Roadside assistance plans and tailored insurance coverages are essential for stress-free driving. These tools offer peace of mind by providing quick support for breakdowns, minimizing financial strain, and protecting against unforeseen events like no-fault claims and uninsured drivers. Proactive preparation, including understanding policy details and adding specialized add-ons, ensures drivers are empowered to navigate the road confidently.

Imagine a scenario where a flat tire pauses your journey, but a well-chosen roadside assistance plan swiftly comes to rescue. This is more than a mere convenience; it’s a testament to the importance of tailored vehicle protection. With insurance options ranging from rental reimbursements to uninsured motorist coverage, understanding these tools is crucial in an era marked by rising no-fault claims. This article guides you through unlocking stress-free driving with comprehensive insights on roadside assistance, insurance navigation, decoding no-fault trends, and crafting personalized plans for peace of mind on the road ahead.

- Unveiling Roadside Assistance: Your Silent Savior

- Navigating Insurance Options: A Comprehensive Guide

- Decoding No-Fault Claims: Recent Trends Unmasked

- Protecting Your Drive: Tailored Plans for Peace of Mind

- Beyond Coverage: Preparing for the Unexpected

- Stress-Free Driving: The Power of Knowledge

Unveiling Roadside Assistance: Your Silent Savior

Unveiling Roadside Assistance: Your Silent Savior

Imagine finding yourself stranded on the side of a busy highway, with a flat tire and no immediate help in sight. This scenario is not uncommon, and it’s where roadside assistance plans step in as your silent saviors. These services provide peace of mind by offering quick and efficient support whenever you face unexpected vehicle breakdowns or mechanical issues. From changing tires to towing your car to the nearest service center, trained professionals are just a phone call away.

In today’s fast-paced world, where road trips and long commutes are common, having roadside assistance is like having a reliable partner on the road. It ensures that minor inconveniences don’t turn into major crises. With just a few simple steps – contacting your service provider, providing your location, and following their instructions – you can rest assured that help is on its way, allowing you to continue your journey without unnecessary stress or financial burden.

Navigating Insurance Options: A Comprehensive Guide

Navigating the insurance options available today can seem like navigating a labyrinthine tapestry of complexities. With each policy boasting unique features and benefits, understanding your needs and prioritizing them is crucial. Start by evaluating the basics—liability coverage protects against harm to others, while comprehensive protection shields yours and your vehicle from various risks. Then, consider add-ons that cater to specific concerns: rental reimbursement for those unexpected trips without a personal vehicle, or uninsured/underinsured motorist coverage for added protection against at-fault drivers who lack adequate insurance.

Don’t overlook the fine print or assume one policy suits all scenarios. Review policies carefully, understanding deductibles and exclusions. A smart approach is to consult with an agent who can break down options, ensuring you secure the right balance of coverage without overspending. This proactive strategy transforms potential financial headaches into a stress-free driving experience.

Decoding No-Fault Claims: Recent Trends Unmasked

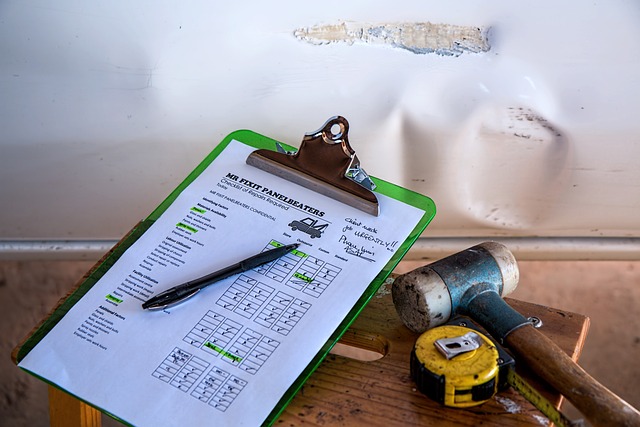

In recent years, no-fault insurance claims have seen a notable surge, prompting a closer look at this aspect of auto coverage. No-fault insurance, designed to provide basic coverage in the event of an accident, regardless of fault, has long been a staple in many states’ insurance frameworks. However, increasing numbers of drivers are filing claims, often for minor fender benders or incidents with no apparent at-fault party. This trend raises questions about potential loopholes and misuses within the system.

One factor contributing to this rise is the changing nature of vehicle ownership and usage. With the rise of ride-sharing services and more people opting for multi-car households, the traditional understanding of personal responsibility on the road is evolving. As a result, drivers may be less inclined to assess fault in minor collisions, opting instead to file claims based on their no-fault coverage, which can lead to increased claims volumes. Understanding these shifting trends highlights the need for consumers to review and customize their vehicle protection plans accordingly.

Protecting Your Drive: Tailored Plans for Peace of Mind

Protecting Your Drive: Tailored Plans for Peace of Mind

When navigating today’s complex insurance landscape, it’s easy to feel overwhelmed by the array of options available. However, taking the time to understand and choose a vehicle protection plan that aligns with your specific needs can offer invaluable peace of mind on the road. A tailored plan acts as a safety net, ensuring that unexpected events like flat tires or accidents don’t turn into financial burdens.

By opting for coverage such as rental reimbursement, you’re prepared for those moments when your vehicle becomes immobilized, allowing you to continue your journey without the added stress of arranging transportation. Additionally, uninsured motorist coverage provides protection against losses when dealing with drivers who lack adequate insurance, a growing concern given the rise in no-fault insurance claims. With these considerations in place, drivers can focus on enjoying their travels rather than worrying about potential financial pitfalls.

Beyond Coverage: Preparing for the Unexpected

In our ever-changing world, unexpected events can strike at any moment, especially when we’re on the road. While comprehensive insurance plans are crucial for financial protection, there’s value in looking beyond coverage and preparing for a wider range of scenarios. Beyond the typical policies, consider adding roadside assistance as a safety net—a game-changer when faced with flat tires or mechanical issues. This service ensures quick response times, providing peace of mind knowing help is just a call away.

Additionally, exploring options like rental reimbursement can prevent financial strain during unexpected vehicle downtime. These smart planning strategies empower drivers to navigate the unknown with confidence, transforming potential headaches into manageable situations. Embracing proactive measures not only secures your travels but also fosters a sense of security on the open road.

Stress-Free Driving: The Power of Knowledge

Stress-free driving isn’t just about smooth rides or efficient navigation; it’s a state achieved through knowledge and preparation. Understanding your vehicle protection plans is the first step towards financial peace of mind on the road. With various insurance options available, from coverage for unexpected events like flat tires to safeguarding against uninsured drivers, every driver should tailor their policy to fit their specific needs. This proactive approach ensures that unexpected incidents don’t turn into major financial setbacks.

By familiarizing themselves with the ins and outs of their auto insurance, drivers can navigate the road confidently, knowing they’re protected. This knowledge empowers them to make informed decisions, choose the right coverage, and avoid costly mistakes. Ultimately, it’s about transforming potential stressors into manageable situations, ensuring every journey is as smooth and worry-free as possible.

In today’s ever-changing automotive landscape, staying informed about vehicle protection plans is paramount. By understanding your options and tailoring coverage to fit your unique needs, you can navigate the road with confidence and peace of mind. Don’t let uncertainty become a hurdle; instead, empower yourself with knowledge to ensure stress-free driving experiences. Remember, smart planning today can save you from financial surprises down the line.