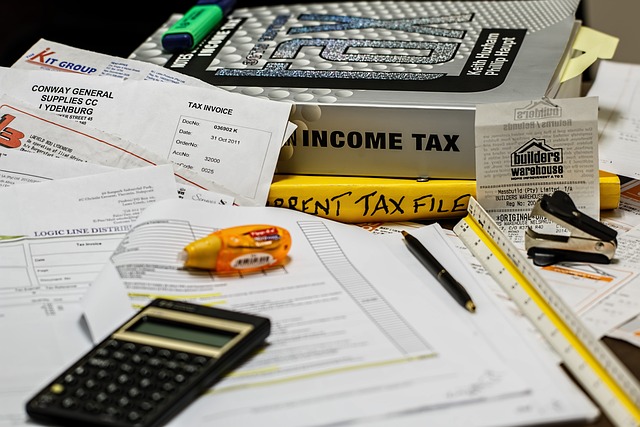

Online tax preparation has transformed how individuals tackle their tax obligations. By leveraging tax filing software, you can electronically file taxes, ensuring accuracy and compliance. These platforms offer features like calculators and digital tax forms, simplifying the process. Understanding available deductions online can boost your refund potential. With e-filing’s convenience, meet deadlines promptly and track refunds in real-time. Embrace these services for time-saving, secure, and efficient tax management, especially beneficial for self-employed individuals.

- The Rise of Digital Tax Filing: A Modern Approach to Income Tax e-filing

- Streamlining the Process: Benefits of Easy tax filing with Online Tax Forms

- Real-Time Convenience: Tax Refund Tracking and its Impact on Self-Employed Individuals

- Security and Efficiency: Why Secure Online Tax Filing is the Future of Tax Preparation

The Rise of Digital Tax Filing: A Modern Approach to Income Tax e-filing

The digital transformation has brought about a significant shift in how individuals manage their income tax obligations. Online tax filing has emerged as a game-changer, offering an efficient and user-friendly alternative to traditional paper-based methods. This modern approach to income tax e-filing empowers taxpayers by providing easy access to tax preparation software and online tax forms. With just a few clicks, individuals can now complete their tax returns from the comfort of their homes, eliminating the need for lengthy visits to accounting offices or long queues at tax centers.

The benefits of digital tax filing are numerous. It simplifies the process by offering intuitive interfaces that guide users through each step, ensuring even those without prior tax preparation experience can navigate it with ease. Additionally, online platforms often include advanced features like tax calculators, which help individuals understand their refund potential and make informed decisions regarding deductions and credits. Furthermore, secure online tax filing guarantees sensitive financial information is protected, addressing concerns about data privacy. This method is particularly beneficial for self-employed individuals who require specialized tax filing assistance, as it allows them to manage their finances efficiently while staying compliant with tax regulations.

Streamlining the Process: Benefits of Easy tax filing with Online Tax Forms

Online tax forms have streamlined the process of income tax e-filing, making it an increasingly popular choice for taxpayers. The convenience and accessibility of these digital platforms are significant advantages for individuals, especially those who are self-employed or have complex tax situations. Easy tax filing with online tax forms offers several benefits. Firstly, it simplifies the entire process by providing a structured, step-by-step guide to complete your tax return. This user-friendly approach ensures even those without extensive tax knowledge can navigate and file their taxes accurately.

Additionally, these platforms often incorporate powerful tools like tax refund tracking, allowing taxpayers to monitor their returns’ progress in real time. They also offer enhanced security for online tax filing, safeguarding sensitive financial information. By leveraging this technology, individuals can efficiently manage their taxes, ensuring compliance while saving valuable time and effort compared to traditional paper-based methods. This accessibility and convenience are particularly beneficial for self-employed individuals seeking reliable tax filing assistance.

Real-Time Convenience: Tax Refund Tracking and its Impact on Self-Employed Individuals

For self-employed individuals, managing taxes can be a complex and time-consuming task. Traditional methods often involve piles of paperwork, numerous forms, and endless hours spent on calculations. However, with the advent of online tax preparation services, this landscape is changing dramatically. Income tax e-filing has become a game-changer, offering unparalleled convenience and efficiency. By utilizing these platforms, self-employed folks can easily access and complete tax forms online, eliminating the hassle of gathering physical documents.

One of the most significant advantages is real-time tax refund tracking. With secure online tax filing, individuals can monitor their refund status as soon as they submit their returns. This feature is invaluable for self-employed taxpayers who may rely on their refunds to cover business expenses or maintain cash flow. Instant access to this information allows them to make informed financial decisions and stay updated on their tax obligations, ensuring a smoother and less stressful tax journey.

Security and Efficiency: Why Secure Online Tax Filing is the Future of Tax Preparation

The future of tax preparation lies in secure online tax filing, offering both unparalleled security and enhanced efficiency. Traditional paper-based methods are time-consuming, prone to errors, and often involve lengthy waits for refunds. Online platforms, however, streamline the process by digitizing tax forms, enabling easy tax filing from the comfort of your home. Secure online tax filing ensures that sensitive financial information is encrypted and protected, addressing a major concern among taxpayers.

This modern approach allows individuals, including self-employed workers in need of specialized tax filing assistance, to take control of their finances. With real-time tax refund tracking, users can monitor the status of their returns, gaining peace of mind. The convenience and accessibility of these platforms make it an attractive option for those seeking efficient and secure income tax e-filing solutions.

Online tax preparation has transformed the way individuals navigate their tax obligations, offering unprecedented convenience and efficiency. By leveraging software solutions, taxpayers can now file electronically, access calculators, and manage digital forms with ease. This modern approach not only streamlines the process but also enhances accuracy and compliance. For self-employed individuals, real-time refund tracking is a game-changer, providing transparency and promptness. Moreover, secure online tax filing ensures data protection, making it the future of tax preparation. Embracing these digital tools can save time, reduce stress, and empower individuals to take control of their financial matters effectively.