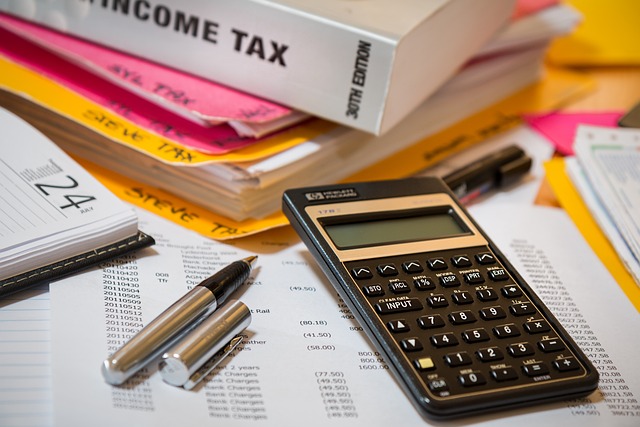

Effective investment tax planning is indispensable for optimizing returns while mitigating liabilities. A strategic approach to understanding the tax implications of various investments empowers investors to make informed decisions that align with their financial aspirations. This article delves into leveraging Tax Exemption Eligibility, avoiding IRS Penalties and Interest through diligent Nonprofit Tax Filing, and selecting Tax-efficient Investments like Roth IRAs or municipal bonds for tax-free income streams. Additionally, it emphasizes the necessity of adapting to Tax Code Changes and optimizing Filing Status to ensure that your investment portfolio not only meets current tax regulations but also contributes to your long-term financial objectives.

- Maximizing Tax Exemption Eligibility: Navigating the IRS Maze for Optimal Investment Returns

- Avoiding IRS Penalties and Interest through Strategic Nonprofit Tax Filing and Compliance

- Leveraging Tax-efficient Investments: A Guide to Minimizing Liabilities with Roth IRAs and Municipal Bonds

- Adapting to Tax Code Changes: The Importance of Regular Investment Strategy Review and Filing Status Optimization for Maximized Returns

Maximizing Tax Exemption Eligibility: Navigating the IRS Maze for Optimal Investment Returns

Investors looking to maximize tax exemption eligibility must navigate the complex landscape of the Internal Revenue Service (IRS) regulations. Understanding the nuances of the tax code is paramount, as it directly affects the returns on investment. Nonprofit Tax Filing entities and individual filers alike can benefit from exploring tax-efficient investments such as Roth IRAs, which offer tax-free income in retirement, or municipal bonds, whose interest earnings are often exempt from federal taxes and sometimes state and local taxes as well. Staying abreast of Tax Code Changes is essential, as these can alter the landscape of eligible investments and their associated benefits. Strategic planning involves not only selecting the right investment vehicles but also timing entries and exits to coincide with periods of lower tax liability.

Moreover, optimizing filing status can yield additional tax advantages. For instance, a married couple may find that filing jointly rather than separately could result in a more favorable tax outcome. The IRS Maze is not static; it requires regular review and adjustment to ensure alignment with current tax laws and financial objectives. As tax laws evolve, so too must investment strategies to continue leveraging tax exemption eligibility. Investors should be vigilant of IRS Penalties and Interest that can accrue from non-compliance, emphasizing the importance of proactive engagement with one’s finances and staying informed on the latest Tax Code Changes to avoid any unwanted financial surprises. By adopting a disciplined approach to tax planning, investors can significantly enhance their investment returns while minimizing their tax liabilities.

Avoiding IRS Penalties and Interest through Strategic Nonprofit Tax Filing and Compliance

Navigating the intricacies of nonprofit tax filing is crucial for organizations seeking to maintain their tax-exempt status under the Internal Revenue Service (IRS) regulations. Nonprofits must adhere strictly to the guidelines set forth in the tax code to avoid IRS penalties and interest, which can arise from oversights or misfilings. Understanding eligibility for Tax Exemption Eligibility is paramount; nonprofits must demonstrate their compliance with the requirements set out in sections 501(c)(3) of the tax code. This involves meticulous record-keeping and transparent reporting, ensuring that all activities align with the organization’s stated mission.

To mitigate financial risks associated with IRS Penalties and Interest, nonprofits should focus on Nonprofit Tax Filing with precision and attention to detail. This includes selecting tax-efficient investments that are consistent with their charitable goals while minimizing unrelated business income (UBIT). As the tax code evolves with changes, organizations must stay informed and adapt their strategies accordingly. Filing Status Optimization is also essential, as it can lead to significant savings and streamline operations. By leveraging legal provisions and utilizing tax-efficient investment vehicles, nonprofits not only enhance their financial sustainability but also reinforce their commitment to serving the public interest without the encumbrance of unnecessary taxes. Regular consultations with tax professionals and continuous monitoring of Tax Code Changes can ensure that nonprofits remain in good standing with the IRS, thereby safeguarding their fiscal integrity and mission-driven work.

Leveraging Tax-efficient Investments: A Guide to Minimizing Liabilities with Roth IRAs and Municipal Bonds

Investors seeking to minimize liabilities and enhance their financial returns should explore the realm of tax-efficient investments. Roth IRAs and municipal bonds offer significant advantages under the current tax code, particularly in terms of tax exemption eligibility. A Roth IRA provides a unique opportunity for earnings to grow tax-free, with withdrawals during retirement being non-taxable, thus ensuring that your hard-earned savings are preserved from erosion by taxes. Municipal bonds, on the other hand, often provide tax-exempt income, as the interest earned is typically exempt from federal income tax and may also be free from state and local taxes for investors residing in the state where the bond was issued. This tax advantage can be particularly beneficial for those in higher tax brackets.

Navigating the complexities of the IRS tax system requires diligent attention to details such as IRS penalties and interest, which can accrue if investment choices are not aligned with current tax laws. It is imperative to stay abreast of tax code changes and optimize your filing status to take full advantage of available tax-efficient investments. Nonprofit tax filing entities, for instance, may have different considerations than individual filers, emphasizing the importance of tailoring strategies to individual circumstances. By actively managing your investment portfolio with an eye on the evolving tax landscape, investors can achieve a more harmonious relationship between their financial goals and their tax liabilities, ensuring that they do not inadvertently compromise their returns or expose themselves to preventable penalties. Regular consultation with a qualified tax professional is advisable to navigate these complexities effectively.

Adapting to Tax Code Changes: The Importance of Regular Investment Strategy Review and Filing Status Optimization for Maximized Returns

Navigating the complexities of investment tax planning requires diligence and a keen understanding of how tax code changes can impact your financial strategy. As the IRS updates its regulations, what was once a tax-efficient investment may no longer offer the same benefits. To adapt to these shifts, investors must engage in regular reviews of their portfolios. This due diligence ensures that their investment choices remain aligned with current tax laws and maximize tax exemption eligibility. By staying informed about Tax Code Changes, investors can take advantage of new opportunities for tax savings and avoid costly IRS Penalties and Interest that may arise from outdated strategies.

For instance, understanding the nuances of Nonprofit Tax Filing can provide insights into which investments are most beneficial within your portfolio. Optimizing your Filing Status can further enhance your tax position, as different statuses offer varying benefits. This optimization is not a one-time task but an ongoing process that should be revisited annually or following significant life events. By leveraging tax-efficient investments such as Roth IRAs or municipal bonds, and by carefully managing your investment choices and timing, you can significantly reduce your taxable income and boost your returns. Regular strategy reviews and a proactive approach to Filing Status Optimization are essential for maintaining a tax-advantaged investment portfolio in an ever-evolving fiscal landscape.

Effective investment tax planning is a cornerstone for enhancing returns and mitigating liabilities. By leveraging strategies such as maximizing Tax Exemption Eligibility, staying abreast of IRS Penalties and Interest through diligent Nonprofit Tax Filing, and investing in Tax-efficient Investments like Roth IRAs and municipal bonds, investors can navigate the complexities of the tax code with confidence. As Tax Code Changes continually evolve, it is imperative to conduct regular reviews and adjustments of investment strategies, ensuring Filing Status Optimization aligns with your financial goals. This proactive approach not only safeguards against unnecessary tax burdens but also positions you to capitalize on opportunities as they arise, ultimately leading to a more robust and tax-efficient investment portfolio.