Securing your home against the unforeseen doesn’t necessitate a hefty financial outlay. With an array of budget-conscious options available, homeowners can now procure comprehensive home insurance that aligns with their individual requirements and financial constraints. The key lies in effectively comparing home insurance plans from reputable providers to identify the best coverage for your circumstances. By leveraging online comparison tools, you can streamline the process of obtaining quotes, ensuring you secure ample protection at a cost that respects your budget. Whether you’re looking for basic coverage or sophisticated policies suited for high-value homes, or special discounts applicable to homeowners and seniors alike, this article will guide you through each step to make informed decisions. Uncover the secrets to affordable home insurance tailored specifically for you.

- Maximizing Affordability: Understanding Home Insurance Comparison

- Effortless Quote Hunting with Home Insurance Quotes Online

- Budget-Friendly Policies: Finding Home Insurance with Low Premiums

- Tailored Coverage for High-Value Homes: Home Insurance for High-Value Homes

- Savvy Saving Strategies: Homeowners Insurance Discounts Explained

- Insurance Options for the Senior Set: Best Home Insurance for Seniors

Maximizing Affordability: Understanding Home Insurance Comparison

When embarking on a home insurance comparison to maximize affordability, it’s crucial to explore various policies from reputable providers. Homeowners should leverage online tools that offer home insurance quotes to get an overview of what’s available in the market. These tools are designed to streamline the process by inputting your specific details and receiving tailored options that align with your needs and budget. By comparing home insurance rates, you can identify which companies provide competitive home insurance with low premiums without compromising on coverage.

For high-value homes, specialized policies such as Home Insurance for High-Value Homes are essential. These policies are crafted to cover the unique aspects of upscale residences, offering comprehensive protection against potential losses or damages. Additionally, smart homeowners can take advantage of homeowners insurance discounts, which can lower premiums significantly. Such discounts may be available for a variety of reasons, including safety features like security systems, claims-free history, or even bundling multiple policies with the same provider. Similarly, the best home insurance for seniors is designed to cater to the specific needs and circumstances of older adults, often at preferential rates. This ensures that no matter your age or the value of your home, there are cost-effective options available that provide the coverage you require.

Effortless Quote Hunting with Home Insurance Quotes Online

In an age where convenience and cost-efficiency are paramount, homeowners can effortlessly navigate the market for home insurance with low premiums through online platforms dedicated to Home Insurance Quotes Online. These digital tools empower you to conduct a comprehensive Home Insurance Comparison, ensuring that you are not overpaying for your coverage needs. By inputting your specific details into these user-friendly interfaces, you can instantly access a plethora of options tailored to your individual circumstances. Whether you own a high-value home or are looking for the Best Home Insurance for Seniors, online services provide a seamless way to compare rates and coverage across multiple providers. The process is designed to be transparent and straightforward, with filters that allow you to sift through Home Insurance options based on the type of dwelling, its value, and any applicable Homeowners Insurance Discounts. This not only simplifies the hunt for the most suitable policy but also saves time and effort, allowing you to focus on what truly matters—protecting your home and belongings without breaking the bank. By leveraging these online tools, you can make an informed decision, confident that you’ve found the most appropriate Home Insurance with Low Premiums for your unique situation.

Budget-Friendly Policies: Finding Home Insurance with Low Premiums

When seeking out budget-friendly policies for home insurance, it’s crucial to conduct a thorough comparison of available plans. Home Insurance Comparison tools are invaluable in this process, allowing homeowners to evaluate various options side by side. These tools can be easily accessed online through platforms offering Home Insurance Quotes Online, which save time and provide a comprehensive overview of potential premiums. By carefully examining Home Insurance with Low Premiums, you can identify the most cost-effective coverage that meets your specific needs.

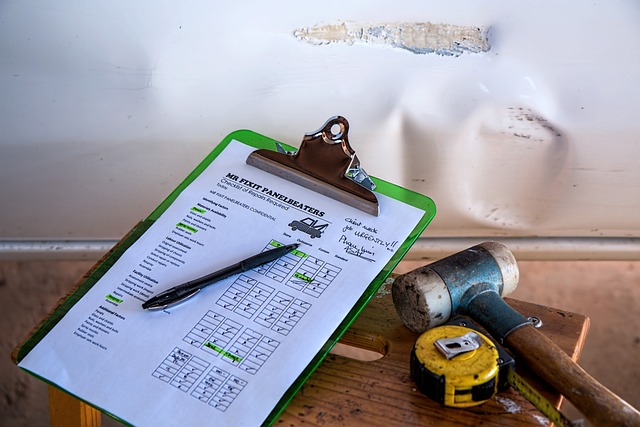

Homeowners can further reduce costs by taking advantage of Home Insurance for High-Value Homes if their property falls into this category. These specialized policies are designed to offer extensive protection without the inflated price tag. Additionally, many homeowners are unaware of the Homeowners Insurance Discounts available to them, which can significantly lower premiums. For instance, installing a security system or making your home more disaster-resistant can yield substantial savings. Seniors, in particular, may find that some insurers offer the Best Home Insurance for Seniors, with policies tailored to their unique circumstances and financial considerations. It’s advisable to explore these options and consult with experts to ensure you’re getting the most affordable coverage without compromising on essential protections.

Tailored Coverage for High-Value Homes: Home Insurance for High-Value Homes

When it comes to securing your high-value home, tailored coverage is paramount. High-value homes often come with unique requirements that necessitate a specialized approach to insurance. Homeowners of such properties can benefit significantly by exploring home insurance options designed specifically for them. These policies are crafted to provide comprehensive protection, accounting for the distinct characteristics and elevated risks associated with luxury residences. By leveraging home insurance comparison tools available online, homeowners can effortlessly assess and compare various plans from reputable insurers. This allows for a strategic selection of a policy that not only aligns with their specific needs but also offers competitive home insurance quotes. Homeowners insurance discounts are also a valuable consideration; by taking advantage of these reductions, you can further minimize costs while maintaining high-quality coverage. For seniors, the best home insurance policies often include additional benefits and lower premiums, reflecting a recognition of their experience and reduced risk profile. These tailored options ensure that your high-value home is protected against unforeseen events without straining your finances. In today’s market, where affordability meets bespoke coverage, finding low-premium home insurance for high-value homes has never been easier or more secure. With the plethora of online tools at your disposal, the process of obtaining quotes and selecting the most suitable policy becomes a streamlined experience, offering peace of mind and financial prudence.

Savvy Saving Strategies: Homeowners Insurance Discounts Explained

When exploring home insurance options, savvy homeowners can leverage various discounts to significantly reduce their premiums without compromising on coverage. Home Insurance Comparison is a pivotal step in identifying the most cost-effective policies available. By evaluating different providers side by side, you can discern which insurers offer the best combination of price and protection for your specific needs. Online tools such as Home Insurance Quotes Online are indispensable in this process, providing instant comparisons that simplify decision-making. These platforms allow you to filter through options specifically designed for High-Value Homes, ensuring that your investment is fully safeguarded regardless of your property’s worth.

Homeowners Insurance Discounts can substantially lower your insurance bill. Insurers often provide discounts for a variety of reasons, including the installation of security systems, claims-free histories, or bundling multiple policies. For instance, homes equipped with smoke detectors, burglar alarms, and deadbolt locks may qualify for safety-related discounts. Similarly, long-standing policyholders, or those who opt for higher deductibles, can also enjoy preferential rates. Moreover, the Best Home Insurance for Seniors often comes with additional perks, recognizing the lower risk profile that many senior homeowners represent. These discounts and tailored policies are designed to provide comprehensive coverage at Low Premiums, making secure, responsible homeownership accessible to all.

Insurance Options for the Senior Set: Best Home Insurance for Seniors

When considering home insurance options, especially as a senior, it’s crucial to find a policy that balances comprehensive coverage with affordability. Homeowners in this demographic often seek home insurance with low premiums that recognize their experience and responsibility in maintaining their homes. Insurance providers offer tailored plans for the senior set, ensuring that their unique needs are met. These can include additional living expenses coverage, which is particularly valuable if an unforeseen event leads to a home being temporarily uninhabitable. Furthermore, many insurance companies extend homeowners insurance discounts to seniors who have a history of safe driving and claims-free years. This makes it essential for seniors to explore home insurance comparison tools available online, which allow for the easy evaluation of various policies side by side. By inputting personal details into these home insurance quote online platforms, seniors can identify providers offering the best home insurance coverage for high-value homes if they own a more expensive or luxurious property. These resources are invaluable for navigating the market and securing the most suitable home insurance with low premiums that cater to both their financial situation and their specific requirements as they age. With careful comparison and consideration of available discounts, seniors can find peace of mind knowing their investment is protected without overextending their budget.

In conclusion, securing your home against unforeseen events is a wise decision that doesn’t have to strain your finances. By leveraging home insurance comparison tools, you can easily navigate through various policies offered by reputable providers to find the most suitable and affordable home insurance plan. Utilizing online platforms like Home Insurance Quotes Online is an effective way to gather quotes, enabling you to make informed decisions on Home Insurance with Low Premiums that align with your budget. For those who own high-value homes, specialized coverage through Home Insurance for High-Value Homes ensures that your investment is adequately protected. Additionally, exploring Homeowners Insurance Discounts can further reduce costs, while seniors have tailored options available to them with the Best Home Insurance for Seniors. It’s a comprehensive approach to safeguarding your home without compromising on quality or overspending.