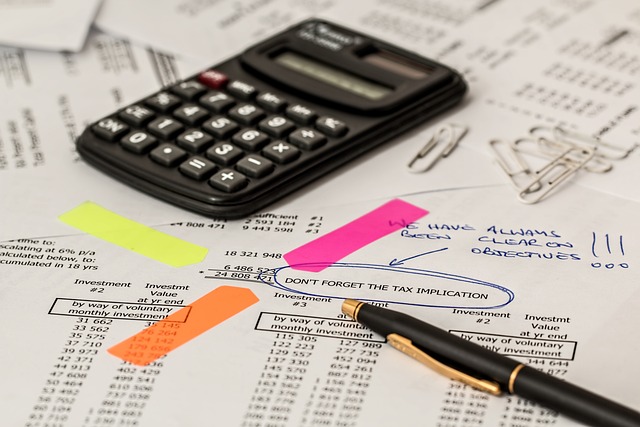

Small business owners, rejoice! There’s a treasure trove of tax deductions waiting to be discovered. From office supplies and travel expenses to employee benefits and even home office costs, savvy entrepreneurs can navigate the tax code to their advantage. Unlocking these tax-saving opportunities means maximizing profits while reinvesting more capital into your business. This article explores essential strategies like IRA contributions, tax-loss harvesting, student loan interest deductions, estate planning, educational tax credits, and capital gains tax reduction, empowering you with valuable insights for financial success.

- Unlocking Tax Savings: Common Deductions for Small Businesses

- IRA Contributions and Tax Benefits for Entrepreneurs

- Tax-Loss Harvesting: A Strategy to Minimize Taxes

- Student Loan Interest Deduction: Lightening Your Tax Burden

- Estate Planning and Tax Strategies for Business Owners

- Educational Tax Credits: Investing in Your Team's Growth

- Capital Gains Tax Reduction: Maximizing Profits Legally

Unlocking Tax Savings: Common Deductions for Small Businesses

Small businesses have access to a variety of tax deductions that can significantly reduce their taxable income. One common area where business owners can unlock substantial savings is through employee benefits and retirement plans, such as IRA contributions. These not only provide tax benefits but also foster a satisfied workforce. Another notable deduction is the student loan interest reduction, offering relief for entrepreneurs with outstanding student loans.

Additionally, businesses involved in investing or estate planning can leverage specific tax strategies. Tax-loss harvesting allows investors to offset capital gains with losses, while estate planning tax strategies, including educational tax credits and capital gains tax reduction methods, enable business owners to minimize taxes on future investments and inheritances. These deductions collectively empower small business owners to optimize their financial situation and reinvest savings into the growth of their ventures.

IRA Contributions and Tax Benefits for Entrepreneurs

Entrepreneurs have access to various tax benefits when it comes to their IRA contributions. Not only can they deduct contributions made to traditional IRAs, but Roth IRA contributions can also offer significant advantages. By investing in their retirement accounts, business owners can reduce their taxable income and potentially avoid higher tax rates in the future. Tax-loss harvesting strategies are another powerful tool for entrepreneurs; by selling investments at a loss, they can offset capital gains and reduce overall tax liability.

Additionally, various deductions and credits cater to specific needs of small businesses. For instance, student loan interest deduction allows entrepreneurs to alleviate the financial burden of education debt, further easing their tax obligations. Estate planning tax strategies are crucial for long-term financial security; by utilizing tools like revocable trusts or charitable remains trusts, business owners can minimize estate taxes and preserve their legacy. Educational tax credits further incentivize investment in skills development, fostering a culture of lifelong learning within the entrepreneurial community. Lastly, capital gains tax reduction provides opportunities to minimize taxation on investments, encouraging smart financial decisions for business growth.

Tax-Loss Harvesting: A Strategy to Minimize Taxes

Tax-loss harvesting is a strategic approach that small business owners can employ to minimize their tax burden. By selling investments at a loss, entrepreneurs can offset capital gains and reduce taxable income. This method allows for significant tax benefits, especially when combined with other deductions like IRA contributions and educational tax credits. It’s an effective way to manage taxes and potentially free up funds for future investments or business expansion.

Additionally, small businesses can leverage various estate planning tax strategies to save on taxes. Taking advantage of deductions for student loan interest and exploring options like life insurance policies with tax-efficient benefits can further reduce taxable income. For instance, using these strategies in conjunction with capital gains tax reduction methods could result in substantial savings, allowing business owners to focus more on growth and less on tax management.

Student Loan Interest Deduction: Lightening Your Tax Burden

For many small business owners, managing finances effectively is a constant juggling act. One often overlooked yet powerful tool in their arsenal is the Student Loan Interest Deduction. This deduction can significantly ease the tax burden for entrepreneurs who are still paying off student loans incurred for higher education or professional training. By deducting the interest paid on qualified student loans, business owners can reduce their taxable income, effectively lowering their overall tax liability.

This benefit is not only a practical financial move but also an investment in one’s future. With the potential to save thousands over time, it encourages individuals to pursue further education and skills development, which are vital for navigating the competitive small business landscape. Moreover, it aligns with broader Estate Planning Tax Strategies by enabling individuals to manage their debt more effectively, potentially impacting their overall tax picture in the long term. Consider this deduction as a key component in your small business’s financial strategy, alongside exploring IRA contributions tax benefits, Tax-loss harvesting, Educational tax credits, and Capital gains tax reduction opportunities for maximum savings.

Estate Planning and Tax Strategies for Business Owners

Business owners should consider integrating estate planning into their tax strategy. Creating a will or trust can help manage and minimize taxable assets upon ownership transition, leveraging tools like IRAs with tax benefits for contributions. Additionally, tax-loss harvesting techniques can offset capital gains, while student loan interest deductions provide relief for qualifying debt.

By combining these strategies, business owners can achieve significant tax advantages, including potential educational tax credits and reduced capital gains taxes. Proactive estate planning not only ensures a smooth transition but also allows entrepreneurs to make the most of available tax deductions, ultimately boosting their business’s financial health.

Educational Tax Credits: Investing in Your Team's Growth

Small businesses have access to various educational tax credits that can provide substantial financial benefits. One such credit is the Student Loan Interest Deduction, allowing entrepreneurs to deduct interest paid on qualified student loans. This incentive encourages business owners to invest in their team’s growth by encouraging further education and skill development. Additionally, the IRA contributions tax benefits offer a way to reduce taxable income while fostering long-term financial planning for both the business and its employees.

Tax-loss harvesting is another strategic approach that can lead to capital gains tax reduction. By implementing this strategy, businesses can offset gains from investments with losses, ultimately lowering their overall tax liability. Furthermore, incorporating Estate Planning Tax Strategies can help small business owners mitigate potential taxes associated with transferring wealth to heirs, ensuring a smoother transition and maximizing the value of the business for future generations.

Capital Gains Tax Reduction: Maximizing Profits Legally

Small business owners can leverage various tax strategies to maximize profits and minimize their tax burden. One such powerful tool is capital gains tax reduction, which allows entrepreneurs to legally decrease their taxable income by strategically managing investments and business transactions. By utilizing methods like tax-loss harvesting, where unrealized losses from certain investments are used to offset capital gains, businesses can lower their overall tax liability.

Additionally, there are specific deductions and credits available that directly impact capital gains tax. For instance, IRA contributions offer tax benefits by allowing businesses to reduce taxable income in the current year. Similarly, educational tax credits and student loan interest deduction can significantly ease the financial burden of investing in employee education, further contributing to long-term business success and legal tax optimization.

Small business owners now have a powerful toolkit at their disposal to optimize taxes and reinvest in their ventures. By taking advantage of specific deductions like IRA contributions, implementing strategic tax-loss harvesting, utilizing the student loan interest deduction, and exploring estate planning tax strategies, entrepreneurs can significantly reduce their tax burden. Additionally, educational tax credits and capital gains tax reduction methods encourage growth and innovation. Staying informed about these benefits allows business leaders to make savvy financial decisions, ensuring they maximize profits while staying compliant with regulations.