In today’s mobile-first world, mobile notaries provide a vital service, but they face unique risks. From handling sensitive documents in diverse locations to the ever-present threat of errors and omissions, these professionals require specialized protection. Insurance for Mobile Notaries offers tailored coverage, addressing the specific challenges they encounter on the go. This article explores why this type of insurance is essential, delving into the types of coverage available, how to choose the right policy, and ensuring financial security for notaries through effective risk management. Discover the benefits of affordable notary insurance and gain valuable insights for your peace of mind.

- Understanding Mobile Notary Risks: A Unique Set of Challenges

- The Value of Specialized Insurance for Mobile Notaries

- Types of Coverage: Protecting Against Common Notary Hazards

- How to Choose the Right Notary Insurance Policy

- Affordable Options: Making Quality Protection Accessible

- Navigating Claims: Ensuring Financial Security for Notaries

Understanding Mobile Notary Risks: A Unique Set of Challenges

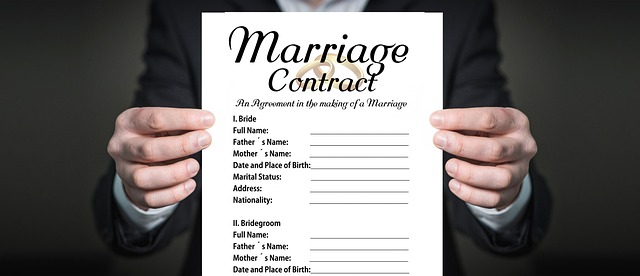

Mobile notaries face a unique set of challenges that differ from their counterparts working in traditional offices. The dynamic nature of their work, which often takes them to various locations and involves handling sensitive documents, exposes them to distinct risks. These risks include potential security breaches, errors in document preparation, or even physical harm while on the move. Without adequate coverage, mobile notaries could find themselves vulnerable to significant financial losses due to unforeseen events.

Notary legal protection is essential for ensuring financial security for notaries. Affordable notary insurance specifically tailored for mobile professionals offers comprehensive coverage for liabilities arising from off-site activities. This includes errors or omissions made while notarizing documents at client locations, as well as potential claims of negligence or property damage. By investing in an insurance policy for notaries, these mobile professionals can safeguard their assets and maintain the integrity of their work, ultimately providing peace of mind in an increasingly mobile world.

The Value of Specialized Insurance for Mobile Notaries

Types of Coverage: Protecting Against Common Notary Hazards

Mobile notaries provide a vital service by bringing document signing and notarization directly to clients, but this flexibility comes with unique risks. The right insurance for mobile notaries acts as a shield against potential hazards that may arise during their travels. These policies offer comprehensive coverage tailored to address the specific needs of mobile professionals.

Common hazards include mishandling sensitive documents, identity fraud, and accidental damage to client property. An affordable notary insurance policy ensures financial security by covering legal expenses, settlements, and court costs associated with claims against the notary public. Additionally, it provides notary legal protection, safeguarding against errors or omissions that may lead to disputes over signed documents. By investing in such an insurance policy for notaries, mobile practitioners can ensure they are equipped to manage risks effectively, offering both peace of mind and enhanced protection for their business operations.

How to Choose the Right Notary Insurance Policy

Affordable Options: Making Quality Protection Accessible

In today’s digital era, mobile notaries are in high demand as folks appreciate the convenience of having legal services come to them. However, this increased accessibility comes with unique challenges. Notary legal protection is essential but can often be overlooked due to concerns around cost. Luckily, affordable notary insurance options are now widely available, making quality protection accessible to all. These policies cater specifically to the needs of mobile notaries, ensuring they have the financial security needed to navigate potential risks and liabilities that arise from their work on the go.

By offering tailored insurance plans, providers enable notaries to manage risks effectively without breaking the bank. This accessibility ensures that even small mobile notarization businesses can operate with peace of mind, knowing they’re protected against errors, omissions, and unforeseen claims. With affordable notary insurance, professionals can focus on providing top-notch services, expanding their reach, and building trust among clients in an increasingly competitive market.

Navigating Claims: Ensuring Financial Security for Notaries

In today’s mobile-first world, insurance for mobile notaries is no longer a luxury but a necessity. By investing in specialized coverage, notaries can mitigate risks associated with their unique work environment, ensuring peace of mind and financial security. With various options available, from affordable notary insurance to comprehensive protection plans, notaries can select policies that align with their specific needs. Embracing this form of legal protection is a proactive step towards navigating the challenges of on-the-go notarization, allowing notaries to focus on serving their clients with confidence and precision.