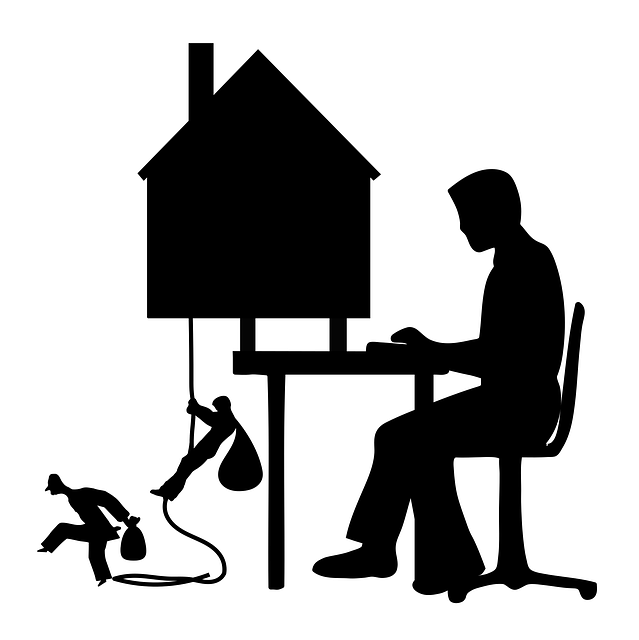

“Unforeseen accidents happen, and having adequate protection in place is vital for homeowners. This article explores the critical components of personal liability protection: accidental injury coverage and property damage insurance. We delve into how these policies safeguard your assets and provide a safety net for unexpected events, such as medical expenses or property repairs due to an accident caused by you or your family members. Understanding third-party liability and personal umbrella policies is essential in managing potential risks and ensuring financial security.”

- Understanding Personal Umbrella Policies: Protecting Against Unforeseen Events

- The Role of Third-Party Liability in Homeowner's Insurance

- Accidental Injury Coverage and Property Damage Insurance: Shielding Your Assets

Understanding Personal Umbrella Policies: Protecting Against Unforeseen Events

Personal umbrella policies are an essential extension to your existing homeowner liability coverage, offering extra protection against unexpected events and providing a safety net for unforeseen circumstances. These policies kick in when your standard insurance limits have been reached, ensuring you’re not left vulnerable during claims. They typically include accidental injury coverage and property damage insurance, safeguarding you from significant financial burdens.

For instance, if a guest slips and falls on your property due to a wet floor, causing injuries that lead to legal action, a personal umbrella policy can cover the costs beyond your basic liability limits. This includes medical expenses, legal fees, and potential settlements or judgments against you, giving you peace of mind knowing you’re protected from substantial out-of-pocket expenses.

The Role of Third-Party Liability in Homeowner's Insurance

In the realm of homeowner’s insurance, third-party liability plays a pivotal role in protecting against unforeseen events. This aspect of coverage is designed to shield policyholders from substantial financial burdens arising from unintentional harm caused to others on their property. Accidental injury coverage and property damage insurance are integral parts of this protection. For instance, if a visitor slips and falls on your pavement due to a slip hazard you didn’t know existed, your homeowner liability can step in to cover medical expenses and legal costs, preventing a costly settlement out of pocket.

Beyond standard homeowner’s policies, many individuals opt for a personal umbrella policy as an additional layer of defense. This policy expands coverage beyond the limits of your primary policy, offering broader protection against suits and claims. In terms of third-party liability, it provides extra security should accidental injuries or property damage result in significant financial obligations that exceed your homeowner’s insurance limits. Thus, it acts as a safety net, safeguarding your assets from potential legal repercussions.

Accidental Injury Coverage and Property Damage Insurance: Shielding Your Assets

Accidental injury coverage and property damage insurance are integral parts of a comprehensive personal liability protection strategy. A personal umbrella policy, for instance, can expand on your existing homeowner liability or third-party liability coverage by providing additional financial security in case of significant claims. This is particularly important as these policies can shield your assets from potential out-of-pocket costs resulting from accidents or damages caused by others on your property.

Property damage insurance specifically covers repairs or replacements for physical damages to someone else’s property, such as a broken window or damaged structure. Accidental injury coverage, on the other hand, focuses on third-party medical expenses and legal fees incurred due to bodily injuries caused by unintentional acts. Together, these protections ensure that you’re prepared to handle unexpected incidents without facing financial strain.

In navigating the complexities of personal liability protection, understanding and leveraging essential components like accidental injury coverage and property damage insurance is paramount. These protections serve as a robust shield against unforeseen events, ensuring that unexpected incidents, such as property damage caused by children or visitor injuries on your premises, are managed with financial feasibility. By integrating these policies into your homeowner’s insurance strategy, including a personal umbrella policy to address third-party liability, you can safeguard your assets and enjoy greater peace of mind in the face of adversity.