Choosing the right auto insurance involves understanding your unique needs based on vehicle age, history, and travel areas, balancing affordability with necessary protection. Key components include collision, comprehensive, and liability insurance for financial security in accidents or damage. Customizing coverage for adverse weather or specialty vehicles ensures tailored protection. Understanding claims processes streamlines resolution, while addressing distracted driving risks is vital for modern drivers' safety and adequate insurance.

In today’s fast-paced world, understanding auto insurance can seem as daunting as navigating a busy highway. However, demystifying your coverage options is key to safeguarding yourself against the financial repercussions of unexpected events on the road. This article guides you through the intricate web of car insurance, from collision and comprehensive insurance to liability protection, helping you make informed decisions. By the end, you’ll have the peace of mind knowing that your vehicle and loved ones are shielded from potential dangers, with savings in your pocket to boot.

- Understanding Your Auto Coverage Needs

- Decoding Collision and Comprehensive Insurance

- The Role of Liability Insurance in Protecting You

- Unlocking Peace of Mind Through Adequate Coverage

- Exploring Additional Car Insurance Options

- Navigating Claims: What to Expect

- Staying Informed: Recent Trends in Auto Accidents

Understanding Your Auto Coverage Needs

Knowing your auto coverage needs is essential for ensuring financial protection and peace of mind behind the wheel. Every driver’s circumstances are unique, so their insurance options should reflect that. Consider factors such as your vehicle’s age and condition, your driving history, and the areas you frequently travel through. For instance, if you live in a region with frequent harsh weather conditions, comprehensive coverage may be beneficial to protect against potential damage from storms or accidents. Conversely, if you’re a cautious driver with no prior claims, you might opt for lower liability limits.

Additionally, evaluate your financial situation and personal risk tolerance. Remember that while the lowest possible insurance rates might seem appealing, they could leave you underinsured in the event of an accident. It’s crucial to strike a balance between affordability and adequate coverage. By understanding these variables, you can make informed decisions, tailoring your auto coverage to match your specific needs and budget while ensuring you’re adequately protected on the road.

Decoding Collision and Comprehensive Insurance

Collision and comprehensive insurance are two crucial components of an auto coverage policy, each offering distinct protections. Collision insurance covers damages to your vehicle when it collides with another object or entity, whether that’s another car, a tree, or even a mailbox. This includes both repair costs and, in some cases, the replacement value of your vehicle if it’s deemed a total loss. On the other hand, comprehensive insurance safeguards against a wider range of perils beyond collisions, including theft, natural disasters like floods or storms, vandalism, and animal-related incidents. It essentially covers any damage to your vehicle that isn’t a result of a collision, providing a broader safety net for unforeseen circumstances.

The Role of Liability Insurance in Protecting You

Liability insurance is your financial safeguard against potential claims arising from accidents caused by your driving. It primarily covers two types of losses: property damage and personal injury. If you’re at fault in a collision, this coverage steps in to pay for damages to others’ vehicles or property, as well as their medical bills if anyone is injured. The limits of liability—typically expressed in dollar amounts—dictate the maximum your insurance will cover. Selecting adequate liability insurance is crucial, especially given the rising costs of healthcare and vehicle repairs. It offers peace of mind, ensuring that unexpected incidents don’t leave you financially vulnerable.

Unlocking Peace of Mind Through Adequate Coverage

In today’s fast-paced and often distracted world, driving presents unique challenges. From navigating crowded roads to dealing with unexpected obstacles, it’s crucial to have a safety net in place – one that offers peace of mind while ensuring you’re adequately protected. Adequate auto coverage isn’t just about meeting legal requirements; it’s about safeguarding yourself from financial strain and stress in the event of an accident.

By understanding your vehicle protection options, you gain control over your future. Collision coverage, for instance, can help pay for repairs if you’re involved in a crash, while liability insurance protects you against claims made by others if you’re found at fault. These measures go beyond ticking boxes; they empower you to drive confidently, knowing that should the unexpected arise, you have the right protection in place.

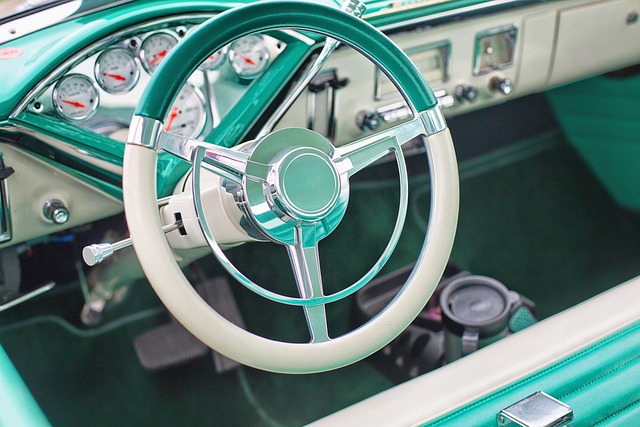

Exploring Additional Car Insurance Options

Beyond the core components of auto coverage, several additional options can significantly enhance your protection and peace of mind. Consider the unique needs of your driving lifestyle when evaluating these extras. For example, if you frequently drive in adverse weather conditions, adding comprehensive or weather-related coverage might be worthwhile. This type of coverage can help shield you from costs associated with accidents caused by storms, floods, or icy roads.

Additionally, if you own a classic or antique vehicle, specialized coverage options may be necessary to ensure its value is protected. Some policies offer custom coverage for high-end vehicles, taking into account their unique repair and replacement costs. Exploring these additional options allows you to tailor your insurance to fit your specific needs, ensuring you’re not paying for protections you don’t need while also feeling confident that unexpected events are covered.

Navigating Claims: What to Expect

Navigating claims can seem daunting, but understanding the process is key to a smoother experience. When an accident occurs, your insurance company will assign a claim adjuster who will guide you through each step. They’ll start by gathering information about the incident, including details from both parties involved and any witnesses. This may involve interviewing you, taking statements, and reviewing any available evidence like photos or police reports.

Next, the adjuster will assess the damage to your vehicle and determine the cost of repairs. They’ll either approve or deny your claim based on policy coverage and the severity of the damages. If approved, they’ll provide a check or direct payment to the repair shop for the agreed-upon work. It’s important to keep detailed records of all communications with your insurance company and retain any documents related to the claim process to ensure a smooth and efficient resolution.

Staying Informed: Recent Trends in Auto Accidents

Recent reports highlight a concerning trend: an increase in car accidents attributed to distracted driving. With the omnipresence of smartphones and growing distractions behind the wheel, this issue has become more prevalent than ever. According to studies, texting while driving can significantly impair reaction times, similar to those of a drunk driver. Moreover, simple tasks like sending a message or checking social media can divert attention away from the road, leading to potentially fatal consequences.

This rising statistic underscores the importance of staying informed about safety measures and insurance options that address modern-day driving challenges. By understanding these trends, drivers can make more conscious decisions when selecting their auto coverage, ensuring they have adequate protection against the risks posed by distracted driving and other emerging threats on the roads.

Understanding your auto insurance options is key to staying protected on the road. By carefully considering collision, comprehensive, liability, and additional coverages, you can create a personalized safety net that fits your unique needs. In today’s world, with distracted driving on the rise, choosing the right coverage isn’t just about saving money; it’s about gaining peace of mind. Armed with knowledge, you can confidently drive, knowing you’re shielded from unforeseen circumstances.