Car owners often underestimate their vehicle's rapid depreciation, leaving them vulnerable financially if unexpected events occur. Auto insurance policies protect against accidents, theft, vandalism, and natural disasters, providing peace of mind and financial security. Collision coverage repairs or replaces damaged vehicles, while comprehensive coverage offers broader protection against various risks. Comparing online quotes efficiently finds tailored policies based on driving history, vehicle details, desired coverage, reviews, and insurer stability.

Do you truly need gap insurance for your vehicle? Contrary to popular belief, cars depreciate at an alarming rate, often surpassing their value within just a few years. This financial reality leaves many drivers vulnerable, especially when unexpected incidents occur. The good news is that auto insurance policies, particularly collision and comprehensive coverage, can bridge this gap, offering both protection and peace of mind. By understanding these crucial components and comparing quotes online, you can find the ideal policy to safeguard your investment.

- Cars Depreciate Fast: The Surprising Truth

- Auto Insurance Policies: Protecting Your Car and Peace of Mind

- Collision Coverage: What It Does and Why It Matters

- Comprehensive Coverage: Beyond the Basics

- Comparing Quotes Online: Tailoring Your Policy to Your Needs

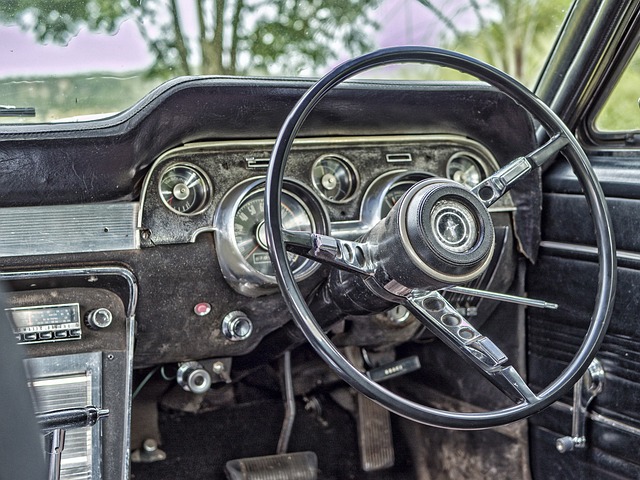

Cars Depreciate Fast: The Surprising Truth

Many car owners underestimate the speed at which their vehicle’s value diminishes over time. It’s a common misconception that a car’s worth stabilizes after a few years, but recent statistics tell a different story. Cars depreciate faster than most people realize, with significant drops in value occurring even in the first few model years. This rapid depreciation is primarily due to various factors like market saturation, technological advancements, and changing consumer preferences. As a result, a vehicle that seemed like a smart investment at purchase time can quickly become a financial burden if unforeseen events lead to repairs or total loss.

Auto Insurance Policies: Protecting Your Car and Peace of Mind

Auto insurance policies are designed to protect both your vehicle and yourself from financial loss in the event of an accident or other unforeseen circumstances. These policies offer a range of coverage options, with collision and comprehensive being two of the most important. Collision coverage pays for damages to your car when it collides with another vehicle or object, while comprehensive coverage protects against non-collision related incidents like theft, vandalism, natural disasters, and more.

Having the right auto insurance policy provides peace of mind knowing that if the worst happens, you’re not alone in bearing the cost of repairs or a total loss. It’s about ensuring your financial security and minimizing stress during challenging times. By understanding your coverage options, you can select a policy that best fits your needs and budget, giving you the confidence to hit the road with assurance.

Collision Coverage: What It Does and Why It Matters

Collision coverage is a crucial component of any auto insurance policy, designed to protect you from financial loss in the event of a car accident. When you’re involved in a collision, regardless of fault, this coverage helps pay for repairs or even replaces your vehicle if it’s deemed totalled. It covers both your car and other vehicles involved in the accident, making it a safety net that ensures you’re not left with a hefty repair bill or stranded without transportation.

The importance of collision coverage lies in its ability to provide peace of mind and financial security. While comprehensive coverage addresses various risks like theft or natural disasters, collision coverage specifically tackles accidents—a common cause of vehicle damage and potential financial strain for drivers. By including this option in your policy, you’re safeguarding against unexpected incidents that could significantly impact your budget.

Comprehensive Coverage: Beyond the Basics

Comprehensive coverage goes beyond the standard protections offered by collision insurance, providing protection against a wider range of risks. While collision coverage primarily covers accidents and resulting damage to your vehicle, comprehensive coverage steps in for other unforeseen events. This includes protection against theft, vandalism, natural disasters like floods or storms, and even damage caused by animals. It’s particularly beneficial for drivers who live in areas prone to such incidents. Additionally, comprehensive insurance often covers personal belongings left inside your car, providing a safety net for valuable items that could be lost or stolen.

Comparing Quotes Online: Tailoring Your Policy to Your Needs

Comparing auto insurance quotes online is a straightforward and effective way to tailor your policy to your specific needs. With just a few clicks, you can access numerous providers’ rates and coverage options, allowing for an informed decision based on your budget and vehicle requirements. This digital approach saves time and effort compared to traditional methods of contacting agents individually.

When comparing quotes, consider factors like your driving history, the make and model of your car, and the level of coverage you desire. Online platforms often provide a side-by-side comparison, making it easy to identify the best value for money. You can also read reviews and check the financial stability of insurers to ensure a reliable and trustworthy policy.

In today’s fast-paced world, where cars depreciate swiftly, it’s prudent to ensure you’re adequately protected. By understanding your auto insurance options, including collision and comprehensive coverage, you can safeguard your vehicle and financial stability. Comparing quotes online allows you to make an informed decision, finding a policy that suits your unique needs and provides peace of mind on the road ahead.