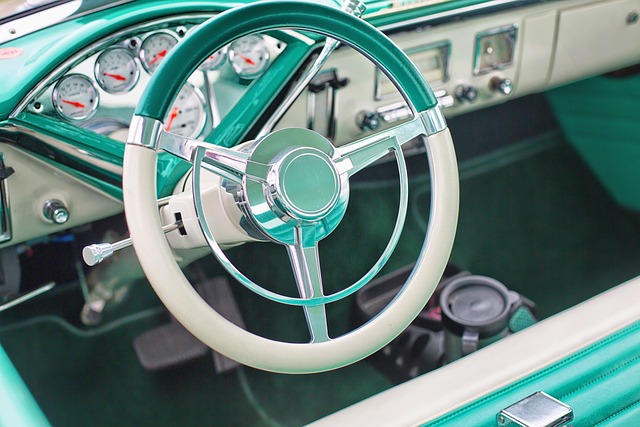

When safeguarding your business from unforeseen incidents on the road, securing robust liability coverage is paramount. Top Commercial Auto Insurance policies are designed to shield your enterprise against the financial repercussions of vehicle-related accidents. By investing in comprehensive and yet affordable options, you can rest assured that your company’s assets and reputation remain intact. This article delves into the critical aspects of selecting the best commercial auto insurance, emphasizing the importance of liability coverage within various business scales, from small enterprises to large fleets. Explore key factors that will guide you in choosing the most suitable policy for your operational needs, ensuring your commercial vehicles are protected against potential liabilities.

- Understanding Liability Coverage in Top Commercial Auto Insurance Policies

- Assessing the Costs and Benefits of Affordable Commercial Auto Insurance Options

- Evaluating the Best Business Auto Insurance for Robust Liability Protection

- The Importance of Reliable Fleet Auto Insurance for Large Operations

- Comprehensive Commercial Auto Insurance: Ensuring Adequate Liability Coverage for Your Vehicles

Understanding Liability Coverage in Top Commercial Auto Insurance Policies

When evaluating top commercial auto insurance policies, it’s crucial to delve into the specifics of liability coverage, which is a linchpin in any robust policy. This type of coverage is designed to shield your business from financial repercussions should one of your vehicles be responsible for property damage or injuries to third parties during an accident. Opting for affordable commercial auto insurance that includes strong liability coverage is a strategic decision that can save your company from potential financial and reputational harm after an incident involving your fleet. The best business auto insurance options will offer reliable fleet auto insurance with comprehensive coverage, ensuring that your operation’s continuity isn’t jeopardized by an unforeseen event. This liability protection not only covers legal costs but also compensates for bodily injury and property damage claims, thereby safeguarding the future of your business and maintaining the trust of your customers and partners. By securing a policy with extensive liability coverage, you’re investing in the stability and resilience of your commercial operations on the road.

Assessing the Costs and Benefits of Affordable Commercial Auto Insurance Options

When evaluating commercial auto insurance options, businesses must carefully consider the balance between cost and coverage. Opting for Top Commercial Auto Insurance from a reputable provider like Affordable Commercial Auto Insurance can be a strategic choice for companies of all sizes. These policies are designed to offer the Best Business Auto Insurance at a price point that doesn’t compromise on essential protections, such as Reliable Fleet Auto Insurance. A comprehensive approach to coverage ensures that your commercial vehicles are protected against a wide range of potential liabilities, including those arising from accidents involving other drivers or property. The key is to select an insurance plan that provides robust Liability Coverage for Commercial Vehicles, which can mitigate the financial impact of incidents on public roads. This not only safeguards your immediate finances but also protects your company’s reputation and long-term viability by ensuring that operational disruptions are minimized after an incident involving your fleet. In essence, investing in a reliable and Affordable Commercial Auto Insurance option is a critical decision for any business with a fleet, offering peace of mind without overspending on unnecessary frills.

Evaluating the Best Business Auto Insurance for Robust Liability Protection

When evaluating the top commercial auto insurance options for your business, it’s crucial to prioritize robust liability protection within your coverage. The best business auto insurance policies provide comprehensive protection that extends beyond mere legality. Opting for affordable commercial auto insurance that offers reliable fleet auto insurance means you’re investing in a safety net against financial losses resulting from accidents involving your vehicles. This is particularly important because liability risks can be significant, and an incident could potentially impact not just your immediate finances but also the long-term health of your business.

To ensure your company is adequately protected, look for policies that offer comprehensive commercial auto insurance with strong liability coverage for commercial vehicles. This includes assessing the policy’s limits, deductibles, and any additional endorsements or riders that might be necessary for your specific operations. For instance, if your fleet operates across different states with varying coverage requirements, a policy that provides consistent liability protection nationwide is essential. In essence, the best business auto insurance is one that offers peace of mind, knowing that whether an accident involves one vehicle or multiple units within your fleet, you’re prepared for the financial responsibility that comes with it.

The Importance of Reliable Fleet Auto Insurance for Large Operations

For large operations, securing a top-tier commercial auto insurance policy is not just a precaution—it’s an indispensable component for maintaining the financial health and operational continuity of your business. The sheer volume of daily vehicle use in extensive fleets means that the risk of accidents or incidents is higher. This underscores the need for reliable fleet auto insurance, which acts as a safety net against unforeseen events. With comprehensive commercial auto insurance, businesses can rest assured that they are protected against liability risks, including costly legal fees and damages resulting from accidents involving their vehicles.

When selecting the best business auto insurance, affordability should not compromise the quality of coverage. Opting for affordable commercial auto insurance doesn’t mean skimping on essential protections. It’s about finding a balance where your company can access reliable liability coverage without strain on financial resources. The right policy provides peace of mind, knowing that your business is safeguarded against potential claims and lawsuits arising from vehicular incidents. This not only protects the immediate assets but also preserves the reputation and future prospects of your enterprise, ensuring that a single incident doesn’t lead to cascading repercussions for your operations.

Comprehensive Commercial Auto Insurance: Ensuring Adequate Liability Coverage for Your Vehicles

When securing your business’s assets on the road, opting for the Top Commercial Auto Insurance is a strategic move that can provide a financial buffer against the unpredictable nature of transportation. A robust policy under the umbrella of Comprehensive Commercial Auto Insurance is essential to ensure adequate Liability Coverage for your vehicles. This coverage is critical as it not only reimburses third-party claims resulting from accidents involving your commercial vehicles but also covers legal defense costs, which can be substantial. In the event of an incident, whether it’s a fender bender or a more severe collision, having this protection in place means that your business operations can continue with minimal disruption. It’s not just about choosing Affordable Commercial Auto Insurance; it’s about selecting a policy that offers the right blend of affordability and comprehensive coverage. The Best Business Auto Insurance is designed to cater to the unique needs of commercial fleets, offering peace of mind that your company’s financial stability won’t be compromised by an accident. Reliable Fleet Auto Insurance tailors its coverage to match the scale of your operations, ensuring that no matter the size of your fleet or the nature of your business, you have a safety net against liability risks. This smart approach to safeguarding your company’s future is not just about compliance; it’s about making a sound investment in the longevity and reputation of your enterprise. With the right Commercial Auto Insurance policy, you can rest assured that your vehicles are covered, your business is protected, and your financial well-being is preserved.

In conclusion, securing robust liability coverage within a comprehensive commercial auto insurance policy is indispensable for businesses of all sizes. Opting for top-tier options like Top Commercial Auto Insurance ensures that your enterprise is safeguarded against the unpredictability of the road. By carefully considering affordable yet reliable policies such as Best Business Auto Insurance and Reliable Fleet Auto Insurance, you can mitigate potential financial burdens and maintain your company’s standing should an incident occur. The key to operational resilience lies in the proactive selection of Comprehensive Commercial Auto Insurance that provides adequate liability coverage for your commercial vehicles. This strategic approach not only protects your immediate interests but also supports the long-term stability and success of your business operations.