Auto insurance has evolved from basic liability coverage to comprehensive, personalized packages. Insurers use data analytics to offer tailored discounts for safe driving behaviors, with teen driver programs using graduated pricing structures to promote responsible habits. Customizable options like pay-per-mile plans and add-ons like PIP and underinsured motorist coverage allow drivers to minimize costs and maximize protection. These advancements foster safer roads, transparent pricing, and informed decision-making based on individual needs.

In a landscape where balancing cost and coverage remains a challenge, auto insurance is undergoing a significant transformation. Newer discounts tailored for safe drivers and teen policies offer more customization options than ever before. Add-ons like Personal Injury Protection (PIP) and Underinsured Motorist Coverage provide enhanced security without inflating premiums. Moreover, emerging trends like pay-per-mile plans cater to occasional drivers, promising savings based on usage. This article explores these innovations, guiding readers through the evolving world of auto insurance and empowering them to make informed decisions.

- Understanding the Evolution of Auto Insurance

- Safe Driver Discounts: Boosting Savings

- Teen Driver Insurance: A Parent's Guide

- Customizing Coverage with Add-ons

- Pay-per-Mile Plans: A New Option for Occasional Drivers

- Shaping the Future: Industry Innovations in Car Insurance

Understanding the Evolution of Auto Insurance

Auto insurance has undergone a remarkable transformation over the years, reflecting evolving driver behaviors and technological advancements. Historically, policies focused primarily on liability coverage, ensuring drivers were financially responsible for damages caused to others. However, as safety standards improved and new risks emerged, comprehensive insurance packages became the norm, including protection against theft, vandalism, and natural disasters.

Today, this landscape is further expanding with a push towards personalized coverage. Insurers leverage data analytics to identify safe driving patterns, offering discounts for drivers who exhibit responsible behavior. Additionally, teen driver insurance programs have been refined to encourage mature driving habits through graduated pricing structures. These developments not only cater to individual needs but also contribute to a safer overall driving environment.

Safe Driver Discounts: Boosting Savings

Safe Driver Discounts have emerged as a powerful tool for drivers looking to save on their auto insurance premiums. These discounts are designed to reward drivers with clean records, safe driving habits, and continuous coverage. By demonstrating a low risk profile, insured individuals can expect significant savings on their policies. Many insurance companies offer these discounts, often providing substantial reductions that can amount to hundreds of dollars annually. This is great news for responsible drivers who want to keep their insurance costs manageable without compromising on protection.

The process typically involves insuring good driving behavior through various means, such as installing tracking devices or maintaining a safe driving history. These incentives not only encourage safer driving practices but also allow insurers to accurately assess risk, leading to more personalized and affordable coverage options.

Teen Driver Insurance: A Parent's Guide

Teen drivers often face higher insurance rates due to their inexperience behind the wheel. However, with specific teen driver insurance plans, parents can help their children gain access to more affordable coverage. These policies typically include restrictions and monitoring features that encourage safe driving habits, such as limiting driving hours and using GPS tracking. Parents should review policy details carefully, focusing on deductibles, coverage limits, and any associated technology requirements. By engaging in open conversations about responsible driving and choosing the right insurance plan, parents can empower their teens to navigate the road with increased confidence and security.

Customizing Coverage with Add-ons

In today’s market, auto insurance providers are offering a wide array of customizable options to suit individual needs. By adding specific coverages like PIP and underinsured motorist coverage, drivers can tailor their policies to include essential protections while keeping costs manageable. These add-ons ensure that even if you’re hit with unexpected expenses or face risks on the road, your financial burden is minimized.

With these customization options, drivers have more control over their insurance than ever before. By choosing specific coverages and understanding what’s included in each, individuals can find a balance between cost and comprehensive protection. This personalized approach to auto insurance means that you pay only for what you need, making it easier to manage your budget while staying safe on the road.

Pay-per-Mile Plans: A New Option for Occasional Drivers

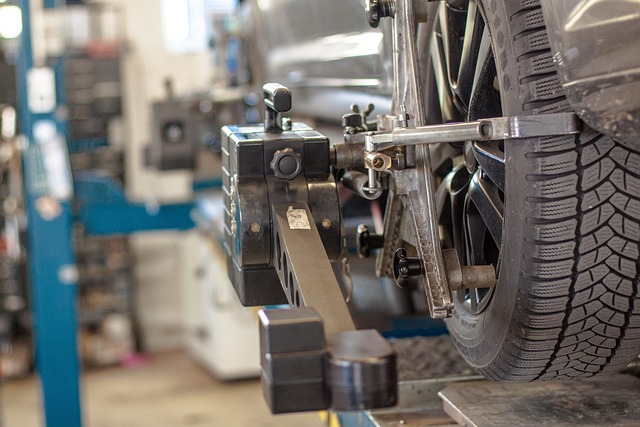

Pay-per-mile insurance plans are gaining popularity among occasional drivers who log fewer miles on the road each year. These innovative policies offer a significant departure from traditional pricing models that largely depend on driving history and vehicle characteristics. Instead, pay-per-mile plans charge drivers based on their actual mileage, providing financial relief for those who primarily drive short distances or during off-peak hours. By installing a tracking device into their vehicles, insureds can accurately record their miles traveled, ensuring they only pay for what they use.

This approach is particularly beneficial for parents insuring teen drivers, university students commuting to and from campus, or professionals with flexible work schedules who drive infrequently. It allows them to avoid paying unnecessary premiums associated with high annual mileage, empowering them to manage their insurance costs more effectively. Moreover, these plans encourage responsible driving habits as policyholders become more mindful of their mileage, potentially leading to safer roads for everyone.

Shaping the Future: Industry Innovations in Car Insurance

The auto insurance industry is undergoing a quiet revolution, driven by technological advancements and evolving consumer needs. Innovative solutions are emerging to address the age-old challenge of balancing cost-effectiveness with robust protection. Pay-per-mile plans offer a breath of fresh air for infrequent drivers, allowing them to pay based on their actual mileage instead of a set premium. This not only encourages safer driving habits but also ensures that drivers who spend less time on the road don’t overpay for insurance.

Additionally, personalized discounts and targeted add-ons cater to individual risk profiles. Safe driver programs reward those with clean records, while teen driver insurance tailored to new license holders offers affordable options with specific conditions. These industry innovations signal a future where car insurance becomes more adaptable, transparent, and accessible, empowering drivers to make informed choices that suit their unique circumstances.

In a rapidly evolving insurance landscape, drivers now have more options than ever to tailor their coverage. From safe driver discounts and teen-focused policies to innovative pay-per-mile plans, these industry advancements ensure that affordable, comprehensive protection is within reach for all. By staying informed about the latest trends, consumers can make smart choices, securing peace of mind on the road without compromising their budget.