Navigating complex tax landscapes is crucial for achieving financial well-being. This article guides you through the intricacies of income tax preparation, emphasizing the significance of understanding deductions and credits to minimize taxable income. Learn about IRS filing deadlines and strategies like retirement accounts and health savings plans for substantial tax savings. Stay ahead of changing tax laws by implementing regular financial planning, optimizing filing status, and exploring nonprofit tax filing and tax-efficient investments. Avoid penalties and interest by ensuring timely submissions, empowering you to make informed decisions and maximize your returns.

- Understanding Tax Deductions and Credits: Unlocking Potential Savings

- IRS Filing Deadlines: The Importance of Timely Submission

- Strategic Tax Savings: Retirement Accounts and Health Savings Plans

- Adapting to Changing Tax Laws: Regular Financial Planning Matters

- Maximizing Tax Benefits: Optimizing Filing Status

- Nonprofit Tax Filing: A Comprehensive Guide for Organizations

- Tax-Efficient Investments: Growing Your Wealth While Minimizing Taxes

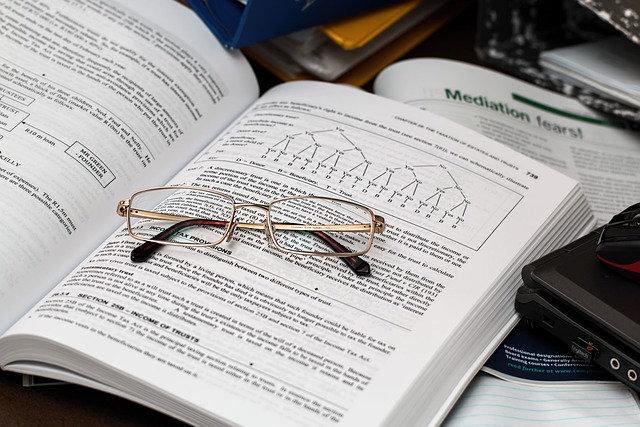

Understanding Tax Deductions and Credits: Unlocking Potential Savings

Understanding tax deductions and credits is a key aspect of navigating complex tax planning. These benefits can significantly lower an individual or business’s taxable income, effectively unlocking potential savings. By carefully reviewing the Tax Code, one can identify various deductions related to home ownership, charitable donations, and education expenses, among others. Additionally, exploring tax credits, such as those for renewable energy or nonprofit organizations, offers substantial financial advantages.

Taxpayers should stay informed about eligibility criteria for these benefits and ensure proper documentation to maximize savings. For instance, contributing to retirement accounts like 401(k)s or IRAs can result in tax-deferred growth and reduce taxable income. Similarly, utilizing Health Savings Accounts (HSAs) allows for tax-free savings and investments for qualified medical expenses. Staying abreast of IRS guidelines, Tax Code changes, and filing status optimization ensures that these potential savings are not overlooked, helping individuals and businesses avoid unnecessary IRS penalties and interest charges.

IRS Filing Deadlines: The Importance of Timely Submission

Staying on top of IRS filing deadlines is paramount for avoiding penalties and interest charges. The Internal Revenue Service (IRS) sets specific timelines for both individuals and nonprofits to ensure fair tax collection practices. Missing these deadlines can result in significant financial consequences, as penalties may accumulate daily until the return is filed.

For individuals, understanding one’s filing status optimization options and adjusting contributions to retirement accounts or health savings accounts can help maximize tax-efficient investments. Nonprofits, on the other hand, must navigate complex tax code changes related to their operations, ensuring they meet all requirements for tax exemption eligibility while adhering to strict nonprofit tax filing deadlines.

Strategic Tax Savings: Retirement Accounts and Health Savings Plans

Strategic tax savings are a crucial aspect of effective income tax preparation. One powerful tool for individuals and businesses alike is contributing to retirement accounts like 401(k)s or IRAs. These contributions can lower taxable income, offering both immediate tax benefits and long-term savings. By utilizing these plans, taxpayers can take advantage of tax-deferred growth, which allows investments to flourish over time without the annual tax hit. This is especially beneficial for those planning for retirement, as it ensures financial stability with increased savings potential.

Additionally, Health Savings Accounts (HSAs) provide another avenue for tax-efficient savings. HSAs are designed for individuals with high-deductible health plans and offer a tax exemption on eligible medical expenses. Contributions grow tax-free, and withdrawals for qualified healthcare costs are also free from taxes. This not only helps in managing healthcare expenses but also contributes to overall financial well-being by maximizing tax benefits and avoiding potential IRS penalties and interest associated with incorrect filing or non-compliance due to changing tax code changes and filing status optimization.

Adapting to Changing Tax Laws: Regular Financial Planning Matters

Adapting to Changing Tax Laws: Regular Financial Planning Matters

In today’s dynamic economic landscape, tax laws are subject to frequent changes, which can significantly impact individuals’ and businesses’ financial strategies. Staying current with modifications in the Tax Code is crucial for navigating complex tax planning. Tax-efficient investments, optimized filing status, and strategic utilization of deductions and credits become more intricate as laws evolve. Regular financial planning allows taxpayers to anticipate these shifts, ensuring they remain eligible for tax exemptions and avoid IRS penalties and interest charges.

By incorporating proactive measures into their routine financial strategies, individuals can take advantage of changes in nonprofit tax filing rules or newly introduced tax incentives. For businesses, staying ahead of the curve enables them to structure operations for better tax positioning. This strategic approach not only helps in compliance but also maximizes returns, allowing taxpayers to make informed decisions, adapt successfully, and ultimately enhance their financial well-being.

Maximizing Tax Benefits: Optimizing Filing Status

Maximizing tax benefits goes beyond simply minimizing taxable income; it involves strategic optimization that can significantly impact financial well-being. One key area is filing status. Whether you’re single, married filing jointly, or head of household, your filing status directly affects your tax rate and eligibility for various deductions and credits. Understanding how to leverage your specific filing status is crucial. For instance, married couples can often benefit from filing jointly, which typically results in lower rates and potential access to more deductions.

Individuals who are self-employed or run nonprofits should also pay close attention to their tax exemption eligibility and nonprofit tax filing requirements. The Tax Code changes frequently, and staying informed about these shifts can open doors to new savings opportunities. By strategically managing your filing status, you can navigate the complexities of the tax system more effectively, potentially increasing refunds or reducing liabilities while ensuring compliance with IRS penalties and interest.

Nonprofit Tax Filing: A Comprehensive Guide for Organizations

Nonprofit organizations play a vital role in society, but they also face unique tax considerations. Navigating the complexities of tax filing for nonprofits requires a deep understanding of the IRS guidelines and the specific rules that apply to their operations. One key aspect is ensuring tax exemption eligibility, which can be achieved by meeting certain criteria set forth by the IRS. This includes demonstrating that the organization is organized exclusively for charitable purposes, operates in compliance with the requirements of the IRS, and distributes its income solely for tax-exempt purposes.

Regularly staying updated on Tax Code changes is crucial as they can impact a nonprofit’s status and obligations. For instance, modifications to rules around tax-efficient investments or filing status optimization may apply, requiring organizations to adapt their strategies. Additionally, nonprofits must adhere to strict deadlines for both filing tax returns and making contributions to avoid IRS penalties and interest. A comprehensive guide should also cover the process of preparing and submitting forms accurately, including necessary documentation to support claims for deductions and credits, ensuring a smooth filing experience.

Tax-Efficient Investments: Growing Your Wealth While Minimizing Taxes

Tax-efficient investments offer a strategic approach to growing wealth while minimizing tax liabilities. By carefully selecting investment options that align with an individual’s or business’s tax profile, it is possible to maximize after-tax returns. For instance, certain types of investments, like municipal bonds or some real estate ventures, may qualify for tax exemptions or deductions, reducing the overall tax burden. Understanding these opportunities and their eligibility criteria is crucial in navigating the intricate Tax Code Changes and optimizing filing status.

Additionally, nonprofits can benefit from specific tax considerations. Proper nonprofit tax filing ensures compliance with IRS regulations, avoiding penalties and interest charges. By strategically planning and utilizing tax-efficient investments, individuals and organizations can foster financial growth while adhering to legal requirements, ultimately enhancing their overall financial well-being.

In conclusion, navigating the complexities of tax planning and filing is a crucial step towards achieving financial well-being. By understanding tax deductions and credits, staying informed about deadlines, and implementing strategic savings measures, individuals and businesses can significantly reduce their taxable income and optimize their financial outcomes. Regular financial planning, adaptability to changing tax laws, and proactive management of tax return preparation ensure compliance, maximize benefits, and potentially increase refunds. Additionally, recognizing the unique considerations for nonprofit organizations and exploring tax-efficient investments further enhances overall financial strategy.