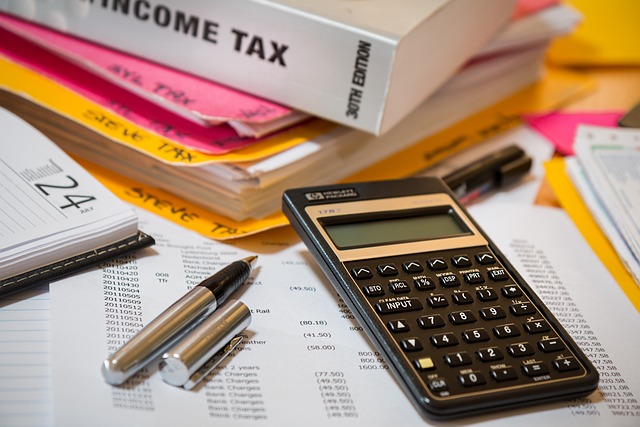

Self-employed individuals face unique tax challenges but also have opportunities to significantly reduce their tax burden through strategic planning. Understanding tax deductions for home offices and health insurance premiums can substantially lower taxable income. Navigating IRS filing deadlines is crucial to avoid penalties and interest. This article explores various aspects of tax optimization, including nonprofit tax filing options, tax-efficient investments, staying updated with tax code changes, and optimizing filing status to maximize savings and ensure eligibility for tax exemptions.

- Home Office Expenses and Health Insurance: Understanding Tax Deductions for Self-Employed

- Navigating IRS Filing Deadlines to Avoid Penalties and Interest

- Exploring Nonprofit Tax Filing Options: What Self-Employed Should Know

- Tax-Efficient Investments: Strategies for Self-Employed Individuals to Maximize Savings

- Staying Updated with Tax Code Changes: How It Impacts Your Business and Taxes

- Optimizing Filing Status: A Guide for Self-Employed to Reduce Tax Liability

Home Office Expenses and Health Insurance: Understanding Tax Deductions for Self-Employed

For self-employed individuals, distinguishing legitimate business expenses from personal costs is essential for maximizing tax exemptions and ensuring eligibility for tax deductions. Home office expenses, for example, can significantly reduce taxable income if properly documented. The IRS provides guidelines on what constitutes a home office, and qualifying expenses such as rent, utilities, and equipment may be deducted. This benefit not only offers financial relief but also contributes to a more comfortable working environment.

Additionally, health insurance premiums are another area where self-employed folks can find substantial tax savings. By deducting the cost of their own health coverage, they can lower their overall taxable earnings. This is particularly advantageous considering the potential for IRS penalties and interest on unpaid taxes. Staying informed about tax code changes and optimizing filing status can further enhance tax-efficient investments like Simplified Employee Pension (SEP) IRAs. Such proactive financial planning ensures that individuals not only comply with tax regulations but also make strategic moves to improve their overall financial well-being.

Navigating IRS Filing Deadlines to Avoid Penalties and Interest

Navigating IRS filing deadlines is a critical aspect of tax planning for self-employed individuals. Missing these deadlines can result in substantial penalties and interest charges, adding to an already complex tax landscape. Understanding when various tax forms are due, such as Schedule C for self-employment income, is essential. The IRS offers extensions under certain circumstances, but proactive compliance is key to avoiding these extra costs.

Staying updated on the latest Tax Code changes, particularly those affecting nonprofit organizations and small businesses, can further optimize tax exemption eligibility. This includes exploring tax-efficient investments like SEP IRAs, which provide significant advantages for self-employed individuals. By strategically timing tax filings and staying informed about relevant sections of the Tax Code, individuals can minimize their tax burden and maximize deductions, ensuring a smoother financial year ahead.

Exploring Nonprofit Tax Filing Options: What Self-Employed Should Know

Self-employed individuals often find themselves in a unique position when it comes to nonprofit tax filing options. Exploring these opportunities can be a strategic move to maximize savings and take advantage of tax exemptions. Nonprofit organizations, for instance, may qualify for specific tax treatments under the IRS guidelines, which could indirectly benefit self-employed individuals through contributions or partnerships. Understanding these structures is crucial as it allows them to make informed decisions regarding their financial planning.

One key aspect to consider is the potential eligibility for tax-efficient investments and deductions related to charitable giving. The Tax Code Changes might offer new opportunities, especially with updated rules on filing status optimization. By staying informed about these regulations, self-employed folks can ensure they take advantage of any available exemptions while also avoiding IRS penalties and interest associated with late or incorrect filings.

Tax-Efficient Investments: Strategies for Self-Employed Individuals to Maximize Savings

Self-employed individuals have a unique opportunity to optimize their tax situation through strategic investments. Tax-efficient investments can help reduce taxable income and take advantage of favorable tax code changes. One such strategy is to contribute to a Simplified Employee Pension (SEP) IRA, which offers significant retirement savings benefits while minimizing tax implications. By carefully managing these contributions, individuals can ensure they meet IRS guidelines for tax exemption eligibility, avoiding penalties and interest charges.

Additionally, staying informed about recent tax law updates is crucial. Changes in the Tax Code can impact various deductions and credits available to self-employed individuals. Optimizing filing status can also make a significant difference, especially for those with substantial business expenses. Utilizing these strategies, combined with regular financial planning, allows self-employed folks to navigate complex tax regulations while maximizing savings and ensuring compliance with IRS nonprofit tax filing requirements.

Staying Updated with Tax Code Changes: How It Impacts Your Business and Taxes

Staying Updated with Tax Code Changes is paramount for self-employed individuals to ensure they remain compliant and make informed financial decisions. The Tax Code is subject to periodic updates, which can introduce new deductions, alter tax rates, or modify eligibility criteria for various tax exemptions. For instance, changes in health insurance provisions might affect how home office expenses are treated, impacting overall taxable income.

Nonprofit organizations, too, must stay abreast of Tax Code Changes specific to their sector, including any adjustments to charitable donations rules and tax-efficient investments options. By keeping up with these modifications, self-employed individuals can optimize their filing status, take advantage of new deductions, and potentially reduce IRS penalties and interest associated with inaccurate reporting, ensuring a more efficient tax strategy.

Optimizing Filing Status: A Guide for Self-Employed to Reduce Tax Liability

For self-employed individuals, optimizing filing status is a strategic move to reduce tax liability. Understanding tax code changes and navigating IRS regulations can help in maximizing tax exemptions eligibility. By carefully considering their filing status—whether it’s single, married filing jointly, or head of household—they can take advantage of deductions and credits tailored to their situation. For instance, self-employed folks might benefit from deducting business expenses related to their home office, as long as they meet the IRS criteria for a qualifying home office.

Staying informed about tax-efficient investments and non-profit tax filing options is also key. Contributions to a Simplified Employee Pension (SEP) IRA, for example, can provide significant tax advantages. Furthermore, keeping an eye out for changes in the Tax Code ensures that self-employed individuals take advantage of new provisions or adjustments that could benefit their financial planning. Regularly reviewing and optimizing filing status can help them avoid IRS penalties and interest while ensuring they meet all legal requirements.

For self-employed individuals, navigating tax obligations can be complex but rewarding. By leveraging deductions for home offices and health insurance, staying informed about IRS deadlines, exploring nonprofit tax filing options, and making strategic investments, taxpayers can significantly reduce their taxable income. Staying abreast of tax code changes and optimizing one’s filing status are essential steps in maximizing tax exemptions and eligibility for benefits like SEP IRAs. With diligent financial planning, self-employed folks can not only avoid penalties and interest from the IRS but also unlock opportunities to save more and grow their businesses tax-efficiently.