Implementing robust tax strategies is paramount for businesses aiming to thrive financially. Effective compliance goes beyond meeting legal mandates; it shields entities from IRS penalties and interest, ensuring long-term stability. By integrating strategic investment planning, careful income management, and thoughtful year-end adjustments, companies can optimize their financial trajectories. This article guides business owners through navigating complex tax landscapes, exploring topics like avoiding penalties, optimizing nonprofit tax filing for exemption eligibility, leveraging tax-efficient investments, and adapting to changing tax code shifts for unparalleled financial efficiency.

- Navigating Tax Compliance: Avoiding IRS Penalties and Interest

- Optimizing Nonprofit Tax Filing for Eligibility and Savings

- Strategic Tax Planning: Leveraging Tax-Efficient Investments

- Year-End Tax Strategy: Maximizing Financial Efficiency Amidst Tax Code Changes

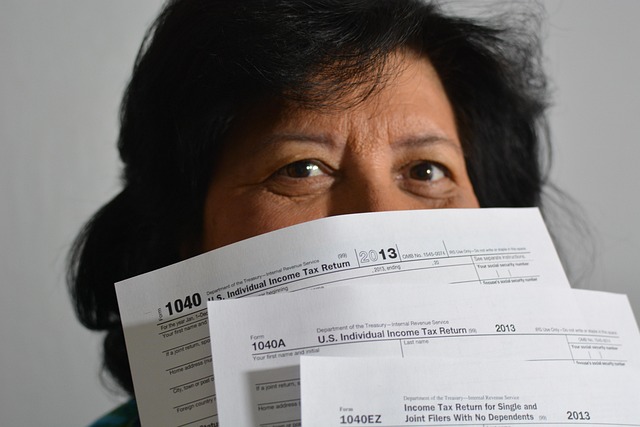

Navigating Tax Compliance: Avoiding IRS Penalties and Interest

Navigating tax compliance is a critical aspect of financial management for any business, especially nonprofits. The Internal Revenue Service (IRS) sets forth stringent rules and regulations that, if ignored or misinterpreted, can result in significant penalties and interest charges. Nonprofit organizations, in particular, must ensure they meet all criteria for tax-exemption eligibility to maintain their exempt status. This involves staying abreast of changing tax code provisions and adhering to strict filing deadlines for both income tax and annual information returns.

By optimizing their filing status and strategically planning for tax-efficient investments, nonprofits can minimize their taxable income and reduce the risk of IRS penalties. Keeping up with regular reporting requirements and accurately documenting revenue sources and expenses are essential practices that help avoid costly mistakes. Effective tax compliance strategies not only protect organizations from legal repercussions but also enable them to allocate resources more efficiently, ultimately supporting their mission and long-term financial sustainability.

Optimizing Nonprofit Tax Filing for Eligibility and Savings

For nonprofits, optimizing tax filing processes is paramount for maintaining eligibility for tax-exemption status and maximizing savings. These organizations must carefully navigate the complexities of the IRS guidelines to ensure they meet all requirements. One key strategy involves staying abreast of annual reporting obligations and any changes in the Tax Code that could impact their operations. Nonprofits should aim for accurate and timely filing, as errors or delays can incur significant penalties and interest charges from the IRS.

By optimizing nonprofit tax filing, organizations can enhance their financial health and ensure they remain compliant with regulatory standards. This includes strategically planning and implementing tax-efficient investments to align with their mission and goals. Additionally, nonprofits should consider optimizing their filing status to take advantage of potential savings and better position themselves for long-term sustainability.

Strategic Tax Planning: Leveraging Tax-Efficient Investments

Strategic tax planning involves leveraging tax-efficient investments and taking advantage of available tax exemptions to reduce overall tax liabilities. Nonprofit organizations, in particular, should focus on navigating complex IRS regulations to ensure accurate nonprofit tax filing. By understanding tax code changes and optimizing filing status, businesses can avoid penalties and interest charges from the IRS.

Careful planning can also help maximize tax benefits related to specific investments, such as those with favorable long-term capital gains treatment or deductions for research and development expenses. This proactive approach not only enhances financial efficiency but also ensures compliance with tax regulations, ultimately contributing to the overall success and stability of the business.

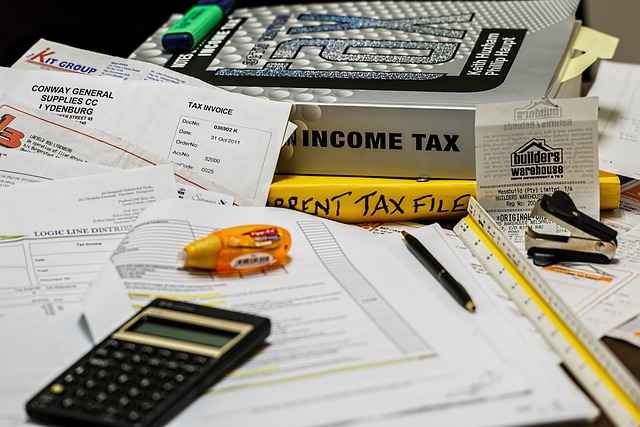

Year-End Tax Strategy: Maximizing Financial Efficiency Amidst Tax Code Changes

As the year comes to a close, businesses have a strategic opportunity to optimize their financial efficiency amidst fluctuating tax code changes. Year-end tax planning is an essential part of any robust financial strategy. By taking advantage of this period, companies can assess their current financial performance and identify areas for improvement while navigating complex IRS regulations. One key aspect is evaluating eligibility for tax exemptions that align with their operations, such as those available to nonprofits, which can significantly reduce taxable income.

Additionally, businesses should consider how to maximize deductions and credits, explore tax-efficient investments, and ensure accurate filing status optimization. Staying proactive during this time not only helps in avoiding IRS penalties and interest but also allows for better management of taxable income. This strategic approach enables businesses to remain compliant while maximizing their financial health and minimizing liabilities under the ever-changing tax code.

Implementing robust tax strategies is not just about avoiding penalties; it’s a key driver for nonprofit financial health and efficiency. By understanding tax compliance requirements, strategically planning investments, and optimizing filing status amidst evolving tax code changes, organizations can achieve Tax Exemption Eligibility while minimizing tax liabilities. This proactive approach ensures smooth operations, fosters growth, and maximizes savings, ultimately strengthening the organization’s financial tapestry.