The quest for affordable auto insurance without compromising protection is no longer an unattainable dream. With recent industry developments, drivers now have access to a plethora of options tailored to their unique needs. Safe driver discounts, teen-focused policies, and customizable add-ons offer flexible solutions. From pay-per-mile plans catering to occasional users to cutting-edge coverage innovations, the insurance landscape is evolving. This article explores these trends, providing insights into how drivers can now access comprehensive protection at competitive rates.

- Safe Driver Discounts: A New Era of Affordable Insurance

- Teen Driver Insurance: Tailored Solutions for Parents

- Customizable Add-ons: Enhancing Coverage Without Breaking the Bank

- Pay-Per-Mile Insurance: Perfect for Occasional Drivers

- Future of Car Insurance: Industry Innovations and Trends

Safe Driver Discounts: A New Era of Affordable Insurance

Safe Driver Discounts: Revolutionizing Affordable Insurance

In a push towards more personalized and accessible auto insurance, safe driver discounts are leading the charge. These incentives reward drivers with cleaner driving records by offering significant savings on their premiums. From reducing speeding tickets to minimizing accidents, these discounts recognize and recompensate responsible behavior on the road. With various insurers adopting dynamic pricing models that consider individual driving habits, policyholders can now expect more tailored and affordable insurance options. This evolution in the industry promises a new era of accessibility, where safety and affordability go hand in hand.

Teen Driver Insurance: Tailored Solutions for Parents

Teen driver insurance is a tailored solution for parents seeking the best protection for their adolescent drivers. With the increasing number of teens on the road, insuring them safely has become a priority for many families. This specialized coverage takes into account the unique risks associated with teen drivers, offering peace of mind for parents and valuable support for young motorists.

By understanding the specific challenges faced by teen drivers—such as inexperience, peer pressure, and higher accident rates—insurance companies can design policies that address these concerns. These plans often include features like good student discounts, safe driving incentives, and parent-supervised driving programs. Such initiatives not only encourage responsible driving behavior but also help keep insurance costs manageable for families while ensuring their teen drivers have access to comprehensive protection.

Customizable Add-ons: Enhancing Coverage Without Breaking the Bank

Auto insurance companies are now offering a range of customizable add-ons that allow drivers to enhance their coverage without significantly increasing costs. Personal Injury Protection (PIP) and Underinsured Motorist Coverage are two examples that provide extra security for drivers and their passengers. These add-ons are particularly beneficial for specific scenarios, such as protecting against high medical bills in the event of an accident or offering compensation when dealing with an underinsured driver.

With the introduction of pay-per-mile insurance plans, even more flexibility is available for drivers who don’t use their vehicles frequently. This innovative approach ensures that policyholders are only charged based on the actual distance they drive, making it a cost-effective option for occasional drivers. These customizable options and emerging trends in auto insurance demonstrate a shift towards more personalized and affordable protection, catering to a diverse range of driver needs.

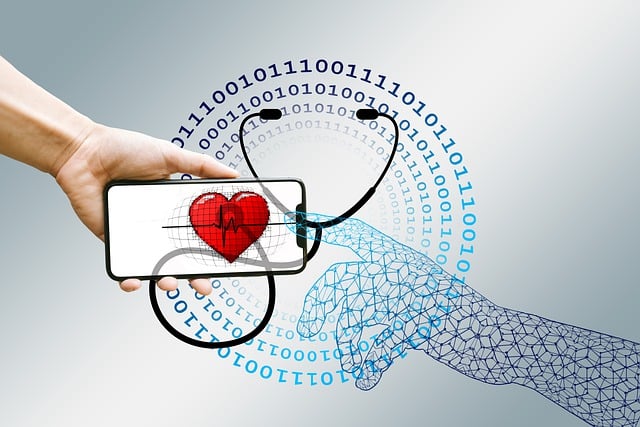

Pay-Per-Mile Insurance: Perfect for Occasional Drivers

Pay-per-mile insurance plans are designed for drivers who log limited miles annually. This innovative approach is particularly appealing to occasional drivers—those who use their vehicles sparingly due to factors like age, occupation, or reliance on public transportation. By charging based on actual driving distance, these plans offer significant cost savings compared to traditional policies that base premiums on estimated annual mileage.

This model allows for greater financial flexibility, as policyholders are only paying for the miles they actually drive. It also encourages safe and responsible driving habits by incentivizing reduced usage. Moreover, pay-per-mile insurance can be easily integrated with existing tech solutions, such as GPS tracking apps, to accurately monitor and record mileage, ensuring a seamless billing process for both providers and customers.

Future of Car Insurance: Industry Innovations and Trends