In today’s digital era, e-filing taxes has emerged as a preferred method for many, offering unparalleled convenience and efficiency in managing tax obligations. Online tax filing platforms provide comprehensive services, from intuitive tax preparation tools to seamless submission of tax returns. These platforms often include advanced features like online tax calculators to estimate liabilities and potential refunds. With the availability of free e-filing options, taxpayers can access solutions tailored to their financial needs. By understanding income tax e-filing, navigating online forms, tracking refunds, ensuring secure digital transactions, and exploring dedicated platforms for self-employed individuals, you can optimize your tax experience and embrace a modern approach to fulfilling your tax obligations.

- Understanding Income Tax E-Filing: A Modern Approach

- Unlocking the Benefits of Easy Tax Filing Platforms

- Navigating Online Tax Forms: A Step-by-Step Guide

- Tracking Your Tax Refund: Real-Time Updates and Tips

- Ensuring Secure Online Tax Filing for Sensitive Data

- Self-Employed Tax Filing Made Simple: Digital Solutions Available

Understanding Income Tax E-Filing: A Modern Approach

Income tax e-filing is a modern approach that has transformed how individuals and businesses manage their tax obligations. By utilizing online tax forms, taxpayers can now conveniently prepare and submit their income tax returns from the comfort of their homes or offices. This digital method streamlines the entire process, from gathering necessary documents to calculating liabilities and even tracking tax refunds in real-time. Online platforms offer comprehensive tax filing assistance, ensuring that self-employed individuals and businesses alike can navigate complex tax laws with ease.

The benefits of income tax e-filing are numerous. It not only simplifies tax preparation but also enhances security through encrypted data transmission. Taxpayers no longer need to worry about losing physical documents or facing potential errors during mail-in submissions. Moreover, free online tax filing services cater to a wide range of financial situations, making it accessible and affordable for everyone. This shift towards digital tax filing has made managing taxes easier, faster, and more secure than ever before.

Unlocking the Benefits of Easy Tax Filing Platforms

The rise of digital transformation has significantly impacted how individuals approach their tax obligations, making income tax e-filing a popular choice for many. Easy tax filing platforms offer an intuitive and user-friendly experience, simplifying what can often be a complex process. These online systems streamline everything from gathering necessary documents to calculating taxes and even tracking tax refunds. By using secure online tax filing methods, taxpayers can rest assured that their sensitive financial information is protected.

For self-employed individuals or those with unique financial circumstances, these platforms provide tailored tax filing assistance. Online tax forms are designed to be accessible, allowing users to fill them out at their convenience. This shift towards digital tax management not only saves time but also reduces the risk of errors commonly associated with manual filing methods.

Navigating Online Tax Forms: A Step-by-Step Guide

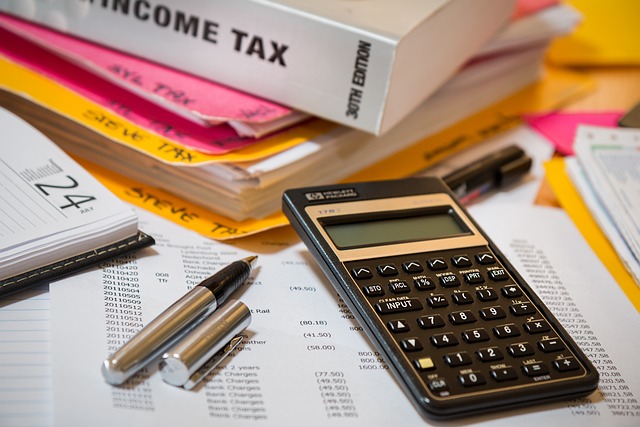

Navigating Online Tax Forms can seem daunting for those new to digital tax preparation, but with a structured approach, it becomes an easy and efficient process. Start by selecting an appropriate online tax filing platform tailored to your needs—whether as a working professional or self-employed individual. These platforms offer step-by-step guidance, walking you through income sources, deductions, and credits relevant to your situation. Fill out the forms accurately, ensuring all necessary information is provided; many platforms include helpful tools like tax calculators to estimate refunds or liabilities, making it easier to understand potential outcomes.

As you progress, double-check each entry for errors, as even minor mistakes can impact your return. Utilize the available tax filing assistance features within the platform, which may include live chat support or comprehensive tutorials. Once completed, review your submission carefully before confirming; many services offer a preview before finalizing your online tax forms. With secure online tax filing, you can trust that your data is protected, and any tax refund tracking will be done efficiently through digital channels.

Tracking Your Tax Refund: Real-Time Updates and Tips

Ensuring Secure Online Tax Filing for Sensitive Data

When embracing digital tax filing, ensuring secure online tax filing is paramount to protect sensitive financial data. Reputable online tax platforms employ advanced encryption technologies and security protocols to safeguard personal information during transmission and storage. These measures ensure that your income tax e-filing, including details from self-employed tax filings, remains confidential and compliant with data protection regulations.

Online tax forms not only simplify the easy tax filing process but also enable robust tax refund tracking. Taxpayers can monitor their refunds in real-time, enhancing transparency and control over their financial affairs. With these platforms, managing taxes becomes more accessible and efficient for everyone, from individuals to those with complex financial situations who require tax filing assistance.

Self-Employed Tax Filing Made Simple: Digital Solutions Available

For self-employed individuals, managing taxes can be a complex task due to varying income sources and expenses. However, digital solutions have made self-employed tax filing simpler and more accessible than ever before. Online tax platforms now offer specialized services tailored for freelancers and small business owners, simplifying the process from start to finish. These tools provide easy-to-use interfaces for inputting financial information, automatically calculating taxes, and generating accurate tax forms, including Schedule C for sole proprietorships.

By utilizing these digital solutions, self-employed individuals can benefit from instant tax refund tracking, secure online filing, and expert tax filing assistance all in one place. This not only saves time but also ensures accuracy, reducing the stress often associated with tax season. With user-friendly interfaces and comprehensive features, online tax forms have revolutionized how self-employed individuals manage their income tax e-filing, making it an easy and efficient process.

The digital transformation of tax filing has empowered individuals with unprecedented convenience and control over their financial obligations. By leveraging easy tax filing platforms and online tax forms, taxpayers can now navigate the complexities of income tax e-filing with ease. These platforms offer not only comprehensive tax preparation services but also essential tools like tax refund tracking and secure data handling. For self-employed individuals, digital solutions have simplified their tax filing process, ensuring compliance without sacrificing efficiency. By embracing modern methods, including online tax calculators for accurate estimates, taxpayers can optimize their experience, meet deadlines, and take advantage of available deductions. Ultimately, the growing trend in e-filing taxes reflects a forward-thinking approach to managing one’s financial responsibilities.