Business interruption insurance is a vital safety net for companies facing unexpected disruptions. In an era increasingly marked by climate-related disasters, this coverage ensures businesses can weather storms, both literal and metaphorical. From floods to hurricanes, earthquakes to wildfires, these events can halt operations and incur significant financial losses. Understanding the role of disaster recovery insurance, including property damage protection and specific coverages like flood, earthquake, hurricane, and wildfire insurance, is crucial for navigating today’s unpredictable landscape. Integrating storm damage coverage into emergency plans enhances financial stability and ensures businesses can bounce back stronger.

- Understanding Business Interruption Insurance: A Key Component of Disaster Recovery

- The Role of Property Damage Protection in Mitigating Financial Losses

- Types of Disaster Risk Coverage: Flood, Earthquake, Hurricane, and Wildfire Insurance

- Integrating Storm Damage Coverage into Your Business's Emergency Preparedness Plan

- Enhancing Financial Stability: Why Disaster Recovery Insurance is Essential in Today's Climate-Change Era

Understanding Business Interruption Insurance: A Key Component of Disaster Recovery

Business Interruption Insurance is a vital component of any comprehensive disaster recovery strategy. It provides businesses with financial protection during unforeseen events that disrupt normal operations, such as natural disasters (including flood insurance, earthquake insurance, hurricane insurance, and wildfire insurance), or other catastrophic occurrences. This coverage goes beyond property damage protection by compensating for lost income, ensuring that companies can maintain their financial stability even when forced to close temporarily.

In today’s world, where disaster risks are increasingly prevalent due to climate change, having this type of insurance is more crucial than ever. It enables businesses to recover faster and more effectively from storms, floods, or other events causing storm damage. By integrating business interruption insurance into their risk management plans, businesses can ensure they’re prepared for the unexpected, allowing them to resume operations promptly and minimize financial losses in the event of a disaster.

The Role of Property Damage Protection in Mitigating Financial Losses

Business interruption insurance isn’t just about covering lost income; it’s underpinned by crucial components like property damage protection, which play a pivotal role in mitigating financial losses during disasters. This includes specialized coverage for events such as floods, earthquakes, hurricanes, and wildfires. These catastrophic events can cause significant physical damage to business properties, disrupting operations and leading to substantial expenses related to repairs and rebuilding.

Having adequate disaster risk coverage, including storm damage coverage, ensures that businesses have the financial backing to recover faster. This protection goes hand-in-hand with disaster recovery insurance, enabling companies to maintain stability and continuity, even in the face of devastating natural occurrences. By integrating these policies into their risk management strategies, businesses can safeguard their financial health and ensure a smoother transition during recovery periods.

Types of Disaster Risk Coverage: Flood, Earthquake, Hurricane, and Wildfire Insurance

In the face of escalating natural disasters, businesses increasingly rely on comprehensive disaster risk coverage to safeguard their operations and financial stability. Key components of this coverage include flood insurance, earthquake insurance, hurricane insurance, and wildfire insurance. Each type addresses specific risks that can disrupt business continuity and cause significant property damage.

Flood insurance protects against water damage caused by heavy rainfall, river overflow, or coastal storms, which can lead to extensive business interruptions. Earthquake insurance covers the structural damage and subsequent instability that can halt operations for extended periods. Hurricane insurance, crucial in coastal areas, addresses storm damage including wind and flying debris, while wildfire insurance is essential for businesses located in fire-prone regions, offering protection against sudden and devastating blazes that can consume buildings and disrupt entire communities.

Integrating Storm Damage Coverage into Your Business's Emergency Preparedness Plan

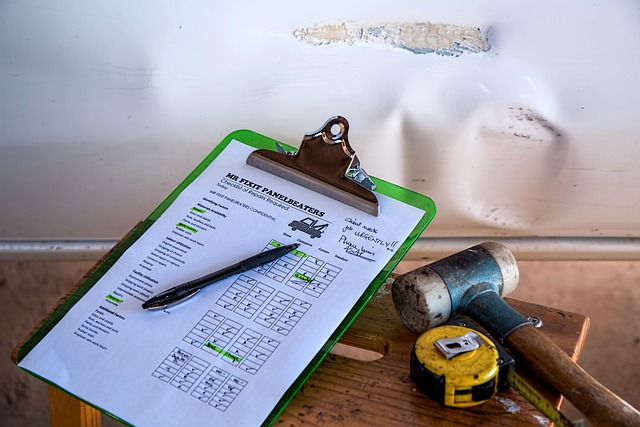

In today’s world, where natural disasters are becoming increasingly frequent and severe, integrating storm damage coverage into your business’s emergency preparedness plan is essential. This includes considering comprehensive disaster risk coverage such as flood insurance, earthquake insurance, and hurricane insurance, in addition to specific protection against wildfire insurance. Such measures ensure that your business is not only prepared for potential property damage but also equipped to handle the subsequent financial impact, crucial for maintaining operations during recovery.

When crafting your disaster recovery insurance strategy, remember that storm damage coverage goes beyond mere property protection. It encompasses loss of income and operating expenses incurred during periods when your business must cease or reduce its operations due to covered events. This ensures financial stability, enabling businesses to not only rebuild but also to continue providing services and maintaining employee welfare during challenging times.

Enhancing Financial Stability: Why Disaster Recovery Insurance is Essential in Today's Climate-Change Era

In today’s world, where natural disasters are becoming increasingly frequent and severe due to climate change, businesses must be prepared for the unexpected. Disaster recovery insurance, a key component of comprehensive risk management, plays a pivotal role in enhancing financial stability. This type of insurance goes beyond mere property damage protection; it includes crucial disaster risk coverage such as flood insurance, earthquake insurance, hurricane insurance, and wildfire insurance, among others. By integrating these policies into their strategy, businesses can secure compensation for lost income and operating expenses during periods of disruption caused by storms, floods, or other covered events.

The significance of disaster recovery insurance lies in its ability to maintain financial stability during emergency preparedness and recovery. Storm damage coverage ensures that businesses can quickly resume operations after a hurricane or storm, minimizing downtime and its associated costs. Similarly, flood insurance protects against potential water damage, while earthquake insurance provides crucial support following seismic events. These policies collectively contribute to a business’s resilience, allowing them to navigate the challenges posed by today’s ever-changing climate with greater confidence.

Business interruption insurance is not just a safety net; it’s a vital strategy for navigating the unpredictable landscape of natural disasters. By integrating this coverage with comprehensive risk management, businesses can ensure financial resilience during unforeseen events such as floods, earthquakes, hurricanes, and wildfires. Storm damage coverage plays a crucial role in emergency preparedness plans, offering peace of mind and rapid recovery support. In today’s climate-change era, where disaster risks are on the rise, prioritizing disaster recovery insurance is essential for sustaining operations and maintaining stability.