TL;DR:

Identity proofing and customer due diligence (CDD) are crucial for preventing fraud in the digital economy. Risk assessment automation leverages advanced tech like biometric authentication to streamline secure identity verification and automated compliance checks during customer onboarding. This combines speed, efficiency, and enhanced security, fostering customer trust in digital transactions. Instant verification solutions automate document verification, risk assessment, and onboarding processes, minimizing human error and fraud while creating a seamless customer experience.

In today’s digital economy, protecting your business from fraud and ensuring compliance are paramount. The evolving landscape demands robust security measures that go beyond traditional methods. Comprehensive identity proofing services, including automated identity checks, document verification, and biometric authentication, offer a holistic approach to fortify defenses. By integrating these solutions, businesses can accurately verify customer identities, automate customer due diligence processes, streamline onboarding with instant verification solutions, and build trust while maintaining secure operational environments through effective risk assessment automation.

- Understanding the Evolving Landscape of Business Security

- The Role of Identity Proofing in Fraud Prevention

- Automating Customer Due Diligence Processes

- Integrating Biometric Authentication for Enhanced Security

- Streamlining Onboarding with Instant Verification Solutions

Understanding the Evolving Landscape of Business Security

The Role of Identity Proofing in Fraud Prevention

Identity proofing plays a pivotal role in fraud prevention within the digital economy. By implementing robust customer due diligence processes, businesses can significantly mitigate risks associated with identity theft and fraudulent activities. Advanced identity proofing techniques, such as risk assessment automation, involve analyzing vast amounts of data to detect anomalies and potential red flags during customer onboarding. This proactive approach ensures that only genuine users gain access, reducing the chances of unauthorized transactions and financial losses.

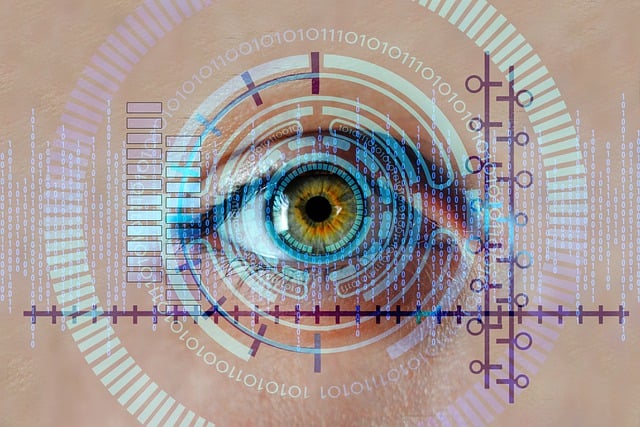

Secure identity verification goes beyond basic document verification; it incorporates biometric authentication for instant verification solutions. Biometrics, including facial recognition or fingerprint scanning, provides an extra layer of protection by confirming a user’s identity based on unique physical traits. This technology streamlines the customer onboarding process while adhering to regulatory requirements, making it easier for businesses to comply with automated compliance checks. Efficient identity proofing practices foster a secure environment, enhancing customer trust and confidence in digital transactions.

Automating Customer Due Diligence Processes

Integrating Biometric Authentication for Enhanced Security

In today’s digital landscape, businesses face unprecedented risks from fraud and cyberattacks. Integrating biometric authentication as part of a comprehensive identity proofing strategy offers a robust solution. By combining automated compliance checks with instant verification solutions, companies can streamline customer onboarding processes while significantly enhancing security.

Biometric data, such as fingerprints or facial recognition, provides an added layer of protection beyond traditional document verification. This ensures more accurate risk assessment automation and reduces the chances of identity fraud. As a result, customers benefit from faster and safer interactions with businesses, fostering trust in digital transactions and promoting a secure operational environment.

Streamlining Onboarding with Instant Verification Solutions

In today’s fast-paced digital landscape, efficient customer onboarding is crucial for businesses aiming to stay competitive and mitigate risks. Instant verification solutions have revolutionized this process by streamlining customer due diligence and risk assessment automation. By integrating automated identity proofing and document verification into the onboarding journey, companies can significantly speed up their operations while maintaining robust security measures.

These innovative solutions offer real-time results, enabling businesses to make informed decisions promptly. Automated compliance checks ensure that every step of the customer onboarding process adheres to regulatory requirements, reducing the chances of human error and potential fraud. As a result, instant verification solutions not only enhance security but also foster a seamless and efficient customer experience, setting the foundation for long-term business relationships.

In today’s digital economy, protecting businesses from fraud and ensuring regulatory compliance are paramount. By integrating comprehensive identity verification services, companies can automate critical processes like customer due diligence, risk assessment, and document verification, while leveraging biometric authentication for enhanced security. These advanced solutions streamline onboarding, build trust with customers, and create a robust, secure operational environment. Adopting these measures is not just a best practice; it’s an essential strategy for thriving in the modern business landscape.