Classic car owners benefit from specialized policies preserving historical value, while teen drivers receive tailored coverage encouraging safe habits. Staying informed about market trends empowers drivers to make wise decisions and find competitive rates. Strategically comparing quotes from niche insurers, leveraging discounts for unique profiles, and understanding policy nuances ensure optimal coverage for specific needs at the best prices.

The escalating cost of car insurance has driven many drivers to explore specialized coverage options. This surge, marked by a 19.2% increase from November 2022 to 2023, highlights the need for tailored solutions. Classic car insurance offers vintage enthusiasts comprehensive protection at competitive rates, while teen driver insurance caters to young, high-risk motorists. By delving into these specialized policies and staying informed about industry trends, including premium hikes and available discounts, drivers can secure adequate coverage without unnecessary expenses. This article guides you through the intricacies of classic and teen driver insurance, navigating industry shifts, and unlocking better rates for a smarter coverage strategy.

- Understanding Classic Car Insurance: Protection for Vintage Vehicles

- Teen Driver Insurance: Tailored Coverage for Young Drivers

- Navigating Industry Trends: Staying Informed About Premium Increases

- Unlocking Competitive Rates: Strategies for Obtaining Favorable Quotes

- Enhancing Your Coverage Strategy: Utilizing Available Discounts and Nuances

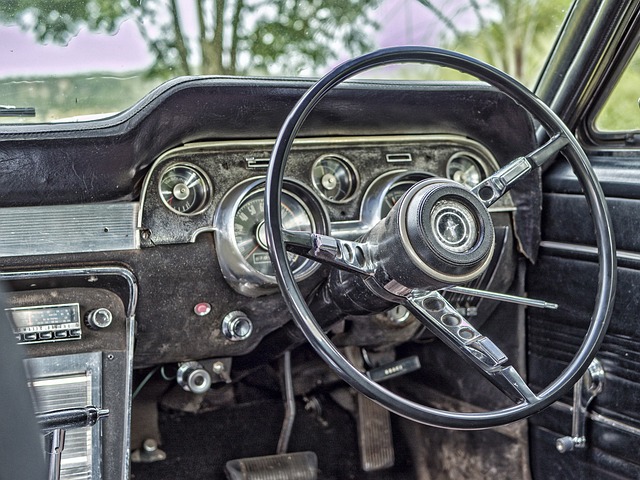

Understanding Classic Car Insurance: Protection for Vintage Vehicles

Classic car insurance is designed to cater to the specific needs of vintage vehicle owners, ensuring their cherished classics are protected on the road. These policies often cover a wide range of services, including specialized repair and restoration work, which can be hard to find through standard car insurance. With a focus on older models, classic car insurance providers recognize the unique risks and potential costs associated with these vehicles, offering tailored coverage at competitive rates.

This type of insurance not only protects against damage and liability but also provides peace of mind for owners who want to preserve the historical value and integrity of their cars. By insuring these vintage gems, owners can enjoy the freedom to drive, show off, or even participate in races, secure in the knowledge that their classic is shielded from unexpected financial burdens.

Teen Driver Insurance: Tailored Coverage for Young Drivers

Teen driver insurance is designed to cater to the specific needs and risk profiles of adolescents behind the wheel. This specialized coverage acknowledges that young drivers, particularly those just starting their driving journey, often face higher rates due to a lack of experience and maturity on the road. As a result, policies in this category offer tailored protections, including features like driver monitoring programs, safe-driving incentives, and limited coverage options that encourage responsible behavior.

By enrolling in teen driver insurance, parents can rest assured that their children are insured under a policy specifically crafted to address common challenges faced by new drivers. These plans typically include educational resources and parental controls, empowering parents to guide and monitor their teens’ driving habits while ensuring they receive appropriate protection at competitive rates.

Navigating Industry Trends: Staying Informed About Premium Increases

In the face of rising car insurance premiums, staying informed about industry trends is crucial for drivers seeking cost-effective solutions. By keeping abreast of market shifts and changes in consumer behavior, policyholders can make more informed decisions when comparing quotes. For instance, understanding the reasons behind premium increases—such as heightened claims levels or revised legal requirements—allows drivers to assess their risk exposure and adjust their coverage accordingly.

Moreover, being proactive about this knowledge enables individuals to take advantage of potential discounts and specialized policies like classic car or teen driver insurance. This proactive approach ensures that drivers not only protect their vehicles and loved ones but also manage their financial commitments more effectively during periods of significant premium growth.

Unlocking Competitive Rates: Strategies for Obtaining Favorable Quotes

Unlocking competitive rates requires a strategic approach when securing car insurance, especially for specialized coverage options like classic cars or teen driver policies. One key strategy is to compare quotes from multiple insurers who specialize in these niche markets. Due to lower risk profiles and often fixed vehicles, vintage cars can attract favorable rates, so exploring dedicated classic car insurance providers is wise. For teen drivers, understanding the specific discounts available for good students, safe driving records, or completion of safety courses can help reduce costs significantly.

Additionally, bundling policies with comprehensive coverage options might offer savings. Insurers often provide incentives for long-term commitments and multiple policy holdings. Staying informed about industry news and trends is also beneficial; emerging technologies, safety advancements, and changing driver behaviors can influence rates, so being proactive in your research ensures you secure the best possible quotes tailored to your unique needs.

Enhancing Your Coverage Strategy: Utilizing Available Discounts and Nuances

Enhancing your coverage strategy involves a deep dive into the intricacies of available discounts and policy nuances. Many insurance providers offer reductions for defensive driving courses, safe vehicle installations, or multiple policy holdings. Understanding these incentives can significantly lower costs while maintaining robust protection. For instance, bundling car insurance with home or life insurance often yields substantial savings due to combined risk assessment.

Additionally, reviewing policy limitations and exclusions is paramount. Some classic car policies may exclude high-performance modifications or require specific storage conditions. Teen driver insurance might have mileage restrictions or strict driving behavior guidelines. By carefully reading these details, you can customize your coverage to align with your unique needs, avoiding unexpected gaps in protection or surprise cost increases at renewal time.

In light of the significant premium increases, drivers now have a heightened awareness of their insurance options. By exploring specialized coverage like classic car insurance and teen driver insurance, individuals can access tailored policies at competitive rates. Staying informed about industry trends and leveraging available discounts are crucial steps to optimize your coverage strategy. Understanding these nuances ensures you receive adequate protection without unnecessary expenses.