Classic car owners need specialized insurance to protect their unique vehicles, which often require custom parts and intricate repairs. Standard policies may not suffice, so Custom Parts Protection is crucial for peace of mind. The resurgence of car restoration shows a growing passion for preserving automotive history. Classic car insurance covers market value, rare parts, and offers perks like contingent liability. Tailored policies balance comprehensive protection with affordable premiums, considering age, condition, and usage.

For enthusiasts who cherish their classic cars, specialized insurance is key to safeguarding these timeless treasures. As a growing community of restorers and collectors embraces vintage vehicles, understanding tailored coverage becomes imperative. This article delves into the nuances of classic car insurance, exploring why it’s more than just standard protection. From unique parts protection to the burgeoning trend of restoration, we’ll uncover the essential elements that set these policies apart, ensuring your beloved classic receives the care it deserves.

- Understanding Classic Car Insurance Needs

- Custom Parts Protection: A Unique Feature

- The Rising Trend of Car Restoration

- Why Every Classic Car Owner Needs It

- Distinguishing Factors of Classic Policies

- Coverage Options for Your Investment

- Finding the Right Plan for Your Classic

Understanding Classic Car Insurance Needs

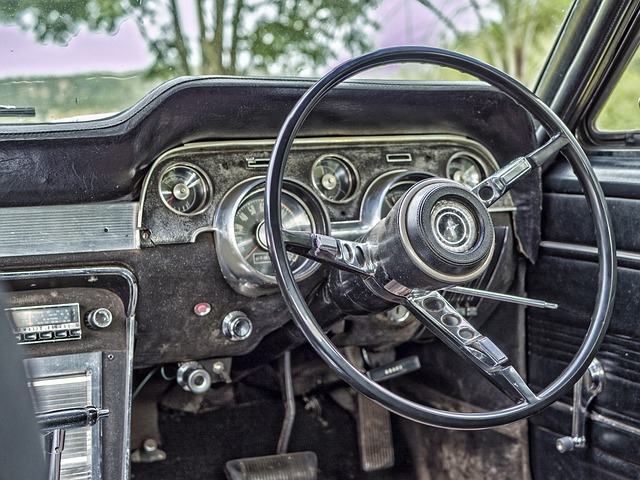

For classic car owners, insurance is more than just a legal necessity; it’s a safeguard against unforeseen circumstances that could affect their cherished vehicles. These cars are often unique, with intricate details and specialized parts that may not be readily available or easily replaceable. Thus, standard insurance policies might not offer the comprehensive coverage needed to protect these gems.

Understanding your classic car’s specific needs involves recognizing its value, both in terms of its historical significance and monetary investment. Custom parts protection is a key feature as many components are no longer mass-produced. Additionally, classic cars may require specialized knowledge for repairs, so choosing an insurer with experienced mechanics on staff can ensure timely and accurate assessments.

Custom Parts Protection: A Unique Feature

Classic cars are more than just machines; they’re cherished possessions, often with a rich history and unique features that require specialized care. Custom Parts Protection is a standout benefit offered by classic car insurance policies. This feature ensures that the one-of-a-kind parts that make these vehicles special are safeguarded against theft or damage. It’s not uncommon for classic cars to have rare or hard-to-find components, making them particularly vulnerable during restoration projects or even daily driving. With Custom Parts Protection, policyholders can rest assured that their investment is protected, allowing them to focus on enjoying their classic car without constant worry.

This coverage goes beyond the typical replacement cost of standard insurance. It recognizes the sentimental value and irreplaceable nature of custom parts, offering a safety net for enthusiasts who often spend countless hours and significant financial resources restoring their beloved classics to their original—or even improved—glory.

The Rising Trend of Car Restoration

In recent years, there’s been a noticeable resurgence in car restoration as enthusiasts delve into the intricate process of breathing new life into vintage vehicles. This trend isn’t just a fleeting fad; it reflects a deeper passion for preserving automotive history and celebrating the craftsmanship of bygone eras. From meticulously reconstructing classic models to sourcing rare parts, restorers are dedicated to keeping these timeless machines on the roads. The rise in popularity can be attributed to various factors, including an increased appreciation for classic cars as collector’s items, the availability of online resources making research and part acquisition easier, and a growing community of enthusiasts who share knowledge and support each other’s projects.

Why Every Classic Car Owner Needs It

For classic car owners, insurance isn’t just about compliance; it’s a safety net that safeguards their passion and investment. These vehicles, often hand-crafted masterpieces or vintage treasures, are more than just machines—they’re pieces of history. Classic car insurance fills the unique coverage gap left by standard policies, offering protection tailored to these specialized assets.

A sudden accident or natural disaster can leave a classic car owner with a hefty repair bill or even total loss. The right policy steps in, covering not just the vehicle’s market value but also the expense of authentic parts—a significant concern for owners dedicated to preserving their cars’ original integrity. This level of protection ensures that restoring a beloved classic remains a feasible endeavor, allowing owners to continue driving their dream machines for years to come.

Distinguishing Factors of Classic Policies

Classic car insurance policies stand apart from their standard counterparts with several key distinguishing features. Firstly, they’re tailored to cover the unique needs of vintage vehicles, which often have specialized parts and require intricate maintenance compared to modern cars. These policies not only offer comprehensive protection against common risks like accidents and theft but also extend coverage for rare or hard-to-find replacement parts.

Additionally, classic car insurance plans typically include perks aimed at enthusiasts and collectors. This might encompass features like contingent liability coverage, which can help protect policyholders if their restored vehicle causes more significant damage than expected, or agreed-value coverage, ensuring a specific, pre-determined amount is paid out in case of a total loss. These policies also often accommodate the hobbyist lifestyle by allowing for reasonable use, such as driving the car to shows or events, without significantly impacting premiums.

Coverage Options for Your Investment

When it comes to classic car insurance, the coverage options are tailored to protect your unique investment in every detail. Policyholders can expect comprehensive protection that goes beyond standard auto insurance. This includes coverage for collision damage, theft, and even natural disasters, ensuring your classic vehicle is safeguarded no matter what challenges it faces.

One of the standout features of these policies is the specialized care they offer for custom parts and modifications. Classic car enthusiasts often invest heavily in unique upgrades, and these insurance plans provide specific protection for these valuable additions. From rare vintage components to meticulously crafted aftermarket fittings, your policy will ensure that the heart of your classic car remains secure and covered, allowing you to enjoy your passion without worry.

Finding the Right Plan for Your Classic

When it comes to insuring your classic car, one size does not fit all. The key is to find a policy tailored to the specific needs and value of your vehicle. Consider the age and condition of your classic—older or more rare models might require specialized coverage due to their limited availability for parts replacement. Additionally, assess the level of use: are you a collector who drives it sparingly for shows, or do you enjoy cruising on weekends? The latter may necessitate different coverages than a car parked in a garage most days.

Researching and comparing policies from reputable providers is crucial. Look beyond basic coverage and explore options that offer extra benefits like roadside assistance, loan/lease coverage (in case of repairs disrupting your daily commute), and even classic-specific discounts through car clubs or restoration shops. The goal is to find a balance between comprehensive protection and reasonable premiums that align with the unique attributes of your beloved classic.

Classic car insurance isn’t just about protecting your vehicle; it’s about preserving a piece of history. With increasing restoration trends, now is the perfect time to secure comprehensive coverage tailored to these unique vehicles. By understanding the specific needs and distinguishing factors of classic policies, owners can ensure their cherished cars are safeguarded for years to come, allowing them to continue cruising down the road with confidence.