Full Coverage Car Insurance is significantly enhanced by including a roadside assistance plan within comprehensive vehicle protection plans. This integration ensures that in the event of breakdowns or accidents, policyholders receive immediate professional support for issues like towing, flat tires, and battery jump-starts, which are critical services that mitigate inconveniences and risks associated with vehicular problems. Unlike traditional auto insurance deductibles, roadside assistance typically does not require payment before service, providing added value. It's important to understand how auto insurance deductibles interact with full coverage plans; choosing a higher deductible can lower monthly premiums but also means paying more out-of-pocket for roadside services. Selecting the right deductible within the context of your financial situation and accident coverage needs is crucial for optimizing both coverage and preparedness. Full Coverage Car Insurance extends beyond liability coverage to safeguard against a variety of incidents, including accidents and non-collision events, and when paired with a well-chosen auto insurance deductible and comprehensive vehicle protection plans, it offers a robust solution that ensures drivers are protected from minor issues to major accidents, all while providing financial and security benefits. This comprehensive approach to car insurance is designed to enhance the driving experience by offering a sense of security and preparedness for unexpected events on the road.

When unexpected vehicle issues occur, roadside assistance stands as a safety net for motorists. This critical service is an integral part of full coverage car insurance, offering essential support through towing, battery services, tire changes, and fuel delivery. By integrating roadside assistance into your comprehensive auto insurance policy, you augment your accident coverage and secure a more robust driving experience. This article delves into the importance of understanding auto insurance deductibles in relation to roadside assistance and explores vehicle protection plans that extend beyond mere accident coverage. It guides readers through efficient roadside services included in their policies and offers insights on maximizing their driving safety and satisfaction with comprehensive coverage.

- Enhancing Your Safety Net: The Role of Roadside Assistance in Full Coverage Car Insurance

- Understanding Auto Insurance Deductibles and Their Impact on Roadside Assistance Coverage

- Comprehensive Vehicle Protection Plans: More Than Just Accident Coverage

- Navigating Unexpected Breakdowns with Efficient Roadside Services Included in Your Policy

- Maximizing Your Driving Experience with Comprehensive Auto Insurance and Roadside Support

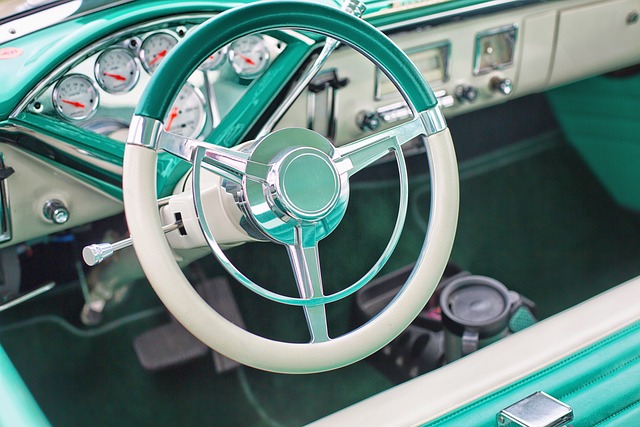

Enhancing Your Safety Net: The Role of Roadside Assistance in Full Coverage Car Insurance

When evaluating full coverage car insurance options, considering a roadside assistance plan as part of your vehicle protection plans is not just prudent—it’s an integral component that significantly enhances your safety net. This service ensures that in the event of unexpected breakdowns or accidents, you have immediate access to professional support. Towing services are available should your car be inoperable due to a mechanical failure or after an accident, minimizing the inconvenience and potential additional damage from keeping your vehicle on a busy or hazardous roadside. Similarly, flat tire changes and battery jump-starts provide immediate remedies to common issues that could leave you stranded. With roadside assistance as part of your comprehensive plan, you’re not only safeguarding against the direct consequences of an accident but also ensuring that minor issues don’t escalate into major complications.

Roadside assistance acts as a buffer between your vehicle and unforeseen circumstances, aligning with the core principle of full coverage car insurance—to protect you from various risks. It complements your accident coverage by offering a proactive approach to vehicle care. Unlike auto insurance deductibles, which you must pay out-of-pocket before your insurer covers the rest, roadside assistance services are typically provided without a deductible, offering additional value for your investment. By integrating this service into your full coverage plan, you’re not only investing in physical vehicle protection but also in peace of mind, knowing that professional help is just a call away, ready to assist you wherever the road takes you.

Understanding Auto Insurance Deductibles and Their Impact on Roadside Assistance Coverage

When considering a full coverage car insurance policy, it’s crucial to understand how auto insurance deductibles function and their influence on your roadside assistance coverage. A deductible is the amount you agree to pay out-of-pocket before your vehicle protection plan kicks in. This financial responsibility can vary depending on the coverage level you choose. For instance, selecting a higher deductible typically leads to lower monthly premiums, making full coverage car insurance more affordable. However, this also means that you will shoulder more of the costs in the event of a claim or when utilizing roadside assistance services.

Roadside assistance is often included as part of a comprehensive policy, which may cover towing, battery jump-starts, flat tire changes, and fuel delivery. If your policy includes a deductible for this service, it’s important to be aware that you will need to pay this amount out of pocket at the time of service before the insurer covers the remainder. For example, if your deductible is $100 and you require a tow after an accident, you would be responsible for that $100 before the insurance company reimburses you for the tow truck service, as outlined in your vehicle protection plan. Understanding this dynamic is essential to ensure that unexpected vehicle issues don’t lead to additional financial strain. By carefully considering your deductible options and aligning them with your financial situation and the level of accident coverage you desire, you can enhance your overall peace of mind while driving, knowing that both your vehicle and yourself are protected in various scenarios.

Comprehensive Vehicle Protection Plans: More Than Just Accident Coverage

When considering a Full Coverage Car Insurance policy, it’s crucial to understand that it encompasses more than just accident coverage. These comprehensive vehicle protection plans are designed to offer a robust shield against various vehicular mishaps and financial liabilities. Beyond the basic liability coverage required by law, full coverage car insurance extends to include collision and comprehensive coverage, which can help mitigate the costs associated with repairing or replacing your vehicle in the event of an accident or non-collision incident such as theft, vandalism, or natural disasters.

Auto Insurance Deductibles play a significant role in this context. They are the amount you agree to pay out of pocket before your insurance coverage kicks in. Choosing the right deductible can affect both your premium and the level of protection you receive. A higher deductible typically leads to lower monthly payments but requires more out-of-pocket expense in the event of a claim. On the other hand, a lower deductible can provide greater peace of mind, knowing that you have a safety net for costs beyond your financial capacity. Vehicle Protection Plans often include additional benefits like roadside assistance, which is invaluable when dealing with issues such as flat tires, dead batteries, or running out of fuel. This aspect of comprehensive coverage ensures that you are not left stranded on the side of the road, enhancing your overall driving experience and providing a layer of security that goes beyond accident scenarios. By integrating roadside assistance into your vehicle protection plan, you are investing in a holistic approach to car insurance, one that considers all potential vehicular challenges and offers a comprehensive solution.

Navigating Unexpected Breakdowns with Efficient Roadside Services Included in Your Policy

When an unexpected vehicle breakdown occurs, having efficient roadside services included in your Full Coverage Car Insurance policy can be a game-changer. These services are designed to mitigate the stress and inconvenience of a breakdown, whether it’s due to mechanical failure, a flat tire, or running out of fuel. With prompt assistance, you can avoid the additional frustration of waiting on the side of the road for help to arrive. Your Auto Insurance Deductibles are less of a burden when these services are part of your policy, as they often come with no or low additional cost beyond your regular premiums. This integration into a comprehensive plan means that the benefits extend beyond mere roadside support; it’s about vehicle protection and ensuring that you have consistent, reliable coverage in the event of an accident or any other car-related emergency. Vehicle Protection Plans that include roadside assistance not only offer peace of mind but also align with the ethos of comprehensive Auto Insurance, where accident coverage is just one aspect of a broader commitment to safeguarding your vehicle and security on the roads. This holistic approach ensures that you are prepared for a variety of scenarios, from minor mishaps to significant accidents, all without the financial strain that could otherwise accompany these situations.

Maximizing Your Driving Experience with Comprehensive Auto Insurance and Roadside Support

Embarking on a journey with Full Coverage Car Insurance by your side can significantly enhance your driving experience. This robust form of vehicle protection ensures that, in the event of an unexpected breakdown or accident, you have access to a suite of services designed to minimize disruption and maximize safety. A pivotal aspect of this comprehensive coverage is roadside assistance, which acts as a safeguard against the inconveniences of vehicular issues such as flat tires, dead batteries, or running out of fuel. This service not only alleviates the stress associated with these scenarios but also expedites resolutions, allowing you to continue your travel plans without significant delay.

Furthermore, incorporating roadside assistance into your Auto Insurance Deductibles framework means that you’re bolstering your overall accident coverage. It functions as an additional layer of support that complements the primary insurance benefits. This holistic approach to vehicle protection offers a comprehensive defense against various road hazards and unforeseen events. With Full Coverage Car Insurance, drivers can navigate with confidence, knowing that their investment in Vehicle Protection Plans extends beyond mere repair or replacement of parts; it encompasses a proactive stance on safety and security throughout their journey.

In conclusion, incorporating roadside assistance into your full coverage car insurance not only bolsters your vehicle protection plans but also elevates your accident coverage. By understanding auto insurance deductibles and their influence on roadside assistance inclusion, you can tailor a policy that maximizes your driving experience while minimizing potential out-of-pocket expenses. Embracing a comprehensive approach to auto insurance ensures that you are prepared for the unpredictable nature of the road, providing peace of mind and reliable support in the event of unexpected vehicle issues. With this robust coverage, drivers can confidently navigate their journeys, knowing they are equipped with a safety net designed to protect both their well-being and their vehicle.