Liability coverage is a crucial component of car insurance, offering financial protection if you’re at fault for accidents causing injury or property damage. This essential aspect is typically categorized into bodily injury and property damage liability. Ensuring your policy meets or exceeds state-mandated minimums provides peace of mind while safeguarding your assets. Whether you drive a rental car, commercial vehicle, or classic, regularly reviewing and updating your liability coverage limits is vital. Explore tips on optimizing your policy, including managing deductibles and leveraging discounts, especially for high-risk drivers, to tailor protection that suits your unique needs and budget.

- Understanding Liability Coverage: Protections for Different Types of Drivers and Vehicles

- Navigating State Mandated Minimums: Ensuring Adequate Protection for Your Assets

- Optimizing Your Policy: Tips for Reviewing and Updating Car Insurance Deductibles and Discounts

Understanding Liability Coverage: Protections for Different Types of Drivers and Vehicles

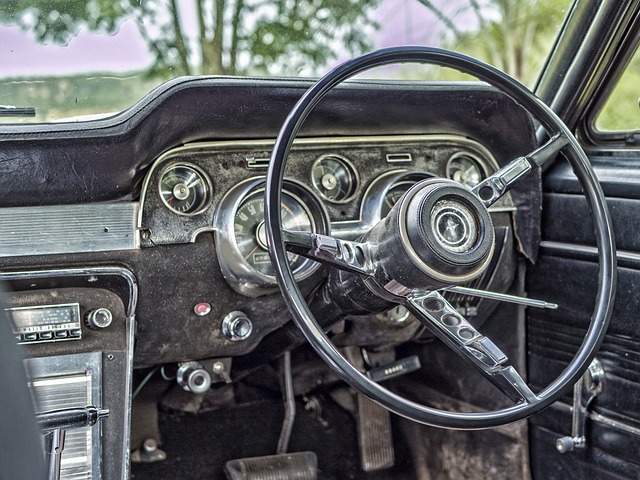

Liability coverage extends protection to various types of drivers and vehicles, catering to diverse needs. For instance, rental car insurance provides liability coverage for individuals renting vehicles temporarily, ensuring they’re shielded against unexpected accidents. Commercial auto insurance is tailored for businesses owning and operating multiple vehicles, offering comprehensive liability protection for commercial fleets. Even classic car owners can benefit from tailored coverage that understands the unique value and historical significance of their prized possessions.

Understanding liability coverage also involves knowing how it interacts with deductibles. A higher deductible typically translates to lower insurance premiums, but it’s crucial for drivers to balance risk tolerance with financial capability. Moreover, certain high-risk driver scenarios may necessitate specialized coverage, ensuring adequate protection despite challenging driving histories. Additionally, discounts on car insurance can significantly reduce premiums, encouraging safe driving habits and promoting responsible ownership.

Navigating State Mandated Minimums: Ensuring Adequate Protection for Your Assets

Navigating state mandated minimums is crucial when it comes to auto insurance. These requirements vary from state to state and dictate the level of financial protection you need to have in place. For those renting cars or driving commercial vehicles, like trucks or vans, understanding these minima is even more critical. Rental car insurance, for instance, often has different standards than personal car policies, so double-checking your coverage is essential before hitting the road.

When considering classic car coverage, high-risk driver coverage, or looking to lower your insurance premiums through discounts, keeping up with state mandates should never be overlooked. While these may seem like separate concerns, adequate liability coverage impacts both your peace of mind and financial security. Knowing where you stand in terms of car insurance deductibles and overall limits ensures your assets are safeguarded, whether driving a daily commuter, classic vehicle, or commercial rig.

Optimizing Your Policy: Tips for Reviewing and Updating Car Insurance Deductibles and Discounts

When optimizing your car insurance policy, it’s crucial to consider both car insurance deductibles and discounts. Start by reviewing your current coverage limits and comparing them to state-mandated minimums. If you’re using a rental car or have a classic car, ensure your policy provides adequate protection for these specific vehicles. High-risk drivers can benefit from shopping around for insurers that offer specialized coverage and discounts tailored to their needs.

Look into discounts on car insurance that could significantly lower your insurance premiums. Many companies offer reductions for safe driving records, anti-theft devices, good students, or membership in certain organizations. Understanding how these factors impact your policy can help you make informed decisions when updating your car insurance deductibles and taking advantage of available discounts.

Liability coverage is a cornerstone of responsible car ownership. By understanding the protections offered under bodily injury and property damage liability, navigating state-mandated minimums, and regularly reviewing your policy’s deductibles and discounts (including those for rental cars, commercial vehicles, and classic cars), you can ensure you’re adequately protected against unexpected accidents. Optimizing your insurance strategy not only safeguards your assets but also helps manage high-risk driver scenarios while potentially reducing insurance premiums. Remember, peace of mind is priceless – let your coverage be a reliable partner on the road ahead.