Navigating the complexities of retirement tax planning is a pivotal step toward ensuring financial security and stability in your post-work years. This article delves into the multifaceted aspects of tax-saving tips, offering guidance on maximizing contributions to tax-advantaged accounts, strategizing for income tax reduction, and selecting tax-efficient investments. It provides a comprehensive approach to embracing retirement tax credits, optimizing your portfolio, and adapting your plan as tax laws evolve. Whether you’re a high-income earner or a small business owner, understanding advanced wealth management tax strategies is essential for a comfortable retirement. Learn how to effectively align your financial habits with the latest tax planning practices tailored specifically for retirees, ensuring that your golden years remain golden.

- Maximizing Tax-Advantaged Account Contributions for Retirement Security

- Strategies for Income Tax Reduction: Planning Ahead for Post-Work Years

- Embracing Tax-Efficient Investments: Diversifying Portfolios for Retirement Savings

- Navigating Retirement Tax Credits: Enhancing Your Financial Stability in Later Life

- Tax Optimization Strategies for High-Income Earners Transitioning to Retirement

- Small Business Tax Planning: Preparing for Retirement While Running Your Business

- Advanced Wealth Management Tax Strategies for a Comfortable Retirement

Maximizing Tax-Advantaged Account Contributions for Retirement Security

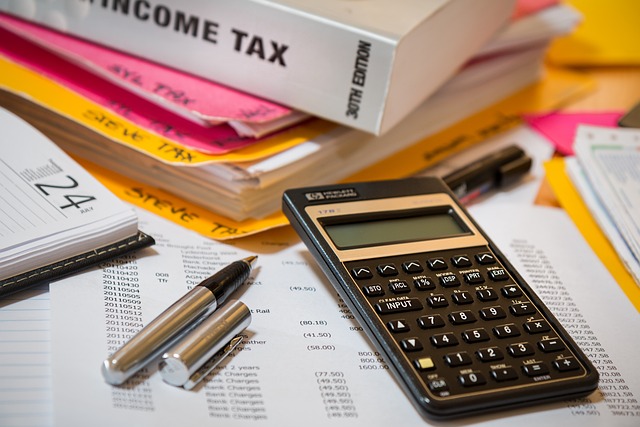

As individuals approach retirement, the focus shifts from accumulating wealth to preserving and managing it in a tax-efficient manner. Maximizing contributions to tax-advantaged accounts is a cornerstone of effective retirement tax planning. By leveraging these accounts, retirees can enjoy significant income tax reduction benefits today while fortifying their financial future. For instance, contributing to Traditional IRAs and 401(k)s allows for pre-tax dollars to grow compounded until withdrawal, which is often at a lower tax bracket during retirement. Additionally, Roth IRAs and Roth 401(k)s offer the unique advantage of tax-free income in retirement, assuming certain conditions are met. Tax-saving tips such as these play a pivotal role in optimizing one’s financial strategy.

Furthermore, beyond individual retirement accounts, tax optimization strategies for small business owners and high-income earners include exploring qualified plans like SEP IRAs or SIMPLE IRAs, which offer higher contribution limits. Wealth management tax strategies also involve understanding the intricacies of tax-efficient investments, such as municipal bonds whose income is often exempt from federal taxes. By staying abreast of changes in tax laws and employing a comprehensive approach to retirement tax planning, individuals can ensure their retirement nest egg remains robust against the ever-evolving tax landscape. This diligence not only enhances financial stability during retirement but also maximizes the potential for wealth preservation across generations.

Strategies for Income Tax Reduction: Planning Ahead for Post-Work Years

Engaging in tax-saving tips well before retirement is a prudent approach for securing financial tranquility post-employment. Effective income tax reduction strategies can significantly enhance your savings’ purchasing power and ensure that your nest egg remains robust against inflation. A key element in this process is the utilization of tax-efficient investments, which are specifically designed to minimize taxes while promoting growth. For instance, contributing to Roth IRAs or Roth 401(k)s can offer tax benefits as these accounts grow tax-free and withdrawals during retirement are also tax-free. Additionally, traditional IRAs and 401(k)s can reduce your taxable income today, lowering your current tax burden while deferring taxes until retirement when you might be in a lower tax bracket.

Furthermore, small business owners have unique opportunities for income tax reduction through strategic tax optimization. By recharacterizing income as business expenses where possible or leveraging deductions specific to their trade, they can minimize their taxable income. Wealth management tax strategies for high-income earners often involve complex structures like trusts or annuities, which require careful planning and a deep understanding of the evolving tax laws. It is imperative for these individuals to work closely with financial advisors and tax professionals to navigate the intricacies of tax planning, ensuring their retirement plans are not only effective today but also adaptable to future changes in tax legislation. Keeping abreast of these changes and adjusting your strategies accordingly is essential for maintaining the integrity of your long-term financial goals.

Embracing Tax-Efficient Investments: Diversifying Portfolios for Retirement Savings

As individuals approach retirement, the focus shifts from accumulating wealth to preserving and efficiently managing it. Tax-efficient investments play a pivotal role in this transition, offering a dual benefit of income tax reduction and safeguarding financial well-being post-retirement. Savvy investors utilize tax-saving tips to diversify their portfolios, ensuring that their retirement savings are not only protected from market fluctuations but also optimized for the most favorable tax treatment. By selecting investments that are friendly to one’s tax situation, retirees can significantly enhance their income and reduce the erosion of capital by taxes.

For high-income earners, in particular, tax optimization strategies become even more critical. These individuals often face higher tax rates, making it essential to employ sophisticated wealth management tax strategies. Small business owners must be especially diligent, as they have additional considerations such as business structure and the potential impact of passive income rules. Retirement tax planning for such earners requires a deep understanding of the current tax landscape and the ability to adapt plans as laws change. Staying informed and agile with one’s investment choices can lead to substantial savings and contribute to a more secure and enjoyable retirement experience.

Navigating Retirement Tax Credits: Enhancing Your Financial Stability in Later Life

In the pursuit of financial stability in later life, understanding and leveraging retirement tax credits is a pivotal component of effective tax planning. For those approaching or already in retirement, maximizing income tax reduction can significantly enhance one’s financial security. Tax-saving tips, such as contributing to tax-advantaged accounts like Roth IRAs or 401(k)s if eligible, are essential. These accounts can offer substantial tax benefits both now and in the future, depending on your income level and the type of account. Additionally, selecting tax-efficient investments is a key strategy for preserving wealth. By focusing on investments that yield tax-advantaged returns, retirees can maintain a higher proportion of their income, which is particularly beneficial during years with lower earnings.

Furthermore, tax optimization strategies should be tailored to individual circumstances, taking into account factors like investment portfolio composition and changes in the tax code. Small business owners and high-income earners, for instance, have unique opportunities and challenges when it comes to retirement tax planning. These individuals often benefit from more complex wealth management tax strategies that can include Roth conversions, charitable giving, and strategic use of tax losses. Keeping abreast of the latest tax laws and how they affect your retirement savings is crucial for maintaining a tax-efficient financial plan throughout retirement. Regular consultations with a trusted financial advisor or tax professional ensure that your retirement tax planning remains aligned with the ever-evolving tax landscape, safeguarding your wealth and securing your financial stability in later life.

Tax Optimization Strategies for High-Income Earners Transitioning to Retirement

High-income earners transitioning to retirement face unique challenges in optimizing their tax burden. As such, strategic tax-saving tips are paramount for preserving wealth during this pivotal life stage. A key component of effective retirement tax planning involves leveraging tax-deferred or tax-exempt investment vehicles, such as Roth IRAs or 401(k) plans, which can significantly reduce income tax now and in the future. These accounts allow high earners to shelter a substantial portion of their earnings, providing a financial buffer that can be critical in maintaining lifestyle choices post-retirement.

Moreover, high-income individuals must employ sophisticated tax optimization strategies that align with their overall wealth management tax strategies. This includes careful consideration of the tax implications of Social Security benefits, pensions, and any other retirement income streams. Additionally, small business owners have the opportunity to leverage specific tax planning tools, such as defined benefit plans or SEP IRAs, which can offer larger contribution limits compared to traditional IRAs. By engaging in proactive small business tax planning, these individuals can ensure their transition into retirement is not only comfortable but also financially sustainable, regardless of the evolving tax environment. Understanding and utilizing these strategies effectively can make a significant difference in maximizing after-tax income throughout retirement. It is crucial for high-income earners to consult with tax professionals who specialize in retirement tax planning to tailor their approach to their unique financial situation and to keep their plans current with the latest tax laws and opportunities.

Small Business Tax Planning: Preparing for Retirement While Running Your Business

For small business owners, integrating retirement tax planning within the broader scope of business operations is crucial for long-term financial security. Tax-saving tips tailored for this demographic can significantly enhance income tax reduction opportunities. One effective strategy involves leveraging tax-advantaged accounts such as SEP IRAs, SIMPLE IRAs, or solo 401(k)s, which allow high-income earners to set aside substantial amounts of pre-tax income. These accounts not only reduce current taxable income but also foster wealth management tax strategies that contribute to a robust retirement fund.

Moreover, small business tax planning requires a keen understanding of tax-efficient investments. Business owners should explore various investment options and select those that offer both growth potential and tax benefits. Health Savings Accounts (HSAs) or certain types of life insurance can serve dual purposes, providing financial security for the owner and their family while also offering tax advantages. By staying informed about changes in tax laws and adjusting retirement planning strategies accordingly, small business owners can navigate the complexities of income tax reduction and maintain financial stability both now and in retirement. Regular consultations with a qualified tax advisor are essential to ensure that these tax optimization strategies align with the evolving tax landscape and the unique needs of the business.

Advanced Wealth Management Tax Strategies for a Comfortable Retirement

As individuals approach retirement, advanced wealth management tax strategies become paramount in ensuring financial comfort and stability. Tax-saving tips are not one-size-fits-all; they should be tailored to each individual’s unique financial situation. For high-income earners, retirement tax planning is a critical component of their overall tax strategy. These individuals can benefit significantly from utilizing tax-efficient investments, which are designed to minimize taxes both now and in the future. By diversifying into accounts like Roth IRAs or Roth 401(k)s, where eligible, they can potentially reduce their income tax burden while providing a tax-free source of retirement income.

Income tax reduction is a key objective in effective tax planning for high-income earners. Strategies such as converting traditional IRAs to Roth accounts can be advantageous, especially if one anticipates being in a higher tax bracket during retirement. Additionally, small business tax planning intersects with personal retirement tax planning when considering vehicles like Health Savings Accounts (HSAs) or SEP IRAs, which offer triple the tax benefit for those who are self-employed. Tax optimization strategies should also include charitable giving, as it can reduce taxable income and provide support to causes that matter. Keeping abreast of changes in tax laws and adjusting one’s retirement tax planning accordingly ensures that these hard-earned savings are protected and that the goals for a comfortable retirement remain attainable. Wealth management tax strategies require a proactive approach, with ongoing monitoring and adjustments to navigate the complexities of the tax code and secure financial wellbeing in retirement.

Effective retirement tax planning is a multifaceted endeavor that extends beyond mere savings; it encompasses savvy financial decisions that leverage tax-saving tips to reduce income tax now and secure a stable future. By contributing to tax-advantaged accounts and selecting tax-efficient investments, individuals can significantly enhance their retirement savings while navigating the complexities of the tax system. Small business owners, too, can integrate tax planning into their operations, ensuring they optimize their contributions without compromising their entrepreneurial pursuits. High-income earners will find that advanced wealth management tax strategies are particularly beneficial in tailoring a plan that aligns with their unique financial landscape. As tax regulations evolve, it’s imperative to keep these plans updated, guaranteeing that retirement goals remain attainable and financially sound. With careful planning and informed choices, retirees can enjoy the fruits of their labor while maintaining control over their financial destiny.