When considering the complexities of car insurance, understanding the nuances between Uninsured and Underinsured Motorist Protection is paramount. As you navigate the roads, the risk of encountering drivers without adequate insurance coverage is a reality for many. This article demystifies these critical components of a comprehensive auto insurance policy, highlighting their role in financial protection post-accident. We will delve into the significance of Uninsured/Underinsured Motorist Coverage within your policy, guide you through evaluating your coverage limits, and address the interplay between Rental Car Insurance and these protections. Additionally, we explore tailored options for Commercial Auto Insurance and Classic Car Coverage. For high-risk drivers, this piece offers strategies to secure suitable coverage and uncovers potential discounts on car insurance premiums, ensuring you are well-equipped to make informed decisions about your vehicle’s insurance needs.

- Understanding Uninsured and Underinsured Motorist Protection

- The Importance of Uninsured/Underinsured Coverage in Your Policy

- Evaluating Your Coverage Limits: A Guide to Adequate Protection

- Navigating Rental Car Insurance and Its Relation to Uninsured Coverage

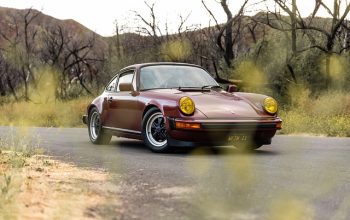

- Exploring Commercial Auto Insurance and Classic Car Coverage Options

- Strategies for High-Risk Drivers: Finding the Right Coverage and Discounts on Car Insurance

Understanding Uninsured and Underinsured Motorist Protection

When navigating the complexities of car insurance, understanding Uninsured and Underinsured Motorist Protection is crucial. Uninsured Motorist Protection offers a safety net in the event of an accident with a driver who has no liability insurance at all. This coverage can help alleviate the financial strain that might otherwise come from medical bills, vehicle repairs, and lost wages if the at-fault party lacks the necessary financial resources to compensate you. It’s particularly important to consider this protection when contemplating Rental Car Insurance, Commercial Auto Insurance, or Classic Car Coverage options, as these situations may increase your exposure to uninsured risks.

On the other hand, Underinsured Motorist Coverage kicks in when the at-fault driver carries insurance but not enough to cover all your expenses. This gap in coverage can leave you with out-of-pocket costs that strain your finances. To mitigate this risk, it’s wise to review your policy’s limits and consider higher ones, especially if you live in an area with a high number of Underinsured drivers. Additionally, exploring Discounts on Car Insurance can help manage Insurance Premiums while still ensuring robust coverage. For High-Risk Driver Coverage seekers, it’s even more imperative to carefully evaluate your Uninsured and Underinsured Motorist options, as you may need these protections most. By understanding the nuances of these coverages and how they fit into your overall insurance strategy, you can better protect yourself financially and ensure that you’re prepared for any scenario on the road.

The Importance of Uninsured/Underinsured Coverage in Your Policy

When navigating the complex landscape of car insurance, understanding the importance of Uninsured/Underinsured Motorist (UIM/UIM) coverage is paramount. This critical component of a comprehensive auto insurance policy provides financial protection should you be involved in an accident with a driver who either lacks insurance or carries insufficient coverage to fully compensate for the damages and injuries incurred. In the event of such an incident, UIM/UIM coverage can bridge the gap between what the at-fault driver’s policy will pay and the actual costs you face, saving you from potentially crippling out-of-pocket expenses.

For those who utilize Rental Car Insurance or require Commercial Auto Insurance, or even Classic Car Coverage, UIM/UIM coverage is equally significant. It ensures that whether on a temporary basis or as part of your business operations, or when enjoying the roads in your prized classic car, you are not left unprotected against uninsured or underinsured drivers. Moreover, for high-risk drivers, securing this additional layer of protection can be particularly beneficial, as it can provide peace of mind that comes with knowing you are not solely responsible for medical bills or vehicle repair costs following an accident.

Incorporating UIM/UIM coverage into your policy may also lead to Discounts on Car Insurance, as many insurance companies recognize the prudence of being well-prepared for all driving scenarios. While adjusting Insurance Premiums to include this coverage may slightly increase the cost of your policy, the potential savings and protection offered can far outweigh these additional expenses. It is wise for drivers to regularly review their car insurance policies, especially in light of recent trends that have seen an increase in the number of uninsured drivers on the road. By doing so, drivers can ensure they maintain adequate coverage limits, tailored to their specific needs and circumstances, thereby safeguarding themselves against the financial risks associated with motor vehicle accidents involving drivers who are not adequately insured.

Evaluating Your Coverage Limits: A Guide to Adequate Protection

When assessing your car insurance policy, it’s crucial to evaluate your coverage limits to ensure they align with your financial needs and assets. This is particularly important for components like Uninsured Motorist Protection (UMP) and Underinsured Motorist Coverage (UIMC), which provide a safety net if you’re in an accident with a driver who either has no insurance or not enough to cover the costs. Considering the frequency of uninsured drivers on the road, having these protections can be the difference between financial ruin and peace of mind.

Rental Car Insurance often includes some level of UMP/UIMC, but it’s essential to review your personal auto insurance policy to ensure comprehensive coverage. This is especially pertinent for those who frequently rent vehicles or have a Classic Car that may require specialized coverage. Commercial Auto Insurance policies also need to be tailored carefully, as they often face higher risks and liability concerns. When evaluating your coverage limits, it’s wise to consider your state’s minimum requirements as a baseline but aim for higher limits to safeguard against substantial medical bills, property damage, and legal fees that can arise from an accident. High-Risk Driver Coverage is designed for those who have had their driving privileges reinstated after various violations or accidents, and it often comes with higher premiums. However, securing adequate coverage can help mitigate the increased costs associated with being a high-risk driver.

To manage insurance premiums without compromising on protection, look for available discounts on car insurance. Many insurers offer reductions for safe driving, installation of safety features, or even for completing defensive driving courses. Understanding your coverage options and utilizing available discounts can lead to significant savings while still maintaining the necessary coverage for UMP/UIMC, Rental Car Insurance, Commercial Auto Insurance, and Classic Car Coverage. Always ensure that your Car Insurance Deductibles are set at a level you can comfortably afford in the event of a claim, as this will also affect your overall insurance costs. By carefully considering these factors, you can tailor your auto insurance policy to provide the right level of protection for your specific needs and budget.

Navigating Rental Car Insurance and Its Relation to Uninsured Coverage

When renting a car, understanding the interplay between Rental Car Insurance and Uninsured Motorist Protection is crucial for safeguarding your finances. Typically, rental agencies offer insurance policies that can supplement your primary auto insurance coverage. These add-ons often include options like collision damage waivers (CDW) and loss damage waivers (LDW), which can mitigate financial responsibility should the rented vehicle be damaged or stolen. However, it’s imperative to review these offerings critically, as they may duplicate coverage you already have through your personal Commercial Auto Insurance or Classic Car Coverage policies. In this context, Uninsured Motorist Protection becomes even more vital, as it can step in when the at-fault driver has no insurance, ensuring that your expenses—including medical bills and car repairs—are covered without exorbitant out-of-pocket costs.

For those with high Car Insurance Deductibles or who are classified as high-risk drivers, this relationship between Rental Car Insurance and Uninsured Motorist Protection becomes particularly significant. High deductibles can lead to substantial costs in the event of an accident, while high-risk driver coverage often comes with higher premiums. In such cases, it’s wise to explore available Discounts on Car Insurance to reduce insurance premiums and alleviate some of the financial burden. By carefully aligning your personal auto insurance with your rental car policy, you can ensure comprehensive coverage without unnecessary expenditure. Always verify that your Uninsured Motorist Protection extends to rental vehicles, as this is not always a given. Doing so will provide peace of mind whether you’re on the road in your own vehicle or behind the wheel of a rented car.

Exploring Commercial Auto Insurance and Classic Car Coverage Options

When delving into Commercial Auto Insurance and Classic Car Coverage options, it’s crucial to understand the unique needs of both commercial fleets and classic car enthusiasts. Commercial Auto Insurance is tailored for businesses that operate vehicles as part of their operations. This type of coverage addresses the specific risks associated with business use, including higher liability limits, which are often necessary given the potential for frequent or high-value cargo transport. It also may encompass rental car insurance, ensuring that any temporary vehicle used for business purposes is adequately protected. For businesses with a history of claims or those deemed high-risk drivers, finding affordable coverage can be challenging, but seeking policies that offer High-Risk Driver Coverage can provide the necessary security without prohibitive Insurance Premiums.

On the other hand, Classic Car Coverage is designed for vehicle owners who appreciate the historical and sentimental value of their cars. This specialized form of insurance often includes agreed value coverage, which means that in the event of a total loss, the insurer pays out the car’s pre-agreed value, minus any applicable deductibles. Classic Car Coverage may also offer various discounts on car insurance for classic vehicles, reflecting their unique status and the fact that they are often driven less frequently than standard cars. Owners can tailor their policies to include features such as coverage for spare parts and equipment, as well as options for historic rallies or tours. By carefully reviewing policy details and considering available discounts, classic car owners can ensure their prized possessions are adequately protected while managing Insurance Premiums effectively.

Strategies for High-Risk Drivers: Finding the Right Coverage and Discounts on Car Insurance

For high-risk drivers seeking comprehensive coverage, it’s imperative to explore tailored insurance solutions that address their unique needs. One such strategy is to consider Rental Car Insurance as part of their policy. This can provide peace of mind when driving a rental vehicle, which is often an unconsidered exposure for many high-risk drivers. Additionally, engaging with Commercial Auto Insurance or Classic Car Coverage providers can yield specialized policies that reflect the higher risk profile while also offering the necessary protection for these specific types of vehicles. High-Risk Driver Coverage is designed to accommodate individuals who have a history of accidents or violations, and it often includes higher liability limits and more comprehensive physical damage coverage.

Another key aspect for high-risk drivers is leveraging Discounts on Car Insurance to offset the potential increase in Insurance Premiums due to their risk category. Insurers may offer various discounts, such as those for driver training courses, installation of safety devices like GPS trackers or dashcams, or even for maintaining a clean driving record following the high-risk period. It’s crucial for high-risk drivers to regularly review their Car Insurance Deductibles to ensure they are set at a level that is both realistic for their financial situation and reflective of the risk associated with their driving history. By carefully selecting coverage options, taking advantage of available discounts, and adjusting deductibles, high-risk drivers can find an affordable and adequate insurance plan that provides the necessary safeguards on the road.

When navigating the roads, it’s crucial to be prepared for any scenario, especially when encountering uninsured or underinsured motorists. The article has delved into the importance of Uninsured Motorist Protection and Underinsured Motorist Coverage as key elements in a comprehensive car insurance strategy. These coverages are not just optional extras; they are safeguards that can shield you from financial hardship after an accident involving drivers who may not have adequate insurance. As highlighted, understanding your policy’s specifics, including Rental Car Insurance, Commercial Auto Insurance, and Classic Car Coverage options, is essential. It’s also important for high-risk drivers to secure the right coverage and explore available discounts on car insurance to manage Insurance Premiums effectively. Adequate coverage limits are your defense against the unpredictable, ensuring that you can recover without undue burden. In light of these insights, it is advisable to review your auto insurance regularly to maintain the best protection possible on the road.