- Streamlining Your Finances: The Advantages of Income Tax E-Filing

- Easy Tax Filing: Navigating Online Tax Forms for a Stress-Free Experience

- Maximizing Your Refund: Discovering Tax Deductions Available Online

- Real-Time Tracking: Monitor Your Tax Refund Status with Ease

- Enhanced Security and Efficiency: The New Era of Secure Online Tax Filing

- Tailored Assistance for Self-Employed Tax Filing

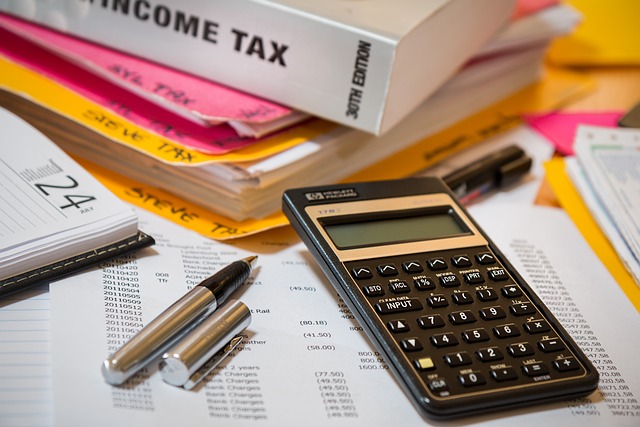

Streamlining Your Finances: The Advantages of Income Tax E-Filing

Income tax e-filing stands as a cornerstone in streamlining individual and self-employed tax filing, offering an array of benefits that transcend traditional methods. By adopting this digital approach, taxpayers gain access to easy tax filing, a process no longer burdened by the manual preparation and physical submission of tax forms. Online tax forms are readily available within these platforms, providing a user-friendly interface that guides users through each step of the tax return process. This not only accelerates the filing procedure but also minimizes errors, ensuring accuracy in compliance with tax regulations. The convenience of submitting taxes electronically is amplified by the real-time tax refund tracking feature, which allows taxpayers to monitor their refund status without the anticipatory wait for snail mail. This transparency and immediacy bring a level of satisfaction that was previously out of reach for many. Furthermore, secure online tax filing addresses concerns over data protection and privacy, employing robust encryption methods and security protocols to safeguard sensitive financial information. The integration of tax filing assistance within these digital systems further empowers users, offering guidance and support throughout the process. This ensures that even those with complex returns can navigate their tax obligations with confidence, knowing that help is readily available should they encounter any challenges along the way. By leveraging the full potential of income tax e-filing, individuals can significantly reduce the time and effort historically associated with tax season, transforming what was once a daunting task into a straightforward, efficient experience.

Easy Tax Filing: Navigating Online Tax Forms for a Stress-Free Experience

Navigating online tax forms has become synonymous with easy tax filing, offering a seamless and stress-free experience for individuals and self-employed taxpayers alike. With income tax e-filing platforms, the cumbersome process of sorting through physical tax forms is replaced by user-friendly digital interfaces. These platforms are designed to guide users through each step of the tax filing process, ensuring that every deduction and credit is considered without the added complexity. The intuitive nature of these online tax preparation services means that even those with limited knowledge of tax laws can confidently file their taxes. Additionally, these services often include features such as online tax calculators, which help users understand their potential refund or tax liability ahead of time. This proactive approach to tax planning allows for better financial management and can lead to maximizing one’s tax refund.

For the self-employed, the benefits of easy tax filing through online tax forms are particularly advantageous. The ability to categorize income and deductions accurately is crucial for those with diverse sources of earnings. Online tax filing assistance is readily available for those who need it, ensuring that every business expense is accounted for and optimizing the potential for a favorable tax outcome. Furthermore, the security measures in place for secure online tax filing provide peace of mind, knowing that sensitive personal and financial information is protected throughout the e-filing process. Tax refund tracking is also made simple with real-time updates, allowing taxpayers to monitor their refund status without the need for constant contact with tax authorities. This level of convenience and efficiency in managing one’s taxes is a testament to the strides made in online tax preparation services.

Maximizing Your Refund: Discovering Tax Deductions Available Online

Navigating the complexities of income tax e-filing can be simplified with the plethora of resources available online for self-employed individuals and those seeking easy tax filing solutions. By utilizing reputable online tax preparation services, taxpayers gain access to a comprehensive array of tax forms that are digitized for convenience. These platforms not only streamline the submission process but also offer intuitive tax calculators designed to identify potential deductions, thereby maximizing your refund potential. The digital landscape of tax filing assistance ensures that individuals can meticulously review their tax situation, take advantage of the latest tax laws, and efficiently file their returns with minimal error margin. With secure online tax filing, the entire process is encrypted and protected, giving users peace of mind as they manage their financial obligations. Furthermore, these platforms often provide real-time tax refund tracking capabilities, allowing taxpayers to monitor the status of their refunds without the need for frequent phone calls or office visits. This feature is particularly beneficial during the busy tax season when prompt resolution of queries is paramount. By leveraging such services, individuals can confidently meet tax filing deadlines and manage their fiscal responsibilities with greater ease and efficiency.

Real-Time Tracking: Monitor Your Tax Refund Status with Ease

In today’s digital age, income tax e-filing has become synonymous with streamlined and efficient tax management. The advent of online tax preparation platforms has significantly simplified the process for individuals and self-employed taxpayers alike. These platforms offer a plethora of easy tax filing tools, including comprehensive online tax forms that can be filled out with precision and ease. One of the most beneficial features is the ability to track your tax refund status in real-time. This functionality ensures that taxpayers are kept up-to-date on the status of their returns, eliminating uncertainty and anxiety during the processing period. The real-time tracking system provides a transparent view into the handling of one’s tax submission, allowing for peace of mind while adhering to tax filing deadlines. Furthermore, these platforms enhance security with encrypted data transmission and storage, making secure online tax filing a reality for millions. The convenience of being able to check on your refund without having to manually contact tax authorities is unparalleled. By leveraging the latest in digital technology, online tax forms are not only accessible but also user-friendly, ensuring that individuals can navigate their tax obligations with greater ease and less stress.

For those who may need additional tax filing assistance, these platforms often offer guidance throughout the process. The user-friendly interface typically includes a step-by-step wizard to help navigate complex tax laws, deductions, and credits, ensuring that all filers, regardless of their financial situation or complexity, can file with confidence. By understanding available tax deductions online and utilizing the provided tools, taxpayers can maximize their refund potential, optimizing their financial outcomes. The integration of secure and efficient systems for e-filing, coupled with comprehensive support, makes managing self-employed tax filing a less daunting task. This democratization of tax preparation means that anyone with internet access can file their taxes accurately and promptly, revolutionizing the way we handle one of our most universal responsibilities.

Enhanced Security and Efficiency: The New Era of Secure Online Tax Filing

Income tax e-filing has transitioned the tax landscape into a realm where complex paper-based processes are streamlined for simplicity and security. The advent of secure online tax filing platforms has made it easier for individuals, especially self-employed taxpayers, to navigate their fiscal obligations with greater ease. These platforms not only offer easy tax filing through online tax forms but also provide real-time tax refund tracking features, ensuring that taxpayers can monitor the status of their returns without the traditional wait times associated with postal services. The integration of advanced cybersecurity measures means that sensitive financial data is safeguarded throughout the process, lending a layer of protection to the otherwise vulnerable task of disclosing income details. As a result, tax filers can confidently utilize these services, knowing that their personal and fiscal information is encrypted and protected against unauthorized access. The efficiency gains are manifold; not only do taxpayers save time by avoiding the need to physically deliver documents, but they also benefit from immediate updates on the status of their refunds, thus eliminating much of the uncertainty and delay traditionally associated with tax filings. This new era of secure online tax filing represents a significant leap forward in accessibility and convenience for anyone needing to file taxes, making it an indispensable tool in managing one’s financial obligations responsibly and efficiently.

Furthermore, the integration of online tax forms into user-friendly e-filing platforms has democratized tax filing assistance. No longer is it a challenge for individuals to understand and apply for available tax deductions; these platforms guide users through the process with clear instructions and interactive tax calculators. The ease with which one can now manage their self-employed tax filing responsibilities means that even those with complex financial situations can approach their tax obligations without undue stress or the need for costly professional assistance. The tax preparation software is designed to be intuitive, accommodating a wide range of users from novices to seasoned taxpayers. This democratization ensures that everyone has access to accurate and timely tax filing services, which are not only secure but also optimized for efficiency, thereby enhancing the overall tax-filing experience.

Tailored Assistance for Self-Employed Tax Filing