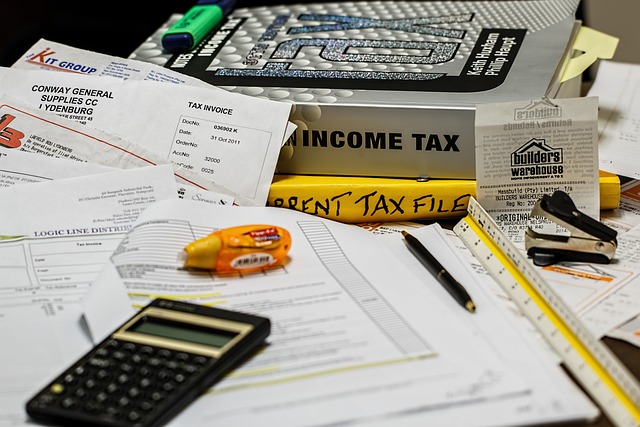

In today’s digital age, income tax e-filing has become the new norm. This article explores how easy tax filing platforms revolutionize the process. From accessing convenient online tax forms to tracking your tax refund status in real-time, these tools streamline preparation and save time. With built-in calculators, user-friendly interfaces, and free services catering to diverse financial situations, digital tax filing offers a stress-free alternative. Learn how secure online tax filing platforms ensure privacy while discussing benefits tailored for self-employed individuals seeking efficient tax refund tracking and expert tax filing assistance.

- Understanding Digital Tax Filing: The New Norm in Income Tax e-filing

- Benefits of Online Tax Forms and Easy Access to Tax Preparation Tools

- Tracking Your Tax Refund: Features for Efficient Tax Refund Tracking

- Security in Digital Tax Filing: Ensuring Secure Online Tax Filing Platforms

- Who Can Use These Services? Exploring Tax Filing Assistance for Self-Employed Individuals

Understanding Digital Tax Filing: The New Norm in Income Tax e-filing

In today’s digital age, income tax e-filing has become the new norm, revolutionizing how individuals and businesses manage their taxes. Easy tax filing platforms offer a seamless experience by providing access to online tax forms from the comfort of one’s home or office. These tools streamline the process, making it less time-consuming and more efficient compared to traditional paper-based methods. With features like tax refund tracking and secure online filing, taxpayers can rest assured that their information is safe and their returns are processed accurately.

For self-employed individuals and those with complex financial situations, these platforms offer tailored tax filing assistance. Online tax calculators help in determining tax liabilities precisely, while intuitive interfaces guide users through the process, ensuring a smooth experience. Many services even provide free online tax filing options, making tax preparation accessible to everyone, regardless of their financial background.

Benefits of Online Tax Forms and Easy Access to Tax Preparation Tools

In today’s digital age, online tax forms have revolutionized the way individuals and businesses handle their income tax e-filing. One of the key benefits is the convenience it offers; taxpayers can access official tax forms from the comfort of their homes or offices, eliminating the need for time-consuming trips to government offices. This ease of access is particularly advantageous for self-employed individuals who require specialized tax filing assistance and need to manage their financial records efficiently. Online platforms provide a centralized hub where users can find all necessary tools for tax preparation, from basic calculators to more complex features tailored to specific financial scenarios.

Additionally, these digital solutions enable secure online tax filing, ensuring sensitive information remains protected. Taxpayers can track their tax refund status in real-time, providing transparency and peace of mind. Many platforms also offer free tax filing services, making it accessible to a wide range of users, regardless of their financial background. This shift towards digital tax preparation not only streamlines the process but also reduces errors commonly associated with manual paperwork, ultimately leading to a more successful and stress-free tax season.

Tracking Your Tax Refund: Features for Efficient Tax Refund Tracking

In today’s digital age, tracking your tax refund has become as simple as a few clicks. Many online tax filing platforms offer robust tax refund tracking features, allowing users to monitor the status of their returns in real-time. This convenience is particularly beneficial for individuals who are self-employed or have complex income tax e-filing needs, as it eliminates the uncertainty and frequent check-ins with traditional methods. With just a login, taxpayers can access updated information on their refunds, including estimated processing times and any potential issues that may require attention.

These platforms streamline the process by providing secure online tax filing options, ensuring sensitive financial data is protected. The easy tax filing interfaces are designed to be user-friendly, even for those without extensive technical knowledge. By leveraging these digital tools, taxpayers can focus on their daily activities while leaving the complexities of online tax forms and tax filing assistance to the platforms. This efficient approach not only saves time but also reduces stress during what can often be a hectic period.

Security in Digital Tax Filing: Ensuring Secure Online Tax Filing Platforms

In today’s digital age, income tax e-filing has become the norm. While convenience is a primary benefit, ensuring security during online tax filing is paramount. Taxpayers must trust that their sensitive financial information, including Social Security numbers and bank account details, is protected from cyber threats. Reputable digital tax filing platforms invest heavily in cybersecurity measures such as encryption technology and secure servers to safeguard data. Additionally, these platforms often employ multi-factor authentication and regularly update their security protocols to counter emerging online risks.

Easy tax filing interfaces play a crucial role in enhancing security by simplifying the process for both individuals and self-employed taxpayers. By using intuitive tools provided by these platforms, users can reduce errors that might compromise data integrity or leave them vulnerable to identity theft. Moreover, many digital tax filing services offer tax filing assistance, providing an extra layer of support to ensure accurate submissions and peace of mind knowing that experts are available to help should any issues arise during the process.

Who Can Use These Services? Exploring Tax Filing Assistance for Self-Employed Individuals

In today’s digital age, income tax e-filing platforms are designed to cater to a broad spectrum of taxpayers, including self-employed individuals. These platforms offer specialized tools tailored for navigating the unique complexities of self-employment taxes. Features like easy tax filing interfaces and online tax calculators help simplify the process, making it accessible even without an accounting background. Many platforms also provide dedicated tax filing assistance, ensuring that self-employed individuals can confidently manage their tax obligations.

Online tax forms are readily available, allowing self-employed folks to input their income and deductions accurately. Additionally, these platforms facilitate secure online tax filing, safeguarding sensitive financial information. Tax refund tracking features further ensure transparency, keeping users informed about the status of their refunds. By leveraging these digital resources, self-employed individuals can streamline their tax preparation, saving time and reducing potential errors, and enjoy a more stress-free tax season.

In today’s digital age, income tax e-filing has become the norm, offering numerous benefits such as easy access to online tax forms and efficient tax refund tracking. Secure online tax filing platforms cater to diverse needs, including those of self-employed individuals, by providing comprehensive solutions and tax filing assistance. By leveraging these tools, taxpayers can streamline their obligations, reduce preparation time, and navigate deadlines with confidence. Staying informed about these digital resources ensures a more stress-free tax season for all.