In today's digital era, instant verification solutions are transforming business operations by streamlining identity proofing and customer due diligence. Traditional manual methods are replaced by automated compliance checks, including secure identity verification and document verification, to enhance efficiency and reduce errors in processes like KYC and AML. This revolutionizes customer onboarding, accelerates transactions, boosts conversion rates, improves customer retention, and strengthens security, making it essential for modern businesses to adopt these innovative tools.

In an era driven by user experience, businesses must embrace innovative solutions to stand out. Implementing real-time verification technologies is a strategic move to meet modern customer expectations. Digital verification tools offer instant identity proofing, eliminating tedious processes and enhancing satisfaction. By automating compliance checks and risk assessment, companies streamline customer onboarding, leading to improved retention and higher conversion rates through efficient customer due diligence. Discover how secure identity verification can revolutionize your business.

- The Rising Importance of User Experience in Digital Spaces

- – Exploring the modern customer's expectations and how it pressures businesses to excel.

- Traditional Identity Verification vs. Real-Time Solutions

- – Comparing manual, time-consuming methods with automated real-time verification tools.

The Rising Importance of User Experience in Digital Spaces

In today’s digital era, user experience (UX) is a key differentiator that sets successful businesses apart from their competitors. As more interactions shift online, consumers expect seamless, efficient, and secure experiences—especially when it comes to sensitive processes like identity proofing and customer due diligence. Traditional methods of manual document verification and risk assessment automation can be time-consuming and prone to human error, leading to prolonged wait times and dissatisfied customers.

Implementing instant verification solutions that automate compliance checks is a game-changer in enhancing UX. Secure identity verification allows businesses to reduce friction points during customer onboarding, ensuring faster and more efficient processes while maintaining the highest level of security. By prioritizing UX through automated identity proofing, companies can foster higher conversion rates, improved retention, and ultimately, build stronger relationships with their customers.

– Exploring the modern customer's expectations and how it pressures businesses to excel.

In today’s digital era, customers expect seamless and instant experiences across all touchpoints—from online purchases to opening new bank accounts. This heightened expectation pressures businesses to excel in every aspect of their operations, particularly when it comes to customer onboarding and identity verification. Modern consumers are accustomed to swift service and accurate information, demanding that businesses not only meet but surpass these standards to ensure a positive user experience.

The need for efficient and secure identity proofing has never been more critical. With stringent regulations like KYC (Know Your Customer) and AML (Anti-Money Laundering) guidelines in place, customer due diligence and risk assessment automation have become essential components of any business strategy. Automated compliance checks, including instant verification solutions and document verification processes, not only streamline operations but also bolster a company’s defense against regulatory fines and reputational damage. By prioritizing secure identity verification through these innovative tools, businesses can maintain high standards while meeting the evolving demands of their customers.

Traditional Identity Verification vs. Real-Time Solutions

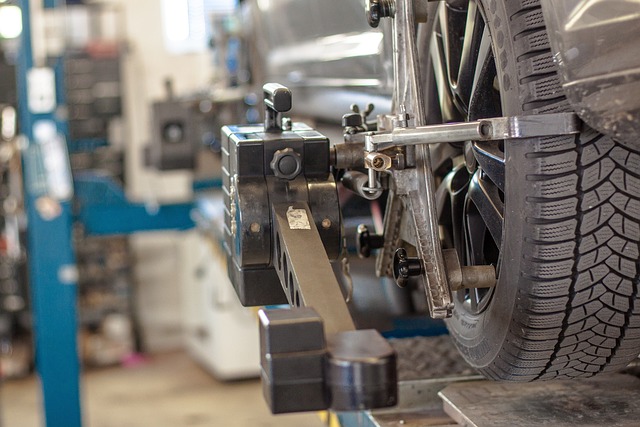

In the traditional identity verification process, businesses often rely on manual document checks and lengthy validation procedures. This method can be time-consuming, prone to human error, and leads to increased customer frustration due to prolonged wait times. It involves gathering physical documents, cross-referencing data with various databases, and manually verifying signatures, which is not only inefficient but also opens up avenues for fraud and identity theft.

Real-time verification solutions, on the other hand, leverage advanced technologies like biometric authentication, document scanning, and artificial intelligence to streamline the entire process. With instant verification solutions, customers can provide their identities digitally, enabling automated compliance checks and risk assessment automation. This reduces the need for physical documents, minimizing the potential for fraud while enhancing customer experience through faster, more secure identity proofing. Automated customer onboarding processes powered by these real-time solutions ensure seamless interactions, boosting customer satisfaction and retention rates.

– Comparing manual, time-consuming methods with automated real-time verification tools.

In the past, identity proofing and customer due diligence processes were cumbersome, relying on manual methods that left room for error and delays. Traditional techniques often involved lengthy document checks, where customers had to submit physical documents, leading to extended wait times. This not only frustrated customers but also presented a significant risk assessment challenge for businesses. With the advent of automated real-time verification tools, this landscape is rapidly transforming.

These innovative solutions streamline the entire process by implementing instant verification methods. Through advanced document verification and secure identity checking, businesses can automate compliance checks, ensuring accuracy and efficiency. By eliminating manual intervention, these tools reduce human error and significantly speed up customer onboarding. This automation not only enhances customer satisfaction but also fortifies risk assessment capabilities, fostering a safer and more compliant business environment.

In today’s competitive digital landscape, where customer expectations are higher than ever, implementing real-time verification solutions is not just an advantage but a necessity. By embracing automated identity proofing, document verification, and risk assessment automation, businesses can significantly enhance their customer due diligence processes. Instant verification solutions streamline customer onboarding, leading to improved retention rates and better overall user experiences. This shift towards secure, efficient identity verification methods ensures businesses stay ahead of the curve and meet the evolving demands of their customers.