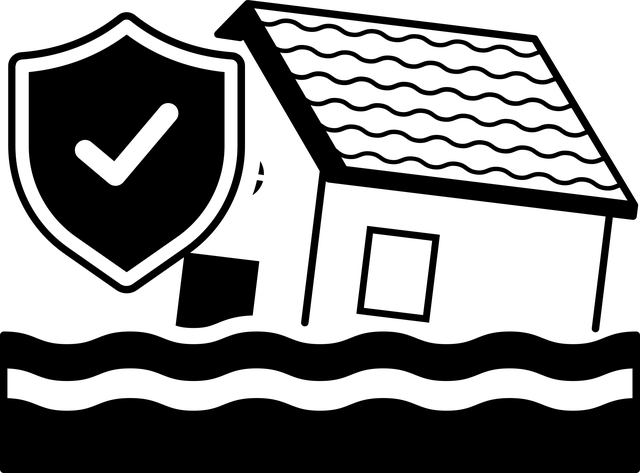

Navigating the world of notarization requires a keen understanding of the legal and financial safeguards in place. At the heart of this is discerning between Notary Bond and Notary Insurance, two protective measures that serve distinct roles. A Notary Bond primarily safeguards the public against any malfeasance or errors committed by a notary, fulfilling a mandated legal requirement. On the other hand, Notary E&O Insurance, or Errors and Omissions insurance, extends additional protection to the notary themselves, shielding their personal assets from financial repercussions due to honest mistakes. This article delves into the nuances of both, guiding you through the essentials of Notary Bond versus Notary E&O Insurance, the factors influencing insurance premiums, managing deductibles and costs, and how to secure the most advantageous notary insurance quotes online for renewal. Understanding these differences is not just prudent but a cornerstone for maintaining professional integrity and securing peace of mind in the notarization process.

- Understanding Notary Bonds: Legal Requirement for Public Protection

- Exploring Notary E&O Insurance: Comprehensive Coverage for Notaries

- Comparing the Essentials: Notary Bond vs. Notary E&O Insurance

- Factors Influencing Notary E&O Insurance Premiums

- Navigating Notary Insurance Deductibles and Costs

- How to Find the Best Notary Insurance Quotes Online and Renewal Options

Understanding Notary Bonds: Legal Requirement for Public Protection

When considering the various types of financial protections available to notaries, understanding the nuances between a notary bond and notary insurance is crucial. A notary bond, which is often mandated by state law, primarily serves as a safeguard for the public. It ensures that if a notary commits an error or breach of duty, individuals harmed by such actions can seek financial recompense up to the bond amount. This legal requirement is designed to provide a layer of protection against potential misconduct.

In contrast, notary E&O insurance (Errors and Omissions insurance) is an optional form of coverage that offers personalized protection for the notary. Unlike a bond, which typically has a fixed limit based on the bond amount, notary E&O insurance provides policyholders with more flexibility in terms of coverage limits. Notaries can select from various notary insurance deductible options and premium levels when purchasing their policies, often finding competitive rates through notary insurance quotes online. The cost to renew notary insurance can vary based on the provider and the level of coverage selected. This type of insurance is particularly beneficial as it can cover legal defense costs and damages that exceed the bond limit, offering additional security for the notary’s personal assets. For those seeking the most comprehensive protection, pairing a notary bond with notary E&O insurance is often advisable to ensure full coverage against a spectrum of potential errors or oversights. This combination provides the broadest possible safety net and is frequently considered the cheapest notary insurance option due to its all-encompassing nature. Benefits of notary E&O insurance are manifold, including peace of mind and financial security that goes beyond what a bond alone can offer.

Exploring Notary E&O Insurance: Comprehensive Coverage for Notaries

Navigating the world of notary public services requires attention to both professional practice and financial protection. Notary Errors and Omissions (E&O) insurance stands out as a critical component of a comprehensive risk management strategy for notaries. This specialized form of coverage is designed to safeguard against claims arising from alleged or actual errors or omissions in the performance of notarial acts. Unlike the mandated notary bond, which primarily protects the public, Notary E&O insurance focuses on protecting the notary’s personal and financial assets.

When considering Notary E&O insurance, it’s important to evaluate various factors that influence the cost and coverage of policies. Premium rates for Notary E&O insurance can vary based on several criteria, including the number of notarizations performed annually, the type of notarial services offered, and the claim history of the notary. Prospective notaries seeking this insurance can obtain quotes online, which allows them to compare coverage and premiums from different insurers. The deductible amount, which is the portion of a loss that the notary must pay out-of-pocket before coverage kicks in, is another key aspect to consider. It’s often adjustable, and choosing a higher deductible can lower the overall Notary E&O insurance premium. Additionally, the cost to renew notary insurance may differ each term due to changes in risk factors or market conditions. Prudent notaries will weigh these variables carefully to secure the most favorable Notary E&O insurance quotes online while ensuring they maintain the benefits of this essential coverage. The advantages of Notary E&O insurance are manifold, offering peace of mind and financial security against potential legal liabilities, thereby complementing the notary bond required by law. It’s a prudent investment for notaries who aim to provide their services with confidence and without undue concern for personal financial exposure.

Comparing the Essentials: Notary Bond vs. Notary E&O Insurance

When navigating the responsibilities of a notary, it’s crucial to understand the distinctions between different types of financial protection available. Notary E&O insurance, also known as errors and omissions insurance, is designed to safeguard notaries against professional liability claims arising from alleged negligence, errors, or omissions in their official acts. Unlike a notary bond, which primarily serves to protect the public, E&O insurance focuses on shielding the individual notary’s personal assets and finances. Notary E&O insurance premiums can vary based on the level of coverage and the specific risks associated with the notary’s practice. For those seeking a comprehensive safeguard, it’s important to consider the cost to renew notary insurance and to compare notary insurance quotes online from various insurers to find the most affordable yet robust coverage. The benefits of notary E&O insurance are manifold: it provides financial protection against claims of professional misconduct, legal defense costs in the event of a lawsuit, and can cover settlements or judgments up to the policy’s limit. This form of insurance is particularly valuable for notaries who handle sensitive matters or those who wish to have an additional layer of security beyond the mandatory notary bond. By obtaining notary E&O insurance, notaries can operate with greater peace of mind, knowing that they are prepared for unforeseen legal challenges that could otherwise jeopardize their professional and personal financial well-being. It’s a prudent step for any notary looking to ensure complete coverage against potential professional liabilities.

Factors Influencing Notary E&O Insurance Premiums

When considering Notary E&O insurance premiums, it’s crucial to understand various factors that can influence the cost and coverage of your policy. The amount of Notary E&O insurance premiums you pay is determined by underwriters who assess the risk associated with your practice. Factors such as the number of notarizations performed annually, the types of documents notarized, and past claims history are key considerations that affect these premiums. A higher volume of notarizations or handling more complex documents may lead to increased premiums due to the elevated risk of potential errors. Additionally, a clean record with no prior claims can result in lower premiums.

Another important aspect to consider when evaluating Notary E&O insurance quotes online is the deductible. The deductible is the portion of a loss payment that you must pay out-of-pocket before your notary insurance coverage kicks in. Higher deductibles typically result in lower premiums, but it’s essential to choose a deductible that aligns with your financial situation. The cost to renew notary insurance can also vary based on these factors, as well as any changes in state requirements or your professional activities. It’s advisable to shop around for Notary E&O insurance quotes online to find the most competitive rates and coverage options. The benefits of notary E&O insurance are manifold; it provides financial protection against claims of negligence or mistakes made while performing notarial acts, safeguarding your personal assets from potential legal costs and settlements. For those seeking the most comprehensive protection, investing in Notary E&O insurance is a wise choice to complement the required notary bond, ensuring full coverage from all angles.

Navigating Notary Insurance Deductibles and Costs

When considering notary public error and omissions (E&O) insurance, it’s crucial to understand the nuances of deductibles, premiums, and costs associated with this type of coverage. Notary E&O insurance is specifically designed to protect against claims arising from errors or omissions made during the performance of notarial acts. The premiums for such insurance can vary based on factors like claim history, the volume of notarizations performed, and the level of coverage desired. It’s advisable to obtain several notary insurance quotes online to compare rates and find the most competitive pricing.

Another aspect to consider is the deductible that applies to notary E&O insurance policies. A deductible represents the amount a notary must pay out of pocket before the insurer covers the rest of the costs associated with a claim. Typically, higher deductibles can lead to lower premiums, so it’s a trade-off between self-insured risk and overall cost. Notaries should carefully weigh the benefits of choosing a lower deductible for more financial security against the higher premiums that come with it. The cost to renew notary insurance can also fluctuate, sometimes due to changes in risk factors or market conditions. Therefore, notaries should review their policies annually to ensure they maintain the most appropriate level of coverage at the best possible rate. The cheapest notary insurance may not always be the most beneficial; the key is to strike a balance between cost and the breadth of coverage provided by the benefits of notary E&O insurance. This ensures that whether you’re dealing with a minor oversight or a significant claim, your financial assets remain protected.

How to Find the Best Notary Insurance Quotes Online and Renewal Options

When seeking comprehensive protection for your notarial practice, it’s crucial to find the best Notary E&O insurance premiums that align with your professional needs and budget. To initiate this process, leveraging online platforms to obtain Notary insurance quotes is a strategic approach. Numerous digital marketplaces specialize in offering a wide array of notary insurance options, allowing you to compare coverages and premiums effortlessly. By inputting your specific requirements into these platforms, you can identify policies that cater to your unique circumstances, including the Notary insurance deductible that suits your risk tolerance and financial planning.

Upon identifying potential insurers, it’s prudent to thoroughly evaluate each policy for its cost to renew notary insurance. Renewal terms can vary significantly between providers, so paying close attention to the fine print is essential. The cheapest notary insurance isn’t always the best value, as some policies might come with restrictive coverage limits or higher deductibles. Instead, focus on the benefits of Notary E&O insurance, such as liability coverage for claims arising from errors or omissions in your professional duties. Opting for a policy that offers robust coverage and a reasonable premium can provide peace of mind and safeguard your assets against unexpected legal challenges. Remember to set reminders for the renewal dates to ensure continuous protection without any lapses in coverage. This proactive approach will help you maintain a secure and reliable notarial practice, shielding both your professional reputation and personal finances from potential claims.

In wrapping up our exploration of the nuanced world of notary professional protection, it’s clear that both Notary E&O insurance premiums and deductibles play a pivotal role in a notary’s financial security. The distinction between a Notary Bond, which serves as a legal safeguard for public trust, and Notary Insurance, particularly E&O insurance, which provides comprehensive coverage for the notary’s personal interests, is crucial for understanding the full spectrum of protection available. For those seeking the most robust shield against potential claims, combining both options is often the most prudent path. By comparing different Notary E&O insurance quotes online and considering various factors influencing premiums and costs, including the cost to renew notary insurance, notaries can find the cheapest notary insurance that aligns with their specific needs and budget. Ultimately, the benefits of Notary E&O insurance extend far beyond the basic requirements, offering peace of mind and complete coverage that every notary should consider for their practice.