The rising cost of vehicle repairs globally poses a significant concern for drivers. Collision coverage is crucial for financial security and peace of mind, with key components being deductibles (out-of-pocket expenses) and premium rates. Lowering deductibles reduces monthly payments but increases out-of-pocket costs during claims, while higher deductibles lower premiums but require more personal contribution post-accident. Comparing collision insurance rates from various insurers, focusing on vehicle details, driving history, and coverage level, helps save money while maintaining essential protection. Understanding deductibles and selecting appropriate ones allows drivers to customize policies for unexpected repairs without financial strain. This proactive approach promotes peace of mind, simplifies post-accident procedures, protects finances, and contributes to a safer driving culture.

In an era marked by escalating vehicle repair costs and surge in demand, drivers worldwide are increasingly recognizing the importance of financial security behind the wheel. Auto collision protection stands as a beacon of solace, shielding individuals from the weighty financial impacts of accidents. Recent data highlights a growing trend among savvy drivers opting for collision damage waivers and similar coverages, prioritizing peace of mind over unexpected expenses. This article delves into the intricate details of auto collision protection, exploring key elements such as deductibles, rate comparison, and aligning policy with evolving needs to ensure you’re not just driving, but driving with financial confidence.

- The Rising Costs of Vehicle Repairs: A Concern for Drivers

- Understanding Auto Collision Protection: Your Financial Safety Net

- Exploring Collision Insurance Deductibles: What You Need to Know

- Comparing Collision Insurance Rates: Saving Money Without Sacrificing Coverage

- Aligning Policy with Protection Needs in a Changing Landscape

- Surge in Demand and Costs: Why Now is the Time for Action

- Ensuring Financial Security: Tips for Drivers Considering Collision Insurance

The Rising Costs of Vehicle Repairs: A Concern for Drivers

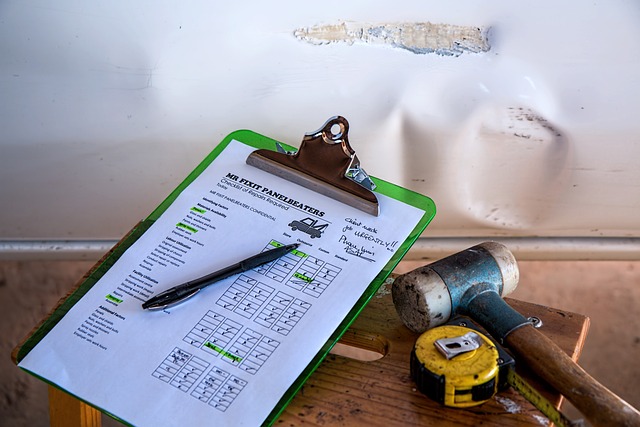

In recent years, the cost of vehicle repairs has been on a steady rise, posing a significant concern for drivers worldwide. This trend is attributed to several factors, including advancements in technology that require more intricate and expensive fixes, increased prevalence of high-end vehicles with complex mechanical systems, and the escalating prices of labor and materials. As a result, even minor accidents can lead to substantial financial burdens for owners who may not have adequate insurance coverage.

The rising repair costs make it crucial for drivers to be financially prepared in case of an accident. Without proper protection, such as collision insurance, individuals might find themselves facing unexpected expenses that could strain their budgets. This is especially true given the current economic climate where many people are already managing various financial obligations. Therefore, understanding how collision coverage works and comparing different policies is a smart step towards ensuring peace of mind and financial security on the road.

Understanding Auto Collision Protection: Your Financial Safety Net

Auto collision protection acts as a financial safety net, shielding drivers from the significant costs associated with vehicle repairs following an accident. This coverage is designed to cover the expenses related to fixing or replacing your car when it sustains damage in a collision, be it with another vehicle, a pedestrian, or stationary objects. By understanding how this protection works, drivers can make informed decisions about their insurance policies and ensure they’re adequately prepared for potential financial shocks.

When considering auto collision protection, two key aspects come into play: deductibles and premium rates. The deductible is the amount you agree to pay out-of-pocket before your insurance coverage kicks in. Lowering this deductible can make your monthly premiums more affordable but could also result in higher out-of-pocket expenses during a claim. On the other hand, higher deductibles typically lead to lower premiums, offering financial savings but requiring a greater personal contribution when an accident occurs. Balancing these factors is crucial in finding the right coverage that aligns with individual needs and budget constraints.

Exploring Collision Insurance Deductibles: What You Need to Know

Collision insurance deductibles are an important aspect of your auto policy that can significantly impact your financial outlay in the event of an accident. When considering collision coverage, understanding deductibles is crucial. A deductible is the amount you agree to pay out-of-pocket for repairs before your insurance kicks in and covers the rest. The higher the deductible, the lower your premium, but it also means you’ll bear more financial responsibility initially.

It’s essential to balance risk and savings when choosing a deductible. Opting for a higher deductible can reduce premiums, but ensure you have adequate savings or emergency funds to cover the cost of repairs without causing financial strain. Conversely, a lower deductible offers peace of mind by allowing your insurance to bear a larger portion of the repair costs, but it will result in slightly higher monthly payments.

Comparing Collision Insurance Rates: Saving Money Without Sacrificing Coverage

Comparing collision insurance rates is a smart way to save money without compromising on essential coverage. It involves researching and evaluating quotes from different insurance providers, ensuring you get the best value for your premium dollar. A few key factors influence collision insurance rates: your vehicle’s make and model (older or high-value cars may have higher repair costs), your driving history (a clean record generally leads to lower premiums), and the level of coverage you choose (higher deductibles can reduce costs but impact your out-of-pocket expenses in case of an accident).

Online platforms and comparison tools make it easy to input your details and quickly access multiple quotes. When comparing, consider not only the price but also the reputation of the insurer, their customer service, and the types of coverage offered. Remember, saving money is a priority, but ensuring you have adequate protection during unexpected events like accidents is paramount.

Aligning Policy with Protection Needs in a Changing Landscape

In today’s digital era, where data on vehicle accidents and repair costs is readily accessible, drivers are increasingly conscious of the financial implications of collisions. This changing landscape demands that policies keep pace with rising repair expenses. Aligning your insurance policy with your protection needs means understanding how deductibles and coverage options directly influence your premium. By comparing collision insurance rates and considering various deductibles, you can tailor your policy to cover unexpected repairs without breaking the bank.

As auto collision protection becomes a priority for many, ensuring your policy is up-to-date allows for peace of mind behind the wheel. It enables drivers to navigate the complexities of post-accident procedures, knowing they are safeguarded from the financial burden of extensive vehicle repairs. This proactive approach not only protects your finances but also promotes a safer driving environment by encouraging responsible behavior and quick claims resolution.

Surge in Demand and Costs: Why Now is the Time for Action

In recent years, the automotive industry has witnessed a surge in demand for vehicle repairs, driven by various factors including accidents, natural disasters, and increased vehicle lifespan. This spike in demand has put immense pressure on repair shops, leading to rising costs for labor and materials. As a result, drivers are facing higher bills for even relatively minor damages. The financial burden of these repairs can be significant, especially for those with limited financial resources or high-value vehicles.

Given the current economic climate and the unpredictable nature of accidents, it’s crucial for drivers to reassess their insurance coverage. Now is the opportune moment to review collision insurance policies and ensure they offer adequate protection against these surging costs. By taking proactive measures, drivers can safeguard their financial stability and peace of mind, ensuring that unexpected repairs don’t strain their budgets further.

Ensuring Financial Security: Tips for Drivers Considering Collision Insurance

When considering collision insurance, drivers should assess their financial situation and risk tolerance. One key step is understanding your deductibles; these are the out-of-pocket expenses you’ll incur in the event of a claim. A higher deductible typically results in lower premiums but requires a more substantial immediate payment when an accident occurs. Therefore, it’s crucial to balance potential savings against the financial burden of a deductible.

Additionally, drivers should explore different coverage options and compare rates from various insurers. This process allows you to find a policy that offers adequate protection while aligning with your budget. Regularly reviewing your insurance needs is essential, especially as vehicle repair costs fluctuate; staying informed ensures you’re adequately prepared for any financial surprises that may arise from an accident.

In today’s automotive landscape, where repair costs continue to rise, having comprehensive auto collision protection is no longer an option but a necessity. As demonstrated by recent trends and data, drivers are wise to prioritize financial security through collision insurance. By understanding deductibles, comparing rates, and aligning your policy with current market demands, you can ensure that your vehicle’s repairs are covered without breaking the bank. Take action now to safeguard your finances and drive with peace of mind.