- Understanding Personal Umbrella Policies: Protecting Against Unforeseen Events

- The Role of Third-Party Liability in Homeowner's Insurance

- Accidental Injury Coverage: Shielding Yourself from Medical Expenses

- Property Damage Insurance: What It Covers and Why It Matters

- Homeowner's Liability: Common Scenarios and How to Prepare

- Maximizing Your Protection: Integrating Accidental Injury and Property Damage Insurances

Understanding Personal Umbrella Policies: Protecting Against Unforeseen Events

Personal umbrella policies are an additional layer of protection that expands on your existing homeowner liability or personal auto insurance. These policies kick in when your standard coverage limits are exceeded, offering enhanced accidental injury coverage and property damage insurance. In scenarios where a third-party suffers damages due to unforeseen events occurring on your property, a personal umbrella policy can shield you from significant financial burdens.

By purchasing an umbrella policy, you gain peace of mind knowing that medical expenses, legal fees, and other associated costs stemming from lawsuits or claims will be covered, even if they surpass the limits of your primary policies. This secondary coverage is particularly valuable for high-asset individuals or those facing potential claims with substantial damages.

The Role of Third-Party Liability in Homeowner's Insurance

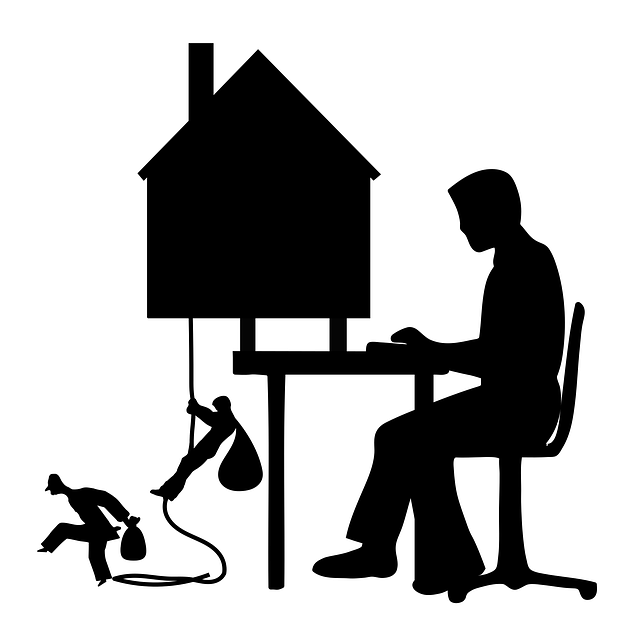

Third-party liability is a critical aspect of homeowner’s insurance policies, offering protection against claims made by others for damages or injuries occurring on your property. This coverage extends beyond the standard accidental injury and property damage insurance components. It includes instances where visitors or guests sustain injuries, whether due to slip-and-fall accidents, dog bites, or other unforeseen events. By including third-party liability in your homeowner liability policy, you’re shielded from potential legal disputes and associated costs, ensuring that unexpected incidents don’t turn into financial burdens.

A personal umbrella policy is an optional add-on to your standard home insurance that significantly enhances your protection against third-party claims. It provides extra coverage above the limits of your primary policies, offering peace of mind knowing you’re better prepared for severe or complex lawsuits. This additional layer of security is particularly valuable if you have high net worth or face increased liability risks due to your occupation, hobbies, or family situation.

Accidental Injury Coverage: Shielding Yourself from Medical Expenses

Accidental injury coverage is a vital component of any comprehensive personal liability protection plan. This type of coverage steps in when you or a family member unintentionally causes harm to someone else, resulting in medical expenses. For instance, if a visitor slips and falls on your property due to a spill or uneven pavement, your accidental injury coverage can help cover their medical bills. This shield extends beyond just physical injuries; it also includes situations where legal liability arises from unintentional damage, such as a pet bite or a child’s accident that leads to another person’s injuries.

A personal umbrella policy, which sits on top of your standard homeowner liability insurance, offers enhanced accidental injury coverage and third-party liability protection. This added layer ensures you’re not left with substantial out-of-pocket costs if a claim exceeds the limits of your primary policies. By incorporating property damage insurance and accidental injury coverage into your risk management strategy, you can safeguard your assets and financial stability against unexpected incidents that could lead to significant legal and medical expenses.

Property Damage Insurance: What It Covers and Why It Matters

Property Damage Insurance plays a pivotal role in safeguarding individuals and their assets from unforeseen circumstances. This type of insurance coverage is designed to protect policyholders from financial burdens resulting from accidental damage to others’ property. When your child inadvertently breaks a neighbor’s window or a guest slips on your doorstep, property damage insurance steps in to cover the costs of repairs or replacements.

Beyond repair expenses, it also extends protection against legal liabilities that may arise from such incidents. By incorporating Property Damage Insurance into your risk management strategy, especially as part of a comprehensive personal umbrella policy, you gain peace of mind knowing that unexpected events won’t lead to significant financial strain. This coverage is integral to managing Third-party liability and Homeowner liability, ensuring that accidental injuries or property damage on your premises doesn’t turn into a costly legal battle with substantial out-of-pocket expenses.

Homeowner's Liability: Common Scenarios and How to Prepare

Maximizing Your Protection: Integrating Accidental Injury and Property Damage Insurances

In conclusion, accidental injury coverage and property damage insurance are indispensable elements of a comprehensive homeowner’s liability strategy. By understanding these policies and their interplay with third-party liability and personal umbrella protections, you can safeguard yourself from significant financial burdens resulting from unforeseen events. Maximizing your coverage ensures peace of mind, knowing that your assets and liabilities are adequately secured in the face of potential claims.