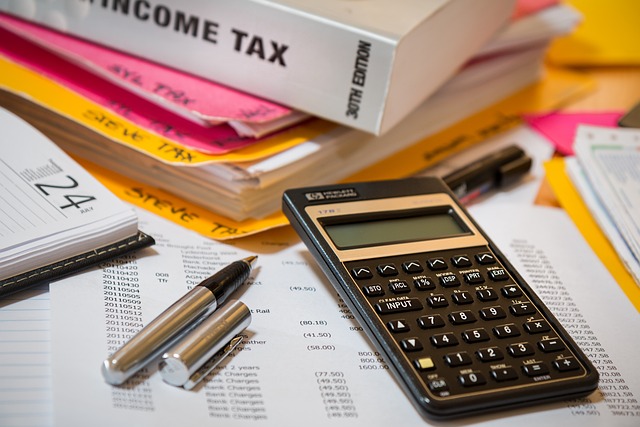

2023’s tax season presents a complex maze of deadlines and documentation. However, the advent of online tax filing platforms simplifies this intricate process. This article explores how income tax e-filing can be executed with ease and precision through digital solutions. With user-friendly interfaces and step-by-step guidance, these tools demystify the tax return process for individuals of all financial backgrounds, offering free online tax filing services to make them universally accessible. Additionally, integrated tax calculators facilitate estimates of liabilities and potential refunds, aiding in financial planning. Discover the benefits of easy tax filing, enhanced security, and efficient refund tracking through secure online systems designed specifically for self-employed individuals. Furthermore, learn about the latest advancements in online tax preparation software to ensure your tax season is as stress-free as possible.

- Simplifying Income Tax E-Filing with Online Tools

- The Advantages of Easy Tax Filing for All Income Levels

- Navigating Online Tax Forms: A Step-by-Step Guide

- Real-Time Tax Refund Tracking Through Secure Online Systems

- Enhancing Security in Self-Employed Tax Filing with Digital Platforms

- Leveraging Tax Filing Assistance for a Stress-Free Season

- Upcoming Trends and Features in Online Tax Preparation Software

Simplifying Income Tax E-Filing with Online Tools

The advent of digital technology has revolutionized the process of income tax e-filing, making it a breeze for taxpayers to navigate their financial obligations with ease. Online tools designed for easy tax filing provide a clear and intuitive interface that simplifies the completion of online tax forms. These platforms are equipped with step-by-step guidance, ensuring that individuals, including self-employed filers, can accurately report their income and deductions without the complexity that traditionally accompanies tax season. The user-friendly nature of these services means that even those who may not be well-versed in tax laws can confidently prepare and submit their returns. Furthermore, the integration of tax refund tracking within these platforms allows filers to monitor the status of their refunds in real time, providing a sense of security and control over their financial situation.

Security is paramount when it comes to handling sensitive financial information, and secure online tax filing has become a cornerstone of the digital tax ecosystem. These platforms employ robust encryption and security protocols to protect personal data throughout the e-filing process. The assurance of privacy and the efficiency of electronic submission mean that taxpayers can rest easy knowing their returns are handled with the utmost care. Additionally, many services offer tax filing assistance for those who may need extra help, ensuring that no one is left behind in this digital transformation. The convenience, accuracy, and security of online tax filing make it an indispensable tool for anyone looking to streamline their income tax e-filing experience.

The Advantages of Easy Tax Filing for All Income Levels

Income tax e-filing has revolutionized the way individuals and self-employed entities manage their annual tax obligations. Easy tax filing, facilitated by online tax forms, has democratized tax season, making it accessible to all income levels. The convenience factor is paramount; taxpayers can now file their returns from the comfort of their homes or on the go, without the need for physical paperwork or extensive knowledge of tax regulations. This accessibility extends beyond just the process of filing; many online services offer free tax filing options, ensuring that financial constraints do not hinder compliance. These platforms are designed with user-friendliness in mind, guiding filers through each necessary step, from basic to more complex tax situations.

Furthermore, online tax filing not only simplifies the process but also enhances security and speed in submitting taxes electronically. Secure online tax filing systems protect sensitive financial information with robust encryption and privacy measures. For those who are self-employed or have more complex tax scenarios, these platforms provide specialized assistance to navigate Schedule C forms, deductions, and credits. Additionally, tax refund tracking is made effortless through these services, allowing individuals to monitor the status of their returns in real time. This means that taxpayers can quickly ascertain whether they are due a refund or have additional tax obligations, enabling better financial planning and peace of mind during the tax season.

Navigating Online Tax Forms: A Step-by-Step Guide

Embarking on the process of income tax e-filing can seem complex at first glance, but with the right guidance, it becomes an easy tax filing endeavor. Online tax forms are designed to be user-friendly, guiding self-employed individuals and those with various income levels through each necessary step. The digital interface simplifies the completion of these forms by breaking down the process into clear, manageable sections. Taxpayers can input their financial data into online tax forms, which then calculate deductions, credits, and potential liabilities or refunds. This real-time computation is a significant advantage over traditional paper-based filing methods, providing instant feedback and reducing the likelihood of errors.

For those seeking additional support, many online tax filing platforms offer tax filing assistance. This feature ensures that you’re not alone in navigating the complexities of self-employed tax filing or understanding the nuances of tax laws. The assistance often includes access to customer service representatives who can answer questions and provide clarification on specific tax situations. Moreover, secure online tax filing is prioritized by these platforms, employing high-grade encryption and security protocols to protect your sensitive financial information. Tax refund tracking is also streamlined within these services, allowing you to monitor the status of your return with ease, knowing that your hard-earned money is being processed efficiently and safely.

Real-Time Tax Refund Tracking Through Secure Online Systems

Engaging in income tax e-filing through secure online systems has revolutionized how individuals and self-employed taxpayers manage their annual returns. With easy tax filing, the process is streamlined with digital forms that are intuitive and designed for simplicity, allowing users to input their financial data without the complexity of paper-based forms. These platforms not only simplify the initial submission but also provide real-time tax refund tracking, offering peace of mind and transparency throughout the tax season. Taxpayers can monitor the status of their returns with a few clicks, reducing uncertainty and wait times associated with traditional mail-in methods. The security features embedded within these systems ensure that sensitive personal and financial information is safeguarded, providing a reliable and efficient means for tax filing assistance. The integration of online tax calculators further empowers users to estimate their liabilities or potential refunds before finalizing their tax submissions, enabling better financial planning and decision-making as they navigate the intricacies of self-employed tax filing.

Enhancing Security in Self-Employed Tax Filing with Digital Platforms

Self-employment often comes with a complex array of tax obligations that can be overwhelming for individuals accustomed to traditional W-2 employment. As a self-employed individual, navigating the intricacies of income tax e-filing requires a reliable and secure platform to ensure compliance and protect sensitive financial data. Digital platforms specializing in online tax forms have risen to meet these needs, offering solutions that cater specifically to the self-employed. These platforms not only simplify the process by guiding users through the preparation of easy tax filing but also provide advanced security features that safeguard personal and business information during the tax filing assistance process. With end-to-end encryption and secure login protocols, these services ensure that each step of the self-employed tax filing is protected against unauthorized access and data breaches. The convenience of online tax filing extends beyond preparation to include tax refund tracking, allowing for real-time updates on the status of one’s return. This level of security and assistance is indispensable for the self-employed, who must manage their financial obligations with the utmost precision and confidentiality. By leveraging secure online tax filing solutions, self-employed individuals can file their taxes with confidence, knowing that their financial details are in safe hands and that they are compliant with tax regulations.

Leveraging Tax Filing Assistance for a Stress-Free Season

Navigating the complexities of income tax e-filing can be a source of stress for many individuals, but with the advent of easy tax filing solutions, the process has become more manageable. Online tax forms are designed to guide self-employed individuals and taxpayers through the intricacies of their tax obligations, offering a clear and straightforward approach to tax refund tracking. These digital tools are not only user-friendly, catering to those with varying levels of financial literacy, but also prioritize security in the process of secure online tax filing. The platforms employ advanced encryption and authentication measures to protect sensitive personal and financial data throughout the e-filing process, ensuring that your tax information remains confidential and is transmitted directly to the relevant tax authorities.

Tax filing assistance extends beyond mere form completion; it includes step-by-step guidance, deduction optimization, and access to real-time updates on tax laws and changes. For those who may have overlooked certain deductions or are unsure about their self-employed tax filing status, these services offer a safety net, allowing individuals to confidently file their returns with the assurance of accuracy and compliance. Furthermore, many online tax filing services provide features that enable taxpayers to track their refunds, providing a timeline for when they can expect their returns. This level of support and convenience makes the tax season significantly less daunting and paves the way for a stress-free experience, empowering taxpayers to handle their financial obligations with greater ease and confidence.

Upcoming Trends and Features in Online Tax Preparation Software

As we look ahead to the upcoming tax season, the trends in online tax preparation software are poised to make the process even more user-friendly and secure for taxpayers. Advancements in income tax e-filing systems promise to streamline the submission of online tax forms, with intuitive interfaces that cater to a diverse range of users, including those who are self-employed. These platforms are expected to offer more sophisticated tax filing assistance, leveraging artificial intelligence and machine learning to analyze financial data and suggest deductions and credits that users might overlook. Furthermore, the integration of easy tax filing features will enable individuals to effortlessly transfer data from various financial institutions, ensuring a seamless flow of information that enhances accuracy and reduces errors.

For those anticipating a tax refund, new features in online tax preparation software will include robust tax refund tracking tools. These tools will provide real-time updates on the status of one’s refund application, offering peace of mind throughout the processing period. Additionally, the emphasis on secure online tax filing is set to intensify, with state-of-the-art encryption and multi-factor authentication becoming standard to protect sensitive taxpayer information from unauthorized access. The evolution of these digital solutions underscores a commitment to making tax season as painless and efficient as possible for all taxpayers, regardless of their income level or complexity of their tax situation. As these technologies advance, they will not only facilitate easier navigation of the tax system but also empower individuals with better financial management capabilities throughout the year.

Navigating income tax e-filing no longer needs to be a source of stress; with the advent of user-friendly online tax filing solutions, the process is now more accessible and efficient for all. This article has explored the myriad ways in which easy tax filing simplifies the annual tax return process, making it an ideal choice for self-employed individuals and those seeking to avoid the complexities of paper-based submissions. Online tax forms are designed with clarity in mind, guiding users through each necessary step, while tax refund tracking offers real-time updates on your return status, ensuring peace of mind. The security measures implemented in online tax filing ensure that your sensitive financial data is protected during transmission. Furthermore, the availability of free options and tax filing assistance caters to a diverse range of income levels, making the process stress-free and inclusive. As we look to the future, advancements in online tax preparation software promise even more streamlined and intuitive experiences. Embrace these digital tools for a simpler, faster, and more secure tax season.