Navigating the complexities of auto insurance can be a daunting task. Full coverage auto insurance stands out as a comprehensive policy option that encompasses liability, comprehensive, and collision protection. This article delves into the various facets of full coverage, from its role in providing rental car insurance to the specialized needs of classic car enthusiasts. Understanding the nuances of commercial auto insurance requirements is also paramount for business owners. Moreover, managing deductibles within a full coverage plan is crucial for budget-conscious drivers. For high-risk drivers, securing the right policy that considers your driving record is essential. Lastly, exploring strategies to access discounts on car insurance premiums can significantly alleviate financial burdens. By examining each of these aspects, you can make an informed decision on whether full coverage auto insurance suits your specific needs and circumstances.

- Understanding Full Coverage Auto Insurance: A Comprehensive Overview

- The Role of Rental Car Insurance in Your Full Coverage Plan

- Navigating Commercial Auto Insurance Requirements

- Specialized Coverage for Classic Cars: Classic Car Coverage Explained

- Managing Car Insurance Deductibles Under Full Coverage Policies

- High-Risk Driver Coverage: Finding the Right Policy Despite Your Driving Record

- Strategies for Accessing Discounts on Full Coverage Auto Insurance Premiums

Understanding Full Coverage Auto Insurance: A Comprehensive Overview

Full coverage auto insurance is a comprehensive policy that encompasses liability, collision, and comprehensive coverages, providing extensive protection for vehicle owners against a spectrum of risks. This robust policy ensures that whether your car is new or old, totaled in an accident, or damaged by an unforeseen event like hail or theft, you are covered. For instance, if you’re involved in an accident or your car is vandalized, collision coverage will take care of the repairs; comprehensive coverage steps in for non-collision incidents. Additionally, should your vehicle be beyond repair, full coverage can also include provisions for its replacement or offer rental car insurance to provide mobility while your car is being fixed.

Rental car insurance is a critical aspect of full coverage, offering peace of mind when driving a temporary vehicle. Furthermore, for those who use their cars for business purposes, commercial auto insurance is tailored to meet the unique needs of commercial drivers and fleet owners. Classic car enthusiasts can also benefit from specialized classic car coverage, which recognizes the value of these vehicles extends beyond their functional worth. It’s also important to understand your car insurance deductibles—the amount you agree to pay out-of-pocket before your insurance kicks in. Choosing higher deductibles can lower your insurance premiums, but it’s a balance that should be carefully considered based on your financial situation. High-risk driver coverage is another aspect to consider; it addresses the needs of drivers who have been identified as more likely to file a claim, ensuring they too can obtain reliable coverage. Lastly, don’t overlook the potential for discounts on car insurance, which can significantly reduce premium costs. These may include safe driver discounts, multi-car discounts, or reductions for drivers who complete defensive driving courses. Consulting with an insurance professional can help navigate these options and determine if full coverage auto insurance is indeed the best choice for your individual circumstances.

The Role of Rental Car Insurance in Your Full Coverage Plan

When evaluating a full coverage auto insurance policy, it’s crucial to understand how rental car insurance fits into your overall protection strategy. Rental Car Insurance is an essential component that can provide peace of mind should you find yourself in need of a vehicle other than your own. This coverage typically offers reimbursement for the cost of renting a car due to a covered loss, such as an accident or theft of your vehicle. It’s particularly beneficial when your car is undergoing repairs after an incident covered by your collision or comprehensive portions of your policy.

Incorporating Rental Car Insurance within your full coverage plan can be pivotal, especially for those with Commercial Auto Insurance needs or driving a Classic Car, where specialized coverage might not include rental as standard. Additionally, if you’re a High-Risk Driver, having this coverage ensures that transportation remains an option while your vehicle is in the shop. It’s also worth exploring Discounts on Car Insurance to offset the cost of both your full coverage and the additional rental insurance. These discounts can be found by maintaining a clean driving record, completing defensive driving courses, or bundling your policy with other insurance products you may need. Remember to consider the impact of Car Insurance Deductibles when reviewing your policy; choosing a higher deductible can lower your Insurance Premiums, which can then be redirected towards affording Rental Car Insurance coverage. Consulting with an insurance professional can further clarify how this aspect of full coverage can best serve you and help tailor your plan to your unique needs and financial situation.

Navigating Commercial Auto Insurance Requirements

When considering commercial auto insurance requirements, it’s crucial to understand how they differ from personal auto insurance policies. Commercial policies are tailored for businesses that use vehicles for operations, ensuring coverage for liability, comprehensive, and collision as part of full coverage options. This is essential for protecting your business assets and mitigating potential financial risks associated with vehicle use in a commercial setting. For instance, rental car insurance often comes under this umbrella, offering necessary protection when renting vehicles for business purposes.

Another important aspect to consider within commercial auto insurance is the coverage for classic cars, which typically require specialized policies due to their unique value and maintenance needs. Additionally, understanding your deductibles and selecting appropriate ones can significantly impact your out-of-pocket expenses in the event of a claim. High-risk driver coverage is also an area where commercial policies can be tailored to include higher limits or additional protections for those with a history of traffic violations or accidents. Discounts on car insurance are available for various reasons, including good driving records, vehicle safety features, and multi-policy bundling, which can help reduce the cost of these comprehensive plans. It’s imperative to regularly review your commercial auto insurance policy and adjust it based on changes in your business needs, as well as to stay informed about the latest developments in insurance premiums to ensure you are getting the best coverage at a competitive rate. Consulting with an insurance professional is key to navigating these requirements and ensuring that your commercial auto insurance aligns with your specific business needs.

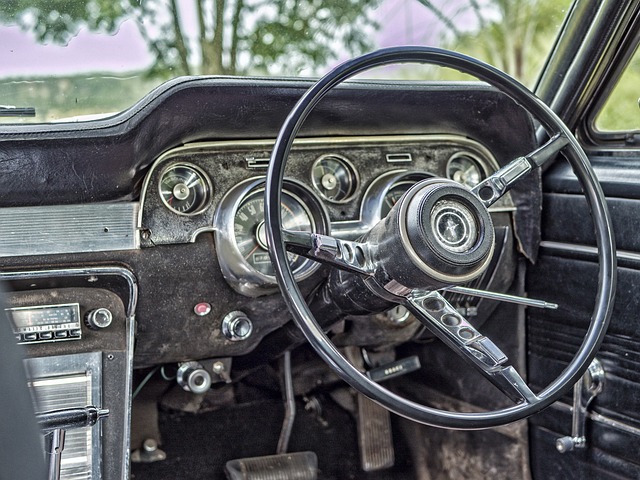

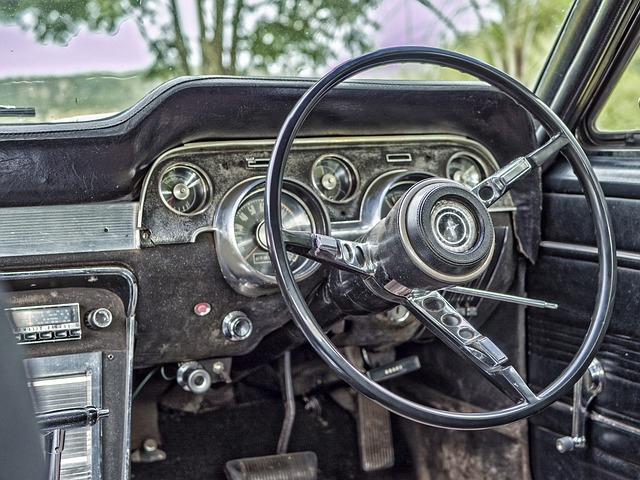

Specialized Coverage for Classic Cars: Classic Car Coverage Explained

When considering specialized coverage for classic cars, it’s crucial to understand that Classic Car Coverage is distinct from standard auto insurance policies. This bespoke insurance is tailored to protect your classic vehicle, which may include cars, motorcycles, and trucks, often used for pleasure rather than daily commuting. It typically offers agreed value coverage, which means if your car is totaled, you receive the amount the policy was purchased for, minus any deductible. Unlike Rental Car Insurance or Commercial Auto Insurance, which cater to specific temporary or business-related uses, Classic Car Coverage considers factors like the vehicle’s usage frequency, storage conditions, and agreed mileage. Owners of classic cars often enjoy Discounts on Car Insurance due to their vehicle’s limited use, safe driver history, and garage keeping. It’s important to evaluate these specialized coverages against your financial situation and needs, as the Insurance Premiums for such policies can vary significantly based on the car’s value and the level of coverage desired. Consulting with an insurance professional is advisable to determine if Classic Car Coverage aligns with your individual circumstances and to navigate the nuances of Car Insurance Deductibles that may apply in the event of a claim. This ensures that you are neither overpaying for insurance nor underinsured, especially if you fall into the category of a High-Risk Driver Coverage due to past driving infractions or accidents. By carefully assessing your options and understanding the coverage, you can make an informed decision that protects your investment while fitting your budget.

Managing Car Insurance Deductibles Under Full Coverage Policies

When considering full coverage auto insurance, understanding how to manage car insurance deductibles is crucial. A deductible is the amount you agree to pay out-of-pocket before your insurance kicks in during a claim. Choosing the right deductible can significantly influence your insurance premiums. Generally, opting for a higher deductible can lower your monthly insurance premiums, which might be beneficial if you’re looking to save on commercial auto insurance or if you drive a classic car where the vehicle’s value might not justify high premiums. Conversely, selecting a lower deductible means you’ll pay less out-of-pocket in the event of an incident but will typically face higher monthly payments. This balance is particularly important for high-risk drivers who require more comprehensive coverage to ensure they are adequately protected.

Moreover, full coverage policies often include rental car insurance as an add-on, which can be a lifesaver if your vehicle is being repaired after an accident. This aspect of full coverage ensures that you have transportation options available while your car is in the shop. Additionally, remember that discounts on car insurance may be available to offset some of the costs associated with higher premiums. These savings opportunities can be found by maintaining a clean driving record, bundling policies, or taking advantage of loyalty programs offered by your insurance provider. It’s always advisable to regularly review your coverage and deductibles, especially as circumstances change, such as when your vehicle depreciates or if your driving habits evolve. Consulting with an insurance professional can provide personalized guidance on how to manage car insurance deductibles effectively under a full coverage policy, ensuring that you have the right balance of protection and affordability for your specific needs.

High-Risk Driver Coverage: Finding the Right Policy Despite Your Driving Record

For high-risk drivers, securing the right auto insurance policy can be a complex task. High-Risk Driver Coverage is specifically tailored to individuals with a history of violations or accidents, which typically leads to higher insurance premiums. These policies are designed to provide the necessary protection while also addressing the concerns of insurers who view such drivers as more likely to file claims. When navigating this segment of the market, it’s crucial to consider options like Rental Car Insurance, which can offer coverage should you need a rental vehicle during repairs or after an incident. Additionally, exploring Commercial Auto Insurance is beneficial if your vehicle is used for business purposes. For those who own Classic Cars, specialized coverage is available to safeguard these valuable assets, often with agreed value options that provide peace of mind.

When evaluating policies, it’s important to understand Car Insurance Deductibles—the amount you agree to pay out-of-pocket before your insurance kicks in. A higher deductible can lead to lower insurance premiums, but ensure this aligns with your financial situation. Discounts on Car Insurance are available to high-risk drivers as well; these can be found through safe driver programs, defensive driving courses, or by bundling multiple vehicles under one policy. It’s advisable to consult with an insurance professional to navigate the nuances of High-Risk Driver Coverage, as they can help you find cost-effective solutions that still provide robust protection. By carefully considering your options and the coverage you need, high-risk drivers can find a policy that balances cost with the comprehensive protection necessary for their unique circumstances.

Strategies for Accessing Discounts on Full Coverage Auto Insurance Premiums

To maximize your savings while maintaining the benefits of full coverage auto insurance, it’s prudent to explore various strategies that can lead to discounts on your premiums. One effective approach is to inquire about rental car insurance options through your current policy. Many insurers offer a package that includes coverage for rentals at an additional cost, which can be both convenient and economical if you frequently rent vehicles. Additionally, if you use your car for business purposes, it’s beneficial to look into commercial auto insurance. This type of coverage is specifically designed to address the unique needs of businesses and can often be tailored to include comprehensive and collision coverage, along with liability protection, at a potentially lower rate compared to personal auto policies.

For those who own classic or collectible cars, specialty coverage such as classic car insurance can provide the necessary protection while offering discounts for limited mileage and storage conditions. When it comes to car insurance deductibles, choosing a higher deductible can significantly reduce your premium, albeit with the understanding that you will pay more out-of-pocket in the event of a claim. High-risk driver coverage, tailored for individuals with a history of violations or accidents, may come with its own set of discounts if you complete driving courses or maintain a clean record for a specified period. Always consult with an insurance professional to navigate these options and determine which discounts are most applicable to your situation. They can guide you through the intricacies of insurance premiums, ensuring that you receive comprehensive coverage without overextending your budget.

In conclusion, full coverage auto insurance serves as a comprehensive shield against a spectrum of financial risks associated with vehicle ownership and operation. This article has navigated through the nuances of this coverage, highlighting its benefits, from Rental Car Insurance provisions to Classic Car Coverage specifics, and addressing the needs of High-Risk Driver individuals. It underscores the importance of understanding Car Insurance Deductibles within full coverage policies and offers strategies for securing Discounts on Car Insurance Premiums. For those in commercial sectors, the requirements of Commercial Auto Insurance have been illuminated, ensuring that every driver is well-informed to make a decision that aligns with their individual circumstances and financial commitments. Ultimately, while full coverage may come with a higher price tag, its breadth of protection can be invaluable, and it’s a decision best made with the guidance of an insurance professional who can tailor coverage to your unique situation.