Small business owners face complex tax laws and a demanding filing season. Certified tax preparers offer specialized Small Business Tax Help with proactive planning strategies. Online tax prep platforms provide convenient, efficient assistance while ensuring IRS compliance. These tools empower business owners to manage taxes alongside daily operations, saving time and money. Services include tailored tax filing, income tax preparation, and maximized self-employed deductions for compliant growth.

Small business taxes can be a complex maze, but navigating it no longer has to be daunting. Our comprehensive small business tax help services are designed to guide you through the challenges and complexities of tax laws with confidence. As experts in income tax preparation and tax planning strategies, we offer tailored solutions to reduce liabilities and ensure compliance. From understanding IRS tax filing requirements to leveraging online tax preparation tools for self-employed individuals, our certified tax preparers provide vital assistance every step of the way.

- Understanding Small Business Tax Laws: Challenges and Complexities

- The Role of a Certified Tax Preparer in Navigating IRS Tax Filing

- Income Tax Preparation: Strategies for Small Business Owners

- Tax Planning Strategies to Maximize Savings and Compliance

- Online Tax Preparation and Self-Employed Tax Deductions: Tools for Efficiency

Understanding Small Business Tax Laws: Challenges and Complexities

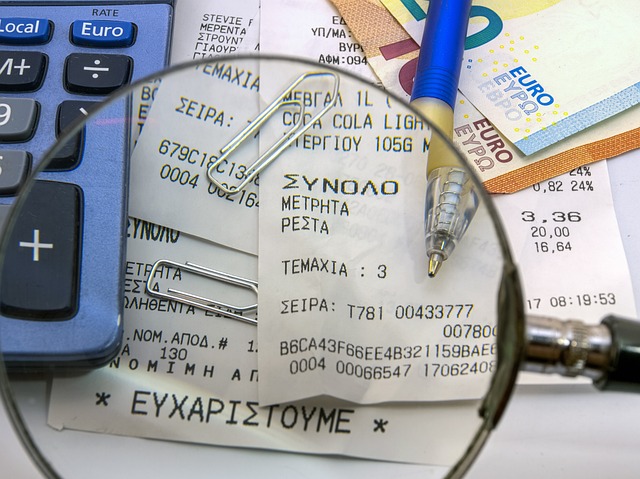

Small business tax laws are a complex web that can intimidate even the most seasoned entrepreneurs. Navigating these regulations involves understanding intricate rules and loopholes, which often change with each fiscal year. As a small business owner, managing taxes alongside daily operations can be a daunting task.

One of the primary challenges is staying current with various tax forms and requirements tailored to different business structures. From sole proprietorships to partnerships and corporations, each has its own set of tax obligations, including income tax preparation, sales tax, employment taxes, and self-employed tax deductions. Certified tax preparers recommend proactive tax planning strategies to minimize surprises during filing season. Online tax preparation platforms offer a convenient solution for business owners seeking efficient tax return assistance while ensuring compliance with IRS tax filing standards.

The Role of a Certified Tax Preparer in Navigating IRS Tax Filing

As a small business owner, navigating the complex world of IRS tax filing can be daunting. This is where a certified tax preparer plays a pivotal role in providing much-needed Small Business Tax Help. With their specialized knowledge and expertise, these professionals are equipped to handle even the most intricate tax scenarios. A Certified Tax Preparer not only ensures accurate income tax preparation but also guides you through effective tax planning strategies, helping to reduce your overall liabilities.

They offer invaluable assistance with online tax preparation, ensuring compliance with current tax laws and regulations. Whether you’re self-employed and seeking to maximize deductions or facing unique tax circumstances, these experts can provide tailored Tax Filing Services. Their goal is to simplify the process, save you time, and give you peace of mind, knowing your taxes are in capable hands.

Income Tax Preparation: Strategies for Small Business Owners

As a small business owner, navigating income tax preparation can seem overwhelming, but with the right strategies and support, it becomes manageable. Our expert team offers tailored tax filing services designed specifically for small businesses. We understand that every enterprise is unique, so we go beyond basic IRS tax filing to provide comprehensive income tax preparation. This includes analyzing your financial statements, identifying deductions, and maximizing credits to ensure you pay only what’s legally required.

Our certified tax preparers are well-versed in the latest tax laws and regulations affecting self-employed individuals. We guide you through the process of claiming all eligible expenses, from office supplies and equipment to travel and entertainment costs. With our assistance, small business owners can focus on growth and development while leaving the complexities of tax return assistance to us.

Tax Planning Strategies to Maximize Savings and Compliance

As a small business owner, navigating complex tax laws can be overwhelming. That’s where our expert team steps in, offering tailored tax planning strategies to ensure both compliance and significant savings. We go beyond traditional income tax preparation by providing comprehensive solutions that align with your unique business structure and goals. Our certified tax preparers help you identify valuable self-employed tax deductions, optimize your financial strategies, and minimize your overall tax burden.

By utilizing advanced online tax preparation tools, we streamline the process, making it efficient and accessible. This not only saves you time but also ensures accuracy in your tax returns. Whether you’re a sole proprietor or managing a growing enterprise, our small business tax help services are designed to empower you with the knowledge and tools necessary to confidently manage your finances year-round.

Online Tax Preparation and Self-Employed Tax Deductions: Tools for Efficiency

In today’s digital era, many small business owners are turning to online tax preparation tools for efficiency and convenience. These platforms offer user-friendly interfaces that simplify income tax preparation, allowing entrepreneurs to manage their finances from the comfort of their homes or offices. Online tax preparation software is designed to guide users through the process, ensuring accurate reporting of revenue and expenses, including self-employed tax deductions. By leveraging these tools, small business owners can streamline their tax filing services, making it easier to stay compliant with IRS tax filing requirements.

Additionally, online platforms often provide valuable insights into potential tax savings and planning strategies. Certified tax preparers who utilize these tools can offer tailored advice based on each client’s unique circumstances, helping them implement effective tax planning strategies to reduce liabilities. This proactive approach not only simplifies tax return assistance but also empowers small business owners to make informed financial decisions throughout the year.

Navigating complex small business tax laws no longer has to be a daunting task. With the right guidance and expertise, business owners can confidently manage their financial obligations. Our comprehensive small business tax help services provide tailored solutions for every stage of your business’s lifecycle, from initial income tax preparation to advanced tax planning strategies. By partnering with a certified tax preparer, you gain access to professional insights that optimize savings, ensure compliance, and simplify the entire IRS tax filing process. Whether it’s mastering online tax preparation or exploring deductions specifically for the self-employed, our resources empower small businesses to thrive while keeping their finances in check.