns with the scale and nature of their operations. Opting for Fleet Van Insurance can be particularly advantageous for companies with multiple vehicles, providing a comprehensive policy that can be more cost-effective than insuring each van individually. This approach not only streamlines management but also ensures consistent coverage across all company assets.

Moreover, within the realm of Commercial Vehicle Insurance, Van Liability Insurance is an essential component. It protects against third-party claims arising from accidents or damages caused by the business’s vans. For small businesses, balancing the need for robust protection with budgetary constraints is key. Cheap Commercial Van Insurance can be a sensible choice, offering cost savings without compromising on essential coverage. Options like Courier Van Insurance and Delivery Van Insurance Coverage are tailored to the specific risks associated with these operations, ensuring that whether goods are being delivered or services provided, the business remains protected. Additionally, Commercial Auto Insurance for Vans can be customized to include additional benefits, such as cover for tools, equipment, or even emergency roadside assistance. This level of customization ensures that small businesses can optimize their protection and costs, aligning their insurance needs with their financial goals for long-term sustainability and growth.

Tailoring Fleet Van Insurance for Your Small Business Needs

When tailoring fleet van insurance for your small business, it’s crucial to consider the specific needs and exposures presented by each vehicle within your operation. Business van insurance policies can be customized to ensure that all aspects of risk are addressed. For instance, if your enterprise includes a diverse set of vans used for courier services, delivery operations, or other transportation needs, having a comprehensive commercial vehicle insurance plan is essential. This plan should include van liability insurance to cover third-party injuries or property damage resulting from accidents involving your vans. Additionally, opting for cheap commercial van insurance that doesn’t compromise on coverage can help manage costs without skimping on the protection your fleet requires.

Choosing the right commercial auto insurance for vans is not just about finding the most affordable option; it’s about securing a robust policy that aligns with your business’s size, scope, and growth potential. Delivery van insurance coverage should be thorough, accounting for potential risks such as cargo loss or damage, vehicle breakdowns, and the daily wear and tear on commercial vehicles. By selecting a tailored fleet van insurance package, small businesses can rest assured that their assets are safeguarded, paving the way for sustainable long-term operations and scalability. With the right insurance partner, your small business can navigate the complexities of the road with confidence, knowing that you’re prepared for a variety of scenarios that could impact your day-to-day operations.

Understanding Commercial Vehicle Insurance Options

When small business owners consider the various insurance options available to them for their commercial vehicles, it’s crucial to navigate the landscape of Business Van Insurance and Fleet Van Insurance with care. Commercial Vehicle Insurance offers a range of policies tailored to different needs, from single vans to extensive fleets. Van Liability Insurance is a fundamental component within these plans, safeguarding against third-party claims and damages arising from accidents involving your vehicles. This liability coverage can be expanded to include comprehensive and collision coverage, which provides protection for your van regardless of fault.

For businesses that rely on courier or delivery services, Van Insurance for Small Businesses must be robust yet cost-effective. Cheap Commercial Van Insurance can be a misnomer; the most affordable policies may not offer the comprehensive protection your business needs. Instead, focus on value-for-money options in Commercial Auto Insurance for Vans that align with your operational risks and financial considerations. Delivery Van Insurance Coverage, in particular, should address the unique challenges faced by businesses whose operations revolve around timely deliveries. This type of insurance often includes cover for goods in transit, as well as breakdown and recovery options, ensuring minimal disruption to services. By carefully selecting the right combination of coverage and premiums, small businesses can protect their assets effectively while managing costs, setting a foundation for long-term sustainability and growth.

The Importance of Van Liability Insurance for SMBs

For small and medium-sized businesses (SMBs) that rely on vans for their day-to-day operations, such as courier and delivery services, van liability insurance is a critical component of their risk management strategy. Business van insurance serves as a financial safeguard against potential accidents or incidents involving the company’s vehicles. It ensures that if a van is involved in an incident causing damage to third-party property or injury to individuals, the business is not left with crippling costs. This coverage is particularly important because it addresses the legal liabilities that arise from such events, protecting the business’s assets and reputation.

Choosing the right van insurance for small businesses goes beyond just liability. Fleet van insurance offers a comprehensive solution for businesses with multiple vans, while commercial vehicle insurance can be tailored to meet the unique needs of each operation. When considering cheap commercial van insurance, it’s essential to balance cost with coverage; opting for the most affordable policy isn’t always the wisest choice if it falls short in critical areas. Commercial auto insurance for vans should be robust enough to cater to the specific demands of delivery and courier services, which often operate on tight schedules and may face higher risks due to the nature of their work. By carefully evaluating different insurance packages, SMBs can find cost-effective solutions that provide adequate protection, enabling them to manage costs effectively while ensuring the long-term sustainability and growth of their business operations.

Exploring Affordable Solutions: Cheap Commercial Van Insurance

When small business owners seek out comprehensive yet affordable solutions for their commercial vehicle needs, Business Van Insurance emerges as a pivotal consideration. Tailored policies for single vans or expanding fleets, such as Fleet Van Insurance, offer the necessary protection without overwhelming budget constraints. These tailored insurance packages are designed to address the specific vulnerabilities that come with operating commercial vehicles, ensuring assets like delivery and courier vans are safeguarded against unforeseen incidents. Choosing the right Van Liability Insurance is crucial for small businesses that rely on these vehicles for day-to-day operations, as it covers damages or injuries resulting from accidents where the business owner might be at fault. Furthermore, opting for Commercial Vehicle Insurance or Cheap Commercial Van Insurance ensures that whether a van is used for transporting goods, making deliveries, or providing services, the small business can continue to operate with minimal disruption should an incident occur.

In the realm of Commercial Auto Insurance for Vans, it’s essential for small businesses to explore options that align with their operational scale and financial position. Van Insurance for Small Businesses must be both robust and cost-effective, enabling these enterprises to navigate the complexities of the market without compromising on quality coverage. Delivery Van Insurance Coverage, in particular, is a specialized area within commercial van insurance that provides tailored protection for businesses engaged in delivery services. By carefully considering the type of coverages, such as third-party liability, comprehensive coverage, and optional extras like breakdown assistance or replacement vehicle hire, small business owners can find an optimal balance between cost and coverage, ensuring their operations remain protected and resilient against vehicular risks.

Comprehensive Coverage with Commercial Auto Insurance for Vans

For small business owners who rely on vans for their daily operations—whether it’s a single courier van or a fleet of delivery vehicles—comprehensive coverage through Business Van Insurance is a critical investment. A robust Commercial Auto Insurance for Vans policy can safeguard against unforeseen events, ensuring that your small business remains operational and protected. This tailored insurance not only covers the physical damage to your vans but also provides liability insurance in case of accidents involving your vehicles. It’s essential to consider Van Liability Insurance within your coverage, as it protects your business from third-party claims resulting from bodily injury or property damage.

Choosing the right Commercial Vehicle Insurance for your fleet means finding a balance between comprehensive protection and cost management. With options like Courier Van Insurance and Delivery Van Insurance Coverage, small businesses can select the most appropriate policy for their specific needs. Cheap Commercial Van Insurance doesn’t have to compromise quality; with the right provider, you can enjoy competitive rates without skimping on essential coverage. By opting for a well-rounded Van Insurance for Small Businesses plan, entrepreneurs can rest assured that their mobile assets are secure and that they’re prepared for the financial impact of any incident on the road. This not only promotes long-term sustainability but also supports the growth ambitions of small businesses in the transportation sector.

In conclusion, small business owners operating courier and delivery services can significantly benefit from the tailored coverage options available through Business Van Insurance. With Fleet Van Insurance, these entrepreneurs gain the flexibility to safeguard their operations, whether they manage a single vehicle or an expanding fleet. By exploring cost-effective solutions like Cheap Commercial Van Insurance, small businesses can secure Van Liability Insurance and other essential Commercial Vehicle Insurance components without overextending their budgets. This strategic approach to Van Insurance for Small Businesses ensures not only immediate protection but also long-term sustainability and growth. It’s clear that comprehensive coverage through Commercial Auto Insurance for Vans is indispensable for any small business in the delivery and courier sectors, providing a robust shield against unforeseen events while maintaining operational efficiency.