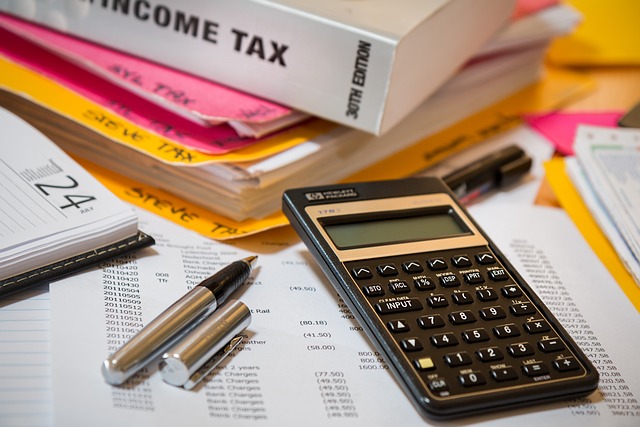

Effective income tax reduction hinges on strategic tax planning and the savvy use of tax-saving tips. As individuals and businesses alike navigate the complexities of the tax code, understanding how to leverage tax-advantaged accounts such as IRAs and 401(k)s becomes crucial for long-term financial security. This article delves into various facets of tax planning, from optimizing retirement savings to tailoring strategies for small businesses and high-income earners. By exploring tax-efficient investments and wealth management tax strategies, readers will gain insights on how to safeguard their future wealth while benefiting from immediate tax reductions. Staying abreast of changing tax laws ensures that every deduction and credit is maximized to its fullest potential, a practice indispensable for anyone seeking to enhance their financial standing.

- Maximizing Income and Minimizing Tax Burdens Through Strategic Tax Planning

- Utilizing Tax-Advantaged Accounts for Long-Term Financial Security

- Leveraging Tax-Saving Tips to Reduce Immediate Taxable Income

- Navigating Tax-Efficient Investments for Retirement Wealth Preservation

- Small Business Tax Planning: Tailored Strategies for Optimal Tax Savings

- Wealth Management Tax Strategies for High-Income Earners and Effective Tax Optimization

Maximizing Income and Minimizing Tax Burdens Through Strategic Tax Planning

Tax-saving tips are a cornerstone for individuals and small businesses aiming to maximize income while minimizing tax burdens. Strategic planning involves understanding the nuances of the current tax code, which can be complex and ever-changing. High-income earners, in particular, benefit from tax optimization strategies that leverage loopholes and deductions to reduce their income tax liability. By proactively managing taxes throughout the year, rather than addressing them retrospectively during filing season, individuals can effectively defer or lower their taxable income. This proactive approach not only saves money but also ensures compliance with the latest tax laws.

Incorporating tax-efficient investments is a critical component of long-term wealth management tax strategies, especially for those approaching retirement. These investments are designed to offer both tax advantages during the accumulation phase and in retirement. For instance, contributing to IRAs and 401(k)s allows for pre-tax dollars to be set aside, growing tax-deferred until withdrawal—often in a lower tax bracket. Additionally, understanding which accounts offer the most favorable tax treatment upon distribution is crucial. By carefully selecting investment vehicles and asset allocation, retirees can enjoy a more secure financial future while minimizing their tax burdens. Tax planning for high-income earners is particularly sophisticated, often involving trusts, estates, and other complex entities to optimize their tax positions and preserve wealth across generations.

Utilizing Tax-Advantaged Accounts for Long-Term Financial Security

Utilizing tax-advantaged accounts is a cornerstone in long-term financial security and income tax reduction strategies. For individuals, contributing to Individual Retirement Accounts (IRAs) or 401(k) plans offers substantial tax benefits; these contributions reduce taxable income in the current year while allowing investments to grow tax-deferred until retirement. The power of compounding within these accounts can be significantly more impactful when the growth phase is sheltered from immediate taxation. Moreover, for those with high incomes, employing tax optimization strategies such as Roth IRAs can be particularly advantageous, as they allow for tax-free withdrawals in retirement.

For small business owners and high-income earners, tax planning is a complex yet crucial endeavor. Tax-efficient investments and carefully structured business operations are vital to minimize the tax burden. Strategic wealth management tax strategies include timing income and deductible expenses, choosing the right business entity, and leveraging available tax credits. Additionally, understanding and implementing tax deferral methods can significantly reduce current taxes while preserving capital for investment or operational needs. By staying abreast of changes in tax laws and utilizing a combination of tax-saving tips tailored to one’s financial situation, individuals can ensure their retirement years are not only comfortable but also tax-optimized, safeguarding their wealth both now and in the future.

Leveraging Tax-Saving Tips to Reduce Immediate Taxable Income

Utilizing tax-saving tips is a prudent approach for individuals and small businesses alike to reduce their immediate taxable income and minimize the tax burden. For high-income earners, it’s particularly beneficial to engage in proactive tax optimization strategies. These may include maximizing contributions to tax-advantaged accounts such as IRAs and 401(k)s, which can offer substantial tax benefits. By deferring income and growing these funds within a sheltered environment, high-income earners can effectively lower their current taxable income while setting themselves up for a more secure financial future. Similarly, choosing tax-efficient investments is crucial for those approaching retirement age. These investments are structured to provide both immediate tax reductions and long-term wealth preservation. For instance, municipal bonds often yield tax-free income, which can be a boon for retirees looking to minimize their tax liabilities.

In the realm of comprehensive wealth management tax strategies, it’s imperative to stay abreast of changes in tax laws. These fluctuations can significantly impact the effectiveness of one’s tax planning, whether for income tax reduction or retirement tax planning. By keeping informed and adjusting one’s strategy accordingly, individuals can ensure they are taking full advantage of available deductions and credits. Small business tax planning requires a nuanced understanding of these laws to optimize operations and maintain competitive advantages. Tax planning for high-income earners often involves complex decision-making processes that balance immediate tax savings with long-term wealth management goals. Consulting with tax professionals who specialize in such areas can provide the necessary guidance to navigate this intricate landscape effectively.

Navigating Tax-Efficient Investments for Retirement Wealth Preservation

Navigating tax-efficient investments is a cornerstone in the strategy for preserving retirement wealth. High-income earners, in particular, can benefit significantly from employing tax optimization strategies that mitigate their income tax burden and enhance their long-term financial security. By understanding which investment vehicles are tax-advantaged, individuals can effectively defer or reduce taxes on earnings and capital gains. Traditional and Roth IRAs, as well as 401(k) plans, offer varying tax benefits depending on the contributor’s circumstances and future income tax brackets. For those in their peak earning years, making contributions to these accounts can lead to substantial income tax reduction.

Moreover, small business owners have a unique set of considerations for retirement tax planning. Tax-saving tips specific to small business owners often involve utilizing SEP IRAs, solo 401(k)s, or SIMPLE plans as part of their wealth management tax strategies. These accounts can accommodate higher contribution limits than traditional IRAs and 401(k)s, allowing for greater tax deferral opportunities. Additionally, understanding the nuances between tax-deferred and tax-exempt growth is crucial for optimizing investment choices within a retirement portfolio. By leveraging these accounts and aligning them with one’s business structure, small business owners can craft a robust tax planning strategy that protects their retirement wealth while maximizing their current income tax reductions.

Small Business Tax Planning: Tailored Strategies for Optimal Tax Savings

For small business owners, crafting a tax-saving strategy is a pivotal component of overall financial health. Effective tax planning for small businesses necessitates a tailored approach that aligns with the unique operational dynamics and financial goals of the enterprise. Utilizing tax optimization strategies can lead to significant income tax reduction, thereby bolstering the business’s cash flow and profitability. Key considerations include identifying and capitalizing on available deductions, such as home office expenses, business vehicle use, and equipment purchases that provide both operational benefits and tax-saving opportunities. Additionally, choosing tax-efficient investments can offer immediate tax savings while also contributing to the long-term growth of the business. Strategic investment in retirement plans like SEP IRAs or Solo 401(k)s not only secures the owner’s future financial well-being but also reduces current taxable income. Staying abreast of changes in tax laws and leveraging the expertise of a qualified tax professional can ensure that small business tax planning is as effective as possible, maximizing savings and minimizing taxes throughout the business lifecycle.

In the realm of retirement tax planning, high-income earners have distinct challenges and opportunities. Wealth management tax strategies for this demographic must be meticulously planned to navigate the complexities of high-earner tax brackets. It’s crucial to optimize contributions to tax-advantaged accounts, such as Roth IRAs or after-tax dollar investments in tax-deferred accounts like 401(k)s, to create a diversified retirement portfolio that is both tax-efficient and income-supportive post-retirement. High earners must also be vigilant about income thresholds that can affect eligibility for tax deductions and credits. By employing informed and strategic tax planning, high-income individuals can significantly reduce their current tax burden while safeguarding their wealth for the future.

Wealth Management Tax Strategies for High-Income Earners and Effective Tax Optimization

High-income earners have unique challenges and opportunities when it comes to income tax reduction, necessitating tailored wealth management tax strategies. These individuals often face higher tax brackets, making tax-efficient investments a cornerstone of their financial planning. By carefully selecting investment vehicles that offer favorable tax treatments, such as municipal bonds or tax-advantaged accounts like Roth IRAs, high earners can significantly reduce their taxable income. Additionally, leveraging tax optimization strategies through charitable contributions and timely donations can further mitigate tax liabilities. It’s crucial for high-income earners to stay abreast of the latest tax laws, as they often contain nuances that can be advantageous when planning for both current income tax reduction and future wealth preservation.

Effective tax optimization is not a one-size-fits-all endeavor; it requires a comprehensive approach, especially for small business owners and those in retirement planning stages. For small businesses, strategic tax planning can involve deducting legitimate business expenses, deferring income, or utilizing the pass-through deduction if eligible. Retirement tax planning, on the other hand, demands a focus on tax-deferred growth accounts like Traditional IRAs and 401(k)s during accumulation years, while considering the conversion to Roth options later to take advantage of tax diversification. By integrating these tax-saving tips into one’s overall financial strategy, individuals can ensure that they are positioned to maximize their after-tax income and safeguard their assets against unnecessary tax burdens. Staying informed about changes in tax laws is an ongoing process, as is the adaptation of one’s tax planning for high-income earners to maintain compliance and optimize financial outcomes.

Effective tax planning emerges as a pivotal strategy for both individuals and small businesses to enhance income potential while mitigating tax liabilities. By implementing tax-saving tips, individuals can significantly diminish their taxable income, thereby reducing their overall tax burden. The strategic use of tax-advantaged accounts such as IRAs and 401(k)s not only aids in securing long-term financial stability but also offers immediate tax relief. For those approaching retirement, transitioning to tax-efficient investments is crucial for wealth preservation, ensuring that hard-earned savings are shielded from unnecessary taxes. Small business owners can reap the benefits of tailored tax planning strategies, designed to optimize their financial position and maximize savings. High-income earners, too, stand to gain from personalized wealth management tax strategies that focus on optimization and efficiency. Staying abreast of evolving tax laws is imperative for anyone aiming to capitalize fully on available deductions and credits. In summary, a proactive approach to tax planning is indispensable for securing financial prosperity.