The journey from applying for insurance to policy approval hinges on a robust underwriting process. Underwriters meticulously assess health, finances, and lifestyle to gauge risk levels. This comprehensive evaluation drives coverage eligibility decisions and premium pricing—a crucial strategy for insurers aiming to manage risks effectively while offering tailored policies that meet individual needs. By integrating underwriting with actuarial analysis and risk classification, insurers streamline policy issuance, ensuring financial security for both the company and its clients.

- Understanding the Underwriting Process: The Backbone of Insurance

- Factors Influencing Underwriter's Decision: A Deep Dive

- The Role of Actuarial Analysis in Risk Assessment

- Classification of Risks: Categorizing Policy Candidates

- Premium Calculation: Weighing Risk and Rewards

- Streamlining Policy Issuance: From Application to Approval

- Balancing Individual Needs and Insurance Company Interests

Understanding the Underwriting Process: The Backbone of Insurance

The underwriting process is a critical component of insurance, serving as the backbone that connects application to policy approval. It involves a meticulous evaluation of various risk factors associated with an applicant, encompassing their health history, financial standing, and lifestyle decisions. Actuarial analysts employ sophisticated tools and models to conduct this risk classification, which not only ensures fair coverage eligibility but also plays a pivotal role in determining insurance premiums. By meticulously scrutinizing these aspects, underwriters can accurately assess potential risks and make informed decisions, ultimately guiding policy issuance accordingly.

This comprehensive process is integral to claims management. It enables insurers to manage expectations from the outset, ensuring that policies are tailored to individual needs while maintaining financial prudence. A robust underwriting framework, powered by Actuarial Analysis, allows for precise risk classification, impacting premium calculation and fostering a sustainable insurance ecosystem. Effective policy issuance, guided by this process, translates into minimized claims risks and enhanced customer satisfaction.

Factors Influencing Underwriter's Decision: A Deep Dive

Underwriters make critical decisions based on a multi-faceted evaluation of an applicant’s profile. Key factors include health history and current medical conditions, which are assessed through medical records and examinations. Financial status is also crucial—examining income, assets, and debt helps gauge an individual’s ability to pay premiums and their potential financial exposure in case of a claim (Claims Management). Additionally, lifestyle choices such as smoking, drinking, and exercise habits play a role in risk classification (Actuarial Analysis). These factors collectively shape the underwriting process, directly impacting policy issuance and premium calculation.

The underwriting team uses this comprehensive data to conduct a thorough Risk Classification, determining the level of risk associated with each applicant. This analysis guides insurers in offering appropriate coverage limits and conditions, ensuring that policies are tailored to individual needs while maintaining the financial health of the insurer (Insurance Premiums). A robust underwriting process is essential for effective claims management, as it enables insurers to anticipate potential risks and underwrite policies accordingly, ultimately contributing to a sustainable insurance market.

The Role of Actuarial Analysis in Risk Assessment

The actuary’s role is pivotal in navigating the intricate landscape of risk assessment within insurance. Actuarial analysis involves meticulous data examination and statistical modelling to predict future claims trends and financial outcomes related to insurance policies. By employing sophisticated tools and methodologies, actuaries quantify uncertainties associated with health conditions, financial fluctuations, and various lifestyle factors that impact risk profiles. This comprehensive risk classification enables insurers to make informed decisions regarding policy issuance and premium setting.

Through actuarial analysis, underwriters gain valuable insights into the potential costs of insuring applicants. It facilitates a structured approach to claims management by identifying high-risk individuals or scenarios. Moreover, it ensures insurance premiums are set at rates that accurately reflect the expected burden on insurers, thereby maintaining financial stability and sustainability in the long term.

Classification of Risks: Categorizing Policy Candidates

Insurers employ a meticulous process to classify risks associated with policy candidates, which serves as a cornerstone for effective claims management and actuarial analysis. This classification involves segmenting applicants based on their health conditions, financial stability, and behavioral factors that impact risk exposure. By categorizing individuals into distinct groups, insurers can tailor their insurance policies to specific risk profiles, ensuring both comprehensive coverage and fair pricing.

Risk classification is a dynamic aspect of the underwriting process, where actuaries utilize sophisticated models and data analytics to predict potential claims. This data-driven approach allows for accurate assessment of insurance premiums, enabling insurers to manage financial risks while offering competitive policy issuance. Through this structured classification system, insurers can efficiently allocate resources, streamline policy administration, and enhance overall risk management strategies.

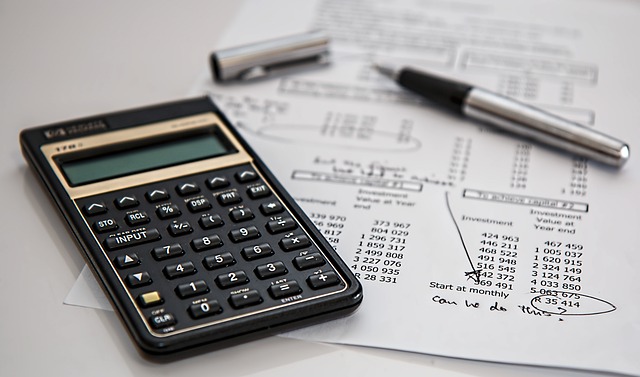

Premium Calculation: Weighing Risk and Rewards

The process of premium calculation is a delicate balance between assessing risk and offering competitive coverage. Insurers employ actuarial analysis to study historical data, claims management trends, and various risk classification factors. This in-depth evaluation enables them to predict potential risks associated with different demographics and behaviors. By understanding these variables, underwriters can determine the likelihood of future claims and adjust insurance premiums accordingly.

Risk-based pricing plays a pivotal role in policy issuance. Insurers set premiums that reflect the expected cost of providing coverage, factoring in the probability and severity of potential claims. This approach ensures that insurance remains accessible to those who need it while incentivizing responsible behavior by policyholders. Effective risk management through actuarial analysis ultimately contributes to a stable insurance market, allowing insurers to offer tailored policies at fair and competitive rates.

Streamlining Policy Issuance: From Application to Approval

Streamlining policy issuance is a critical aspect of efficient insurance operations. It involves a seamless flow from receiving applications to final policy approval. This process has become increasingly digital, with many insurers adopting online platforms for application submission and initial assessment. Automated systems can perform basic data validation and flag potential issues, reducing the time underwriters spend on preliminary checks.

Once an application is received, actuarial analysis comes into play. Underwriters employ risk classification techniques to evaluate various factors, such as health conditions, financial stability, and risky hobbies or professions. This in-depth analysis informs decisions on coverage eligibility and helps insurers set competitive insurance premiums. By leveraging Actuarial Analysis, insurers can ensure fair pricing while managing risks effectively, streamlining the claims management process and fostering trust among policyholders.

Balancing Individual Needs and Insurance Company Interests

The underwriting process is a delicate balance between catering to individual needs and safeguarding insurance company interests. Underwriters play a pivotal role in this equilibrium by conducting thorough Actuarial Analysis and Risk Classification. They scrutinize an applicant’s health, financial history, and lifestyle to assess potential risks associated with insuring them. This meticulous evaluation not only determines eligibility for specific coverage but also enables insurers to set competitive Insurance Premiums.

By aligning underwriting practices with robust Claims Management strategies, insurance providers can offer personalized Insurance Policies that meet the unique requirements of each applicant. This approach ensures individuals receive tailored protection while enabling insurers to mitigate financial risks effectively. Risk-based pricing and targeted coverage options contribute to a sustainable insurance market where both policyholders and insurance companies benefit from transparent and responsible practices.

Insurers’ success in offering tailored coverage while managing risks hinges on their underwriting process. By meticulously assessing health, finances, and lifestyle through actuarial analysis, underwriters facilitate accurate risk classification. This approach ensures that insurance premiums reflect the true level of risk, enabling efficient claims management. Streamlining policy issuance from application to approval, while balancing individual needs with company interests, is key to fostering a robust and sustainable insurance market.