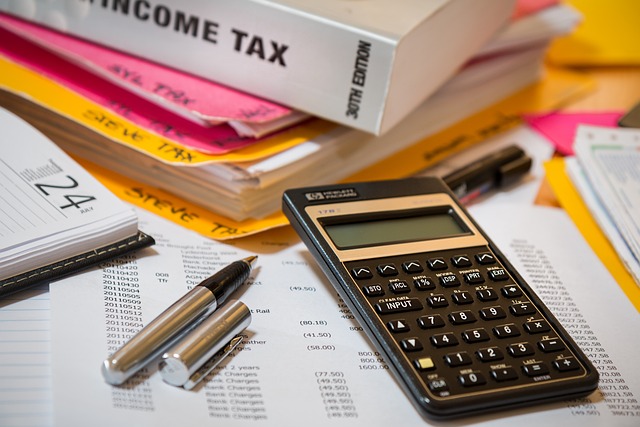

Navigating the complexities of tax season can be a daunting task for many individuals and businesses alike. However, with expert guidance in Year-End Tax Planning, the process becomes more manageable. Our comprehensive suite of services, including Certified Tax Preparers and tailored Tax Saving Strategies, ensures precision filings and optimizes deductions. We stay abreast of the latest IRS updates to meet all return deadlines, providing peace of mind through compliance and efficiency. For those facing tax challenges, our Taxpayer Relief Services offer a stress-free solution. Moreover, our Corporate Tax Solutions cater specifically to businesses, aiming to maximize efficiency and minimize financial strain. Trust in our professional advisors to simplify your tax experience and guide you every step of the way, utilizing advanced Income Tax Calculation techniques for optimal outcomes.

- Mastering Year-End Tax Planning with Expert Guidance

- Leveraging Certified Tax Preparers for Precision Filing

- Comprehensive Tax Saving Strategies Tailored to Your Needs

- Exploring Income Tax Calculation and Optimization Techniques

- Utilizing Taxpayer Relief Services for Stress-Free Tax Season

- Corporate Tax Solutions: Ensuring Compliance and Maximizing Efficiency

Mastering Year-End Tax Planning with Expert Guidance

As the year comes to a close, proactive Year-End Tax Planning becomes a pivotal step for individuals and businesses alike to minimize their tax liabilities and maximize their financial positions. Our certified tax preparers at [Your Company Name] are adept at navigating the complexities of income tax calculation and offering personalized strategies tailored to your unique financial situation. By engaging with our Taxpayer Relief Services, clients can take advantage of informed decision-making that aligns with their long-term objectives. Our expert guidance ensures that no opportunity for a tax saving goes unnoticed, from identifying potential deductions and credits to structuring transactions in a tax-efficient manner.

In the realm of corporate tax solutions, our team’s deep understanding of the ever-evolving tax code allows us to provide advanced planning and strategic advice. We stay abreast of the latest IRS updates and tax laws to ensure compliance and optimize your corporate tax position. Our approach is comprehensive, covering all aspects from income tax calculation to the strategic timing of income and deductions. By entrusting your year-end tax planning to our certified tax preparers at [Your Company Name], you are not just filing taxes; you are making informed financial decisions that can offer significant relief and set the stage for a prosperous new year.

Leveraging Certified Tax Preparers for Precision Filing

Embarking on the year-end tax planning process is a pivotal step for individuals and businesses alike, ensuring that every dollar is optimized in compliance with current tax laws. Our certified tax preparers are adept at navigating the complexities of income tax calculations, offering precision filing services that are tailored to your unique financial situation. By engaging our expertise early, taxpayers can capitalize on strategic tax-saving opportunities and avoid potential pitfalls. These professionals not only excel in preparing and filing tax returns but also provide year-round taxpayer relief services, ensuring that clients are well-positioned to take advantage of deductions and credits. Their deep understanding of the evolving IRS updates and corporate tax solutions means your financial portfolio is safeguarded and leveraged effectively for optimal savings. With our certified tax preparers at the helm, you can trust that your tax filings will be handled with precision and care, guiding you through each step with clarity and expertise.

Comprehensive Tax Saving Strategies Tailored to Your Needs

Engaging our comprehensive tax saving strategies ensures that your financial interests are safeguarded throughout the year. Our approach to Year-End Tax Planning is proactive, analyzing your unique financial situation to identify opportunities for significant tax savings. We leverage the expertise of our Certified Tax Preparers to craft personalized strategies that align with your fiscal objectives, ensuring that you benefit from every legal advantage available. Our tailored solutions are not mere calculations; they encompass a deep understanding of the intricacies of income tax calculation and are designed to maximize your returns while minimizing your liabilities.

For those navigating the complexities of corporate tax solutions, our team is equipped with the latest knowledge of IRS updates and tax laws. We provide meticulous Taxpayer Relief Services that address the specific challenges faced by businesses, ensuring compliance without compromising on financial efficiency. Our strategies are informed by a commitment to staying abreast of the evolving tax landscape, which means you receive advice that is not only current but also forward-thinking, setting you up for success in the upcoming fiscal periods. With our guidance, the often daunting process of tax filing becomes a strategic opportunity for growth and security.

Exploring Income Tax Calculation and Optimization Techniques

Engaging in year-end tax planning is a prudent strategy for individuals and businesses alike to minimize their tax liabilities. Our certified tax preparers are adept at navigating the complexities of income tax calculation, employing sophisticated techniques that align with each client’s unique financial situation. By meticulously analyzing your financial data throughout the year, these experts can identify potential deductions and credits, ensuring that every opportunity for tax savings is leveraged. This proactive approach not only simplifies the filing process but also often results in a more favorable outcome for taxpayers.

Furthermore, our taxpayer relief services extend beyond individual needs; we also offer comprehensive corporate tax solutions tailored to the nuances of business taxation. Our team stays abreast of the latest IRS updates and tax laws to guarantee that your returns are not only accurate but also optimized for the best possible outcome. With a focus on income tax calculation, our strategies are designed to maximize your financial position while ensuring compliance and peace of mind. Trust in our professional tax advisors to provide clarity and guidance every step of the way, transforming what could be a stressful experience into a straightforward process that positions you for success.

Utilizing Taxpayer Relief Services for Stress-Free Tax Season

navigating the complexities of tax laws can be a daunting task for many individuals and businesses alike. This is where our Taxpayer Relief Services come into play, offering a beacon of relief during the often stressful tax season. Our expert Certified Tax Preparers are adept at providing Year-End Tax Planning strategies tailored to each client’s unique financial situation. By leveraging these personalized strategies, we ensure that our clients are positioned to maximize their tax savings and minimize potential liabilities.

Furthermore, our suite of services extends beyond individual filings; we also offer sophisticated Corporate Tax Solutions for businesses seeking to optimize their fiscal management. Our team stays abreast of the latest IRS updates and incorporates them into our calculations, guaranteeing that every deduction is accurately claimed and all deadlines are met. With our assistance, the income tax calculation process becomes a streamlined experience, allowing you to focus on what matters most while we handle the complexities of your taxes, providing peace of mind and stress-free compliance throughout the fiscal year.

Corporate Tax Solutions: Ensuring Compliance and Maximizing Efficiency

Our corporate tax solutions are meticulously designed to ensure compliance with the intricate web of tax regulations while also maximizing efficiency for your business. As the year draws to a close, engaging in year-end tax planning becomes a pivotal step for businesses aiming to minimize their tax liabilities. Our team of certified tax preparers employs strategic foresight to navigate complex income tax calculations and to implement effective tax saving strategies tailored to your company’s unique financial situation. By staying abreast of the latest IRS updates and guidelines, we provide peace of mind that your corporate taxes are not only filed on time but also in a manner that aligns with current regulations and optimizes your financial position.

Furthermore, our taxpayer relief services are an invaluable resource for businesses encountering challenges with their tax obligations. We understand the complexities and pressures of managing corporate finances, and our expert advisors are equipped to handle all aspects of income tax calculation, ensuring that your business remains compliant while leveraging every available opportunity to save on taxes. Our approach is holistic, considering both short-term needs and long-term financial health, to ensure that your corporate tax solutions are not just reactive but proactive, providing a solid foundation for sustainable growth and profitability.

Navigating the complexities of tax season can be a daunting task; however, with our comprehensive suite of services designed for both individuals and corporations, you can approach year-end tax planning with confidence. Our certified tax preparers excel in precision filing, ensuring that your returns are accurate and optimized for the greatest savings. We stay abreast of the latest IRS updates to guarantee compliance without delay. By leveraging our tailored tax saving strategies and accessing our taxpayer relief services, you’ll find the process significantly less stressful. For businesses, our corporate tax solutions provide the efficiency and compliance your company needs to thrive. Trust our professional advisors to be your steadfast partner in simplifying income tax calculations and optimizing your financial position. Let us transform your tax experience into a streamlined and rewarding endeavor.