In many jurisdictions, notary bonds serve as a crucial safeguard against notarial misconduct, offering public protection where professional liability insurance (E&O) falls short. Unlike E&O, which protects notaries from errors and omissions, a notary bond ensures clients can recover losses stemming from an official’s error or fraudulent act. Key to understanding this mechanism is recognizing that bond payments are typically reimbursed by the notary upon resolution of a claim. For comprehensive protection, maintaining both a notary bond and E&O insurance is recommended, addressing financial security for notaries while safeguarding client interests through robust notary public risk protection.

- Understanding Notary Bonds: A Key Component in Legal Liability Protection

- The Role of Notary Public Risk Protection in Safeguarding Clients' Interests

- Financial Security for Notaries: Why Comprehensive Insurance is Essential

- Navigating Notary Business Insurance Options to Prevent Potential Liability

- Strategies to Mitigate Risks and Ensure Public Trust in Notarial Services

Understanding Notary Bonds: A Key Component in Legal Liability Protection

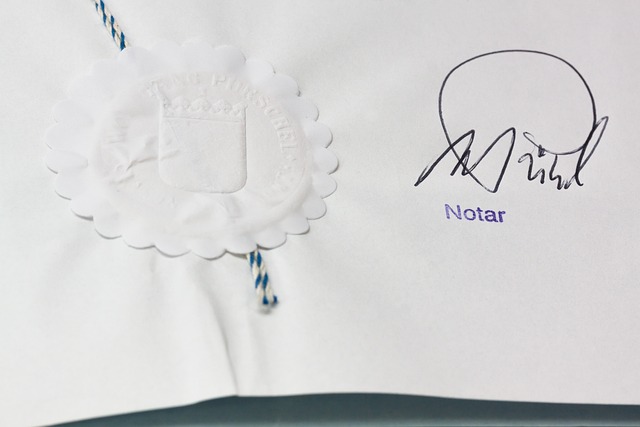

Notary bonds are a crucial component in safeguarding against legal liability for notaries public. These surety bonds serve as a financial security net, providing protection against potential risks and errors that may arise during notarial duties. When a client suffers losses due to a notary’s misconduct or negligence, such as incorrect certification, falsification of documents, or fraudulent activity, the bond ensures they receive compensation. This mechanism is distinct from Errors & Omissions (E&O) insurance, which primarily protects notaries from financial loss rather than offering direct client reimbursement.

Understanding the role of a notary bond is essential for professionals in this field to prevent potential liability. Unlike traditional business insurance policies, which protect against specific risks, a notary bond offers broad coverage, ensuring clients are financially secured. This dual protection strategy—combining a notary bond and E&O insurance—provides comprehensive legal liability protection for notaries public, giving them the confidence to serve their communities with peace of mind.

The Role of Notary Public Risk Protection in Safeguarding Clients' Interests

In today’s world, where legal documents play a pivotal role in various transactions, the role of Notary Public Risk Protection cannot be overstated. This financial security measure is designed to safeguard both clients and notaries by mitigating potential risks associated with notarial misconduct. By requiring a notary bond, many jurisdictions ensure that clients are protected if any errors or fraudulent acts occur during the notarization process. Unlike insurance policies that primarily shield the notary, a notary bond provides direct compensation to affected clients, ensuring they receive financial redress for any losses incurred.

Notary Public Risk Protection is crucial in preventing notary liability and promoting trust in the legal system. When a claim is made against a notary bond, it serves as a safety net, compensating clients and upholding their interests. This mechanism encourages notaries to conduct their duties with utmost care and responsibility, knowing that they are held accountable for their actions. Ultimately, this dual protection—notary business insurance and E&O insurance—offers comprehensive financial security for notaries while preventing any potential losses for their clients.

Financial Security for Notaries: Why Comprehensive Insurance is Essential

Notary public risk protection is a critical aspect often overlooked in the legal profession. While many states mandate notary bonds as a basic requirement, comprehensive insurance for notaries goes a step further to provide robust financial security. Notary legal liability protection is essential due to the unique position of notaries, who have access to sensitive documents and are entrusted with official duties. Despite their important role, notaries can face significant risks and potential claims from clients, employers, or other parties if they make mistakes or engage in fraudulent activities.

Having notary business insurance, including both a bond and professional liability (E&O) coverage, ensures that notaries have the financial security needed to prevent and mitigate notary public risk. In the event of a claim, this dual protection allows for a structured approach to resolving issues, with the bond covering immediate compensation for clients’ losses while E&O insurance covers legal fees and potential settlements. This comprehensive insurance strategy is vital in preventing notary liability and safeguarding both notaries’ reputations and financial well-being.

Navigating Notary Business Insurance Options to Prevent Potential Liability

Navigating the world of notary business insurance is essential to prevent potential liability and protect both notaries and their clients. Notary legal liability and public risk protection are paramount considerations for any notary looking to maintain a reputable and secure practice. Financial security for notaries comes in various forms, including Surety Bonds and Errors & Omissions (E&O) insurance, each serving unique purposes.

Notary business insurance options provide comprehensive coverage against different risks. A Notary bond acts as a financial guarantee, ensuring clients are compensated if the notary makes an error or engages in fraudulent activities. On the other hand, E&O insurance protects notaries from claims of professional negligence, offering financial security when dealing with complex legal documents and transactions. Combining both types of insurance is a robust strategy to mitigate risks, as it provides double protection against financial losses and ensures business continuity.

Strategies to Mitigate Risks and Ensure Public Trust in Notarial Services

To mitigate risks and ensure public trust in notarial services, several strategies can be employed. First, notary legal liability can be significantly reduced by adhering to strict procedural guidelines and best practices. This includes thorough document verification, maintaining accurate records, and staying updated with relevant laws and regulations. Additionally, notary business insurance, such as professional liability (E&O) and surety bonds, provides financial security for notaries by safeguarding against potential claims of misconduct or errors.

By combining these measures with ongoing education on ethical practices, notaries can actively preventing notary liability. Regular reviews of bond policies and insurance coverage ensure that the protection keeps pace with changing legal landscapes. Moreover, open communication with clients about the security measures in place can enhance public trust, fostering a reputation for integrity and reliability within the notarial community.

In conclusion, notary bonds and comprehensive insurance, including E&O coverage, are vital tools for notaries to safeguard against potential client losses and maintain public trust. By understanding the role of each in protecting both clients’ interests and their own financial security, notaries can navigate the complexities of legal liability and prevent costly mistakes. Embracing strategies to mitigate risks and staying informed about notary business insurance options are essential steps towards ensuring a reputable and reliable notarial service.