Navigating the complexities of tax season can be a challenge for many individuals and self-employed workers alike. However, with advancements in digital technology, the process of income tax e-filing has become remarkably easy and accessible. This article delves into the benefits of online tax filing, offering readers a comprehensive guide to simplify their tax experience. From step-by-step instructions on using user-friendly online tax forms to maximizing returns with precise tax calculators and planning tools, we explore how you can efficiently manage your financial obligations. Additionally, we highlight the enhanced security measures in place for self-employed tax filers and provide insights into effective tax refund tracking. For those concerned about accessibility, rest assured that there are free options available to accommodate various income levels. Embrace the convenience of online tax preparation and make this tax season a less stressful affair.

- Simplifying Your Tax Season with Income Tax E-Filing: A Step-by-Step Guide to Easy Tax Filing

- Leveraging User-Friendly Online Tax Forms for a Stress-Free Filing Experience

- Maximizing Your Returns with Accurate Online Tax Calculators and Planning Tools

- Elevating Security in Self-Employed Tax Filing: The Advantages of Secure Online Tax Filing

- Efficient Tax Refund Tracking: Keeping an Eye on Your Online Tax Return Status

- Accessible Tax Filing Assistance: Free Options and Support for All Income Levels

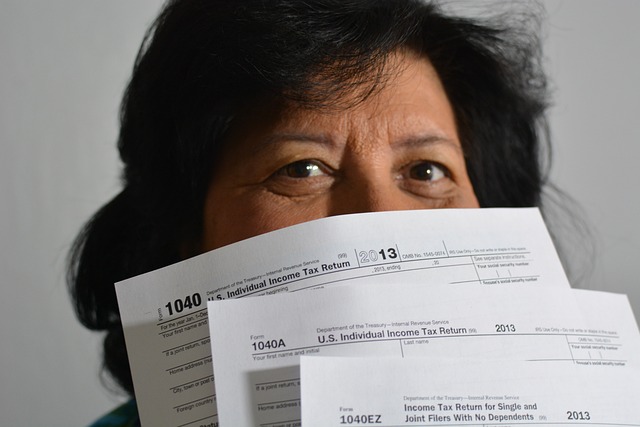

Simplifying Your Tax Season with Income Tax E-Filing: A Step-by-Step Guide to Easy Tax Filing

Embarking on your income tax e-filing journey can be a seamless experience with the right guidance and tools. The advent of online tax forms has revolutionized the way taxpayers, including self-employed individuals, approach tax season. By leveraging user-friendly interfaces provided by reliable e-filing services, you can navigate through the complexities of your tax return with ease. These platforms are designed to simplify the process, ensuring that each form is accurately completed and that all necessary information is entered correctly. The step-by-step prompts and clear instructions make it straightforward to input your financial data, from wages earned to deductions claimed. Moreover, these services often include a range of tools tailored to facilitate easy tax filing, such as tax refund tracking, which allows you to monitor the status of your return post-submission.

For those concerned about security, rest assured that secure online tax filing is a priority for these platforms. They employ state-of-the-art encryption and other cybersecurity measures to protect sensitive financial information throughout the process. Additionally, tax filing assistance is readily available should you encounter any hurdles or have questions about your return. With many services offering free online tax filing options, income tax e-filing becomes a cost-effective solution for individuals at various income levels, including those who are self-employed. By embracing the digital shift, you can not only save time and reduce stress but also ensure that your taxes are filed promptly and accurately, contributing to a smoother tax season experience overall.

Leveraging User-Friendly Online Tax Forms for a Stress-Free Filing Experience

Engaging with income tax e-filing through user-friendly online tax forms can significantly alleviate the stress traditionally associated with tax season. These digital forms are meticulously designed to guide self-employed individuals and taxpayers alike, leading them seamlessly from the initial stages of data entry to the final submission. The intuitive interface of these platforms simplifies complex tax codes and calculations, making it easier for users to navigate through their financial obligations. With step-by-step instructions and clear explanations, even those with minimal tax knowledge can confidently complete their tax returns.

Furthermore, the ease of online tax filing is complemented by its security features. Secure online tax filing ensures that sensitive personal and financial information is protected throughout the process. Taxpayers can rest assured knowing that their data is encrypted and handled with the utmost confidentiality. Beyond submission, these platforms often offer easy tax filing solutions such as tax refund tracking, allowing filers to monitor their returns in real-time without the need for additional follow-ups. Additionally, many services provide comprehensive tax filing assistance, offering support for various income levels, including free online tax filing options for qualifying individuals. This democratization of tax preparation tools means that anyone, regardless of their financial situation or tax complexity, can benefit from the streamlined and efficient nature of e-filing.

Maximizing Your Returns with Accurate Online Tax Calculators and Planning Tools

Engaging in income tax e-filing through reliable online platforms can significantly enhance your ability to maximize your returns. With easy tax filing, individuals and self-employed tax filers have access to sophisticated online tax forms that streamline the process of claiming deductions and credits. These tax calculators are designed to be user-friendly, allowing users to input their financial data accurately and efficiently. By leveraging these tools, filers can identify potential areas for tax savings, ensuring they receive their rightful refunds or minimize their liabilities. The intuitive design of the online tax filing system also helps in navigating complex tax laws, which otherwise could be a challenging task without professional assistance.

Furthermore, the best online tax filing services provide comprehensive planning tools that go beyond mere calculations. These include tax refund tracking to monitor the status of your returns post-submission and secure online tax filing options to protect sensitive financial information. The assistance these platforms offer is not limited to the filing process; they extend to providing guidance on managing your taxes throughout the year, helping you stay organized and prepared for any changes in tax laws or your personal financial situation as a self-employed individual. With the added convenience of accessing these tools at any time from anywhere, online tax preparation stands out as the most prudent approach for those looking to make informed decisions regarding their income taxes.

Elevating Security in Self-Employed Tax Filing: The Advantages of Secure Online Tax Filing

Self-employment necessitates a meticulous approach to income tax e-filing, as self-employed individuals must accurately report all income and deductions. The transition to secure online tax filing has significantly elevated the security and efficiency of this process. Online tax forms are designed with robust encryption and security protocols to protect sensitive financial data. This ensures that the confidential information of self-employed individuals remains safe from cyber threats, providing peace of mind while managing tax obligations. Additionally, these digital platforms offer easy tax filing solutions tailored for the unique needs of freelancers and entrepreneurs. With step-by-step guidance through the complexities of self-employment taxation, these online tools simplify the process, allowing users to focus on their business operations rather than the intricacies of tax code compliance.

Furthermore, the integration of tax filing assistance within secure online tax filing systems is a game-changer for the self-employed. These platforms often include features such as tax refund tracking, which allows individuals to monitor the status of their returns in real time. This transparency and accessibility are crucial for those who rely on timely tax refunds for cash flow management. The convenience of having all these features in one secure location not only streamlines the process but also provides a level of support that was previously unattainable for many self-employed individuals. As such, the shift towards online tax filing is not just a technological advancement; it’s a practical solution that aligns with the dynamic and often unpredictable nature of self-employment.

Efficient Tax Refund Tracking: Keeping an Eye on Your Online Tax Return Status

The advent of digital platforms has revolutionized the way individuals manage their income tax e-filing. With easy tax filing at the forefront, online tax forms are designed to streamline the process for taxpayers, including the self-employed. These comprehensive digital tools offer a user-friendly experience, guiding filers through each necessary step with clarity and precision. One of the most significant advantages of using online tax filing services is the ability to track your tax refund with ease. Tax refund tracking systems provide real-time updates on the status of your return, allowing you to monitor its progress from submission to approval and eventual disbursement. This feature offers peace of mind, ensuring that your financial matters are not left in limbo during the busy tax season.

Moreover, the security measures implemented in secure online tax filing systems ensure that your sensitive personal and financial data is protected throughout the e-filing process. These platforms employ encryption and other cybersecurity practices to safeguard your information against unauthorized access or breaches. Tax filing assistance is also readily available for those who may require guidance, whether due to complexity of their finances or simply because they are new to the online tax filing process. The combination of ease, efficiency, and security in online tax filing makes it an indispensable tool for taxpayers looking to navigate the intricacies of tax season with confidence.

Accessible Tax Filing Assistance: Free Options and Support for All Income Levels

The advent of income tax e-filing has revolutionized the way Americans file their taxes. With user-friendly online tax forms, the process is now easier and more accessible than ever before. Many reputable tax filing platforms offer free options for those with simple returns, while comprehensive solutions cater to the self-employed and those with more complex tax situations. These services are designed to guide users through each step of the tax return process, ensuring that even individuals who typically find tax season daunting can navigate their way to a completed return with confidence. The support for all income levels underscores the inclusivity of online tax filing; it’s no longer a privilege reserved for the wealthy or those with prior tax knowledge. Taxpayers can access easy tax filing resources that are tailored to their specific needs, providing peace of mind and financial clarity.

Moreover, the security of online tax filing has improved significantly over the years, making secure online tax filing a viable option for most. The Internal Revenue Service (IRS) provides tools such as tax refund tracking, allowing taxpayers to monitor their returns’ progress. These digital platforms not only expedite the submission process but also enhance the accuracy of tax calculations and the timely delivery of any due tax refunds. With robust customer support and intuitive interfaces, online tax filing assistance is available at every step, ensuring that taxpayers can confidently submit their taxes electronically, knowing their sensitive information is protected and their filings are in order.

In conclusion, the transition from traditional paper-based tax filings to digital income tax e-filing represents a significant advancement in simplifying the tax season process. With user-friendly online tax forms and accessible tax filing assistance available for all income levels, individuals and self-employed taxpayers can navigate the complexities of tax season with ease. The integration of tax refund tracking and sophisticated online tax calculators allows for informed financial planning and maximum returns. Emphasizing security and efficiency, online tax filings ensure that your information is protected while also expediting the submission process. As the digital divide narrows, these services become increasingly inclusive, offering a more equitable tax filing experience. Thus, leveraging the benefits of e-filing can alleviate the seasonal stress associated with tax season, making it a more manageable and less daunting task for everyone involved.