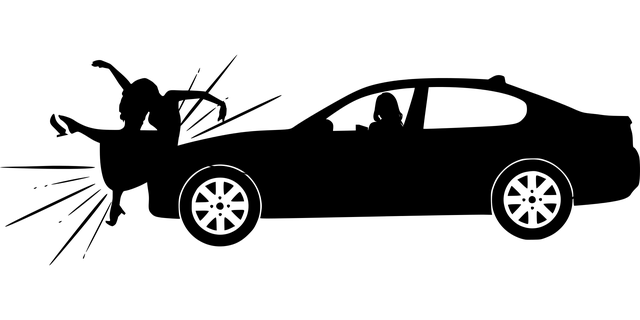

Not every driver on the road follows traffic rules or carries adequate insurance. This is where Uninsured and Underinsured Motorist Protection steps in as vital coverage, safeguarding you from financial burdens in case of accidents with uninsured drivers. Especially prevalent in high-risk areas, this extra layer of security ensures that your car insurance policy protects you against unexpected costs. While the premium might increase, underinsured motorist coverage can prevent major out-of-pocket expenses and provide peace of mind, ensuring you’re not left paying the price for someone else’s lack of responsible driving.

- Understanding Uninsured and Underinsured Motorist Protection

- Why This Coverage is Crucial in High-Risk Areas

- How Uninsured Motorist Protection Impacts Your Car Insurance Policy Cost

- The Role of Uninsured Motorist Protection in Preventing Out-of-Pocket Expenses

Understanding Uninsured and Underinsured Motorist Protection

Uninsured and underinsured motorist protection is a critical component of your car insurance policy that shields you from financial burden in the event of an accident caused by drivers with inadequate or no insurance. This coverage kicks in when the at-fault driver doesn’t have sufficient liability insurance to cover the damages they’ve inflicted. In such scenarios, your own auto insurance policy’s Uninsured Motorist Protection or Underinsured Motorist Coverage steps up to pay for the repairs to your vehicle and any medical expenses incurred by you and your passengers.

This type of comprehensive coverage is especially valuable in areas with high-risk drivers, where accidents involving underinsured or uninsured individuals are more common. While adding this protection to your car insurance policy may result in a slightly higher insurance premium calculation, it offers peace of mind knowing that you’re protected against potential major out-of-pocket expenses due to someone else’s lack of liability coverage, including collision coverage and third-party liability insurance.

Why This Coverage is Crucial in High-Risk Areas

In high-risk areas where accidents and incidents involving uninsured or underinsured drivers are more prevalent, having adequate car insurance becomes even more critical. These regions often have a higher concentration of novice drivers, older vehicles, or areas with heavy traffic and congestion, increasing the likelihood of collisions. Without proper coverage, like Uninsured Motorist Protection (UMP) and Underinsured Motorist Coverage (UMC), victims of such accidents might find themselves facing significant financial burdens.

While comprehensive and collision coverages are essential components of a Car Insurance Policy, they may not always suffice. Third-party liability insurance, for instance, typically covers damages to others’ property or injuries they sustain in an accident caused by the policyholder. However, UMP and UMC specifically protect policyholders from financial losses when dealing with drivers who lack sufficient insurance or any insurance at all. These coverages are valuable investments that can significantly reduce out-of-pocket expenses in the event of a claim, making them a crucial addition to any Auto Insurance Quotes tailored for high-risk areas.

How Uninsured Motorist Protection Impacts Your Car Insurance Policy Cost

Uninsured Motorist Protection is a crucial addition to your car insurance policy, though it does come at an additional cost. When you purchase this coverage, your auto insurance quotes will be influenced by the level of protection you select. Comprehensive and collision coverage are often bundled with uninsured motorist protection, increasing your insurance premium calculation. However, these add-ons offer vital third-party liability insurance, ensuring that if you’re involved in an accident caused by an uninsured or underinsured driver, your damages will be covered up to your policy limits.

The price of uninsured motorist protection varies depending on several factors, including your location and driving history. In areas with a high density of high-risk drivers, the cost may be higher, but it’s a small price to pay for peace of mind. Remember, while this coverage adds to your overall car insurance policy cost, it can prevent significant out-of-pocket expenses in the event of an accident caused by a driver lacking adequate insurance.

The Role of Uninsured Motorist Protection in Preventing Out-of-Pocket Expenses

Uninsured motorist protection plays a pivotal role in safeguarding drivers from unexpected financial burdens resulting from accidents with irresponsible or underinsured drivers. This coverage is designed to fill the gap left by inadequate insurance policies, ensuring that victims of such incidents are not left holding the bag for costly repairs or medical bills. In regions where high-risk driving behaviors are prevalent, this protection becomes an invaluable component of a comprehensive car insurance policy.

By incorporating uninsured and underinsured motorist coverage into your auto insurance quotes, you gain peace of mind knowing that your insurance premium calculation takes into account potential risks on the road. This form of comprehensive coverage goes beyond basic collision coverage or third-party liability insurance, offering a safety net that can prevent major out-of-pocket expenses in the event of an accident caused by an uninsured or underinsured driver.

In light of the above, it’s clear that Uninsured and Underinsured Motorist Protection is an invaluable addition to any car insurance policy. By understanding these coverages and their significance in high-risk areas, drivers can make informed decisions when comparing auto insurance quotes. This protection acts as a safety net, preventing major financial burdens caused by accidents involving uninsured or underinsured drivers. Incorporating comprehensive coverage, collision coverage, and third-party liability insurance, along with Uninsured Motorist Protection, ensures drivers are shielded from unexpected costs. When considering your Insurance Premium Calculation, remember that this extra layer of defense can save you from hefty out-of-pocket expenses, making it a smart investment for peace of mind on the road.