“Navigating the complexities of tax season can be a daunting task, but our comprehensive income tax services are here to transform this process into a seamless experience. With recent IRS initiatives focusing on simplification, we empower individuals and businesses alike through expert tax preparation, filing assistance, and consulting. Our certified tax preparers, armed with in-depth knowledge and years of experience, offer tailored strategies for year-end tax planning, ensuring maximum savings and minimal errors. From federal and state returns to corporate tax solutions, we provide the tools and guidance needed to file accurately, maximize deductions, and minimize your tax burden.”

- Year-End Tax Planning: Strategize for Maximum Savings

- – Importance of early preparation

- – Key considerations for individuals and businesses

- Meet Our Certified Tax Preparers: Expertise You Can Trust

- – Qualifications and experience

- – Dedicated support throughout the tax season

Year-End Tax Planning: Strategize for Maximum Savings

Year-End Tax Planning is a crucial strategy for maximizing tax savings and ensuring compliance with IRS regulations. Our team of Certified Tax Preparers offers specialized services to help individuals and businesses navigate complex tax laws, especially towards the end of the year. By understanding your financial situation and goals, we develop tailored strategies to minimize tax liabilities and optimize deductions.

We provide valuable insights on various tax-saving opportunities, including tax credits, deductions for business expenses, and retirement savings accounts. Our experts can guide you through the process of organizing financial records, estimating taxes, and planning for upcoming tax obligations. With our Taxpayer Relief Services, businesses can benefit from efficient corporate tax solutions, ensuring accurate income tax calculation and timely filing.

– Importance of early preparation

Early preparation for year-end tax planning is paramount in maximizing tax savings and avoiding potential penalties. Our team of certified tax preparers leverages their expertise to guide individuals and businesses through the complexities of income tax calculation, ensuring compliance with the latest IRS regulations. By starting the process early, clients can benefit from thoughtful strategic planning that takes advantage of various taxpayer relief services and deductions.

This proactive approach allows for a thorough review of financial records, enabling our advisors to identify valuable tax-saving strategies. From optimizing business expenses to navigating corporate tax solutions, we help clients minimize their tax liability while maintaining accurate record-keeping. With deadlines looming, early preparation ensures a smooth filing process, giving you peace of mind during what can often be a stressful time.

– Key considerations for individuals and businesses

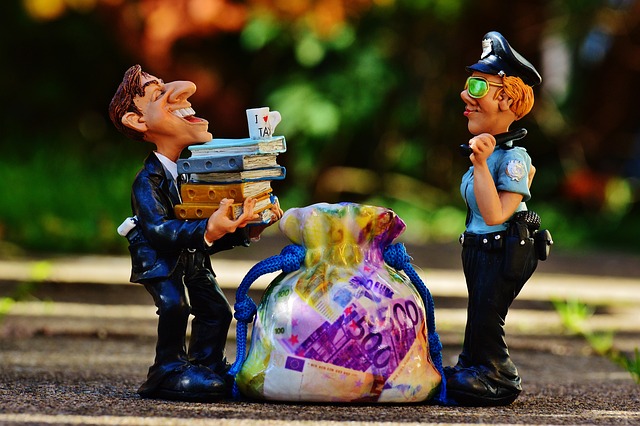

As tax season approaches, individuals and businesses alike face a multitude of considerations to ensure compliance and maximize their financial position. Key among them is year-end tax planning, which involves strategically reviewing income and expenses to optimize deductions and minimize taxable income. Engaging certified tax preparers can significantly alleviate this process, providing expert guidance tailored to unique circumstances. Their expertise in navigating complex tax codes and regulations helps taxpayers take advantage of available credits, deductions, and exemptions, ultimately leading to significant tax savings.

For businesses, corporate tax solutions are equally critical. This includes meticulous income tax calculation, ensuring accurate reporting of revenue and expenses across federal and state levels. Taxpayer relief services, such as consulting on tax strategies, can help companies minimize their tax burden while maintaining robust compliance. By proactively addressing these aspects with the assistance of qualified professionals, individuals and businesses can navigate the tax process efficiently, making the most of their financial resources throughout the year.

Meet Our Certified Tax Preparers: Expertise You Can Trust

Meet our team of Certified Tax Preparers, your trusted experts in navigating complex tax regulations. With a deep understanding of year-end tax planning and strategic tax saving strategies, they are dedicated to ensuring every taxpayer receives the relief services they deserve. Our preparers are well-versed in corporate tax solutions and income tax calculation methods, enabling them to offer tailored advice that goes beyond simple filing assistance.

They stay abreast of the latest IRS initiatives and changes in tax laws, so you can be confident your taxes are handled accurately and efficiently. Whether you’re an individual or a business, our certified tax preparers provide personalized support, maximizing deductions and minimizing errors to help you achieve financial peace of mind come tax season.

– Qualifications and experience

Our team comprises certified tax preparers with extensive experience in navigating complex tax codes and regulations. This expertise ensures that our clients receive the best possible service, tailored to their unique circumstances. We offer year-end tax planning strategies to help individuals and businesses optimize their tax positions, leveraging legal deductions and credits for significant tax savings.

Our taxpayer relief services extend beyond simple preparation; we provide valuable insights into corporate tax solutions and income tax calculation methodologies. With a keen eye for detail, our professionals minimize errors, ensuring compliance with federal and state tax laws. This allows you to focus on your core business activities while we handle the complexities of tax season, delivering peace of mind and maximum returns.

– Dedicated support throughout the tax season

Throughout the bustling tax season, our dedicated team offers consistent support to ensure a stress-free experience for all taxpayers. We understand that each individual and business has unique needs, so we provide personalized services tailored to your specific circumstances. Our certified tax preparers are experts in navigating complex tax codes, allowing you to focus on other aspects of your life or business.

We go beyond basic preparation by offering year-end tax planning strategies to help maximize tax savings. From income tax calculation to corporate tax solutions, our advisors guide you through every step, ensuring compliance and minimizing errors. With our taxpayer relief services, we make sure that your taxes are filed accurately and on time, leaving you with peace of mind.

Our comprehensive income tax services are tailored to help individuals and businesses navigate the complex tax landscape with ease. By combining strategic year-end tax planning with expert certified tax preparers, we ensure accurate filing, maximize tax savings, and provide valuable consulting for corporate tax solutions. With a focus on streamlining the process and delivering taxpayer relief services, we’re committed to making tax season less stressful and more rewarding for everyone.