Personal Injury Protection (PIP) and Medical Payments Coverage are crucial components of your car insurance policy, offering vital protection for unexpected medical expenses and more. In the event of an auto accident, these coverages step in to assist with immediate care and long-term rehabilitation. PIP goes beyond medical bills by covering lost wages and rehabilitation costs, regardless of who’s at fault. Understanding these policies is essential, especially for high-risk drivers, classic car owners, and those renting vehicles, as they can significantly impact rental car insurance and commercial auto insurance premiums through discounts on car insurance.

- Understanding Personal Injury Protection (PIP): Coverage for More Than Just Medical Bills

- Medical Payments Coverage: Immediate Assistance for Unexpected Medical Expenses

- The Difference Between PIP and Medical Payments in Car Insurance Policies

- How PIP Protects You Against Lost Wages and Rehabilitation Costs

- Benefits of Comprehensive Coverage for High-Risk Drivers and Classic Cars

- Maximizing Savings: Discounts on Car Insurance and Their Impact on Premiums

Understanding Personal Injury Protection (PIP): Coverage for More Than Just Medical Bills

Personal Injury Protection (PIP) goes beyond simply covering medical bills after a car accident. This vital component of your auto insurance policy is designed to protect you and your passengers, offering compensation for lost wages, rehabilitation expenses, and other related costs, regardless of who’s at fault. In many states, PIP is mandatory, ensuring that victims receive the necessary support during their recovery.

When considering different types of car insurance, such as rental car insurance, commercial auto insurance, or classic car coverage, understanding PIP’s scope is crucial. Even with high-risk driver coverage or discounts on car insurance premiums, adequate PIP can make a significant difference in managing unexpected medical expenses and ensuring you’re protected financially in the event of an accident.

Medical Payments Coverage: Immediate Assistance for Unexpected Medical Expenses

In the event of an auto accident, Medical Payments Coverage (MPC) steps in to provide immediate financial assistance for unexpected medical expenses. This aspect of car insurance is particularly crucial for policyholders who might not have access to comprehensive health insurance or those facing high out-of-pocket costs. MPC covers a wide range of expenses, including hospital stays, doctor visits, medical tests, and even transportation costs related to treatment. Unlike Personal Injury Protection (PIP), which offers more extensive coverage, MPC is typically limited to the policyholder and their immediate family members.

When considering car insurance options, whether for your classic car, rental vehicle, or commercial fleet, understanding MPC’s role is essential. It serves as a safety net, ensuring that unexpected medical emergencies following an accident don’t lead to financial strain. Moreover, some insurance providers offer discounts on overall insurance premiums when you bundle MPC with other coverages like PIP and high-risk driver coverage. This can be especially beneficial for drivers facing higher insurance deductibles due to their vehicle type or personal circumstances.

The Difference Between PIP and Medical Payments in Car Insurance Policies

Personal Injury Protection (PIP) and Medical Payments Coverage are two distinct components within car insurance policies, each serving a unique purpose in safeguarding your financial well-being after an accident. PIP stands out for its comprehensive approach, covering not only medical bills but also lost wages and rehabilitation costs, regardless of who’s at fault. This makes it a crucial component, especially for those who rely on their vehicles for work or have high daily mileage.

In contrast, Medical Payments Coverage focuses more narrowly on immediate medical expenses incurred as a result of an accident. While it doesn’t extend to other costs like lost wages, it ensures that you and your passengers receive prompt and adequate medical attention. This coverage is particularly relevant for high-risk drivers or those with classic cars that might not be covered by standard policies, as well as those considering rental car insurance. Understanding these differences and the role of car insurance deductibles in each case can help individuals make informed decisions when determining their insurance premiums and exploring discounts on car insurance.

How PIP Protects You Against Lost Wages and Rehabilitation Costs

Personal Injury Protection (PIP) is a crucial component of your car insurance policy that offers comprehensive protection in the event of an accident. Unlike other coverages that primarily focus on property damage or liability, PIP is designed to safeguard your financial well-being and help you recover from injuries sustained in a motor vehicle crash.

One of the key advantages of PIP is its ability to cover lost wages and rehabilitation costs, regardless of who is at fault. This means if you’re involved in an accident and are unable to work due to injuries, PIP can step in and provide financial assistance to help make up for the loss. Additionally, it covers expenses related to rehabilitation, such as physical therapy or counseling, ensuring that you have the resources needed to regain your health and mobility after an injury. This comprehensive approach ensures that victims of auto accidents are not left burdened with medical debts and lost income, especially when dealing with a high-risk driver or classic car coverage scenarios where traditional insurance may offer limited protection.

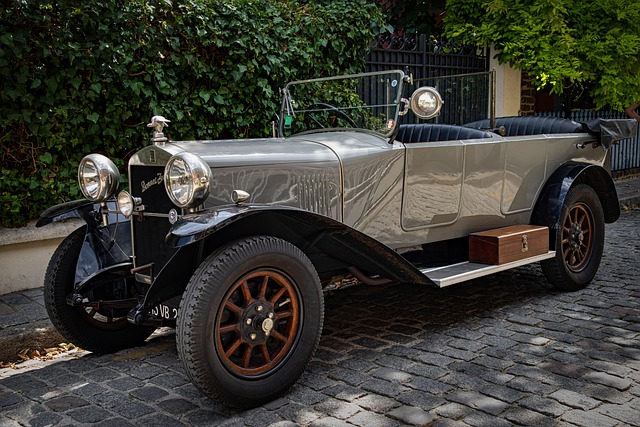

Benefits of Comprehensive Coverage for High-Risk Drivers and Classic Cars

For high-risk drivers, Comprehensive Coverage offers a safety net that goes beyond basic liability. This type of coverage is essential for those who are more susceptible to accidents due to factors like age, inexperience, or a history of claims. It includes protection against unforeseen events like vandalism, theft, and natural disasters, which can result in significant financial burden without it. By including Comprehensive Coverage, high-risk drivers can mitigate the risk of facing substantial out-of-pocket expenses, even if they are at fault for an accident.

Classic car owners also benefit from specific coverage options tailored to their needs. Classic Car Coverage goes beyond standard auto insurance by recognizing the unique value and delicate nature of these vintage vehicles. This specialized coverage accounts for higher repair costs, scarcity of replacement parts, and potential loss of historical integrity. In addition, rental car insurance can be a valuable add-on for anyone relying on a substitute vehicle after an accident. It ensures that drivers have access to a reliable transport without incurring extra fees, making it especially beneficial for those with high insurance deductibles or facing lengthy repairs. Discounts on car insurance are also available for policyholders who bundle multiple types of coverage, commercial auto insurance, or maintain good driving records, further enhancing the financial protection provided by these policies.

Maximizing Savings: Discounts on Car Insurance and Their Impact on Premiums

Maximizing savings on car insurance is a smart move for any driver looking to reduce their out-of-pocket expenses. One effective strategy is to explore various discounts offered by insurers, which can significantly impact your premium. For instance, if you’re in the market for rental car insurance, commercial auto insurance, or even classic car coverage, many companies provide discounts that cater to these specific needs.

By carefully reviewing your policy and comparing rates, you can take advantage of savings on car insurance deductibles, which represent the amount you pay out-of-pocket before insurance covers the rest. Additionally, high-risk driver coverage, while potentially raising premiums, ensures that you’re protected even in challenging driving conditions. Understanding these discounts and their impact is key to managing your budget and ensuring comprehensive protection for your vehicle and yourself.

Understanding and maximizing the benefits of Personal Injury Protection (PIP) and Medical Payments Coverage is crucial for any driver. These provisions ensure that you and your loved ones receive comprehensive support in the event of an auto accident, covering not just medical bills but also lost wages and rehabilitation costs. For those driving rental cars or commercial vehicles, or owning classic cars, selecting the right coverage, such as comprehensive insurance options, can significantly reduce financial burdens. Additionally, taking advantage of discounts on car insurance can further lower insurance premiums, making it a win-win situation. By familiarizing yourself with these coverages and their potential savings, you’re better equipped to make informed decisions that protect both your assets and your peace of mind.